Customers’ Lack of Trust and Desire For Innovation Are Eroding Bank Relevance

by Fintech News Singapore October 11, 2016Forty percent of 55,000 consumers (including 1,007 in Singapore, 2,025 in Malaysia and 2,053 in Indonesia) surveyed worldwide report decreased dependence on their traditional bank and increased excitement about alternatives, according to the EY 2016 Global Consumer Banking Survey.

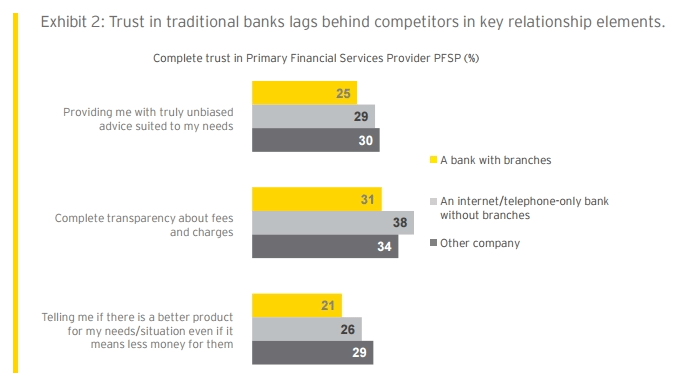

A lack of trust, changing consumer behaviors and expectations set by digital innovators and increased competition from new players are eroding traditional banks’ relevance. Globally, retail banks scored just 75.1 out of a maximum value of 100 on the inaugural EY Bank Relevance Index (BRI), which evaluates how customers interact with banks now, and how they expect to in the future.

In Asia-Pacific, bank relevance varies significantly among the countries surveyed, with banks across Southeast Asia possessing some of the lowest scores in the region. Retail banks in Singapore garnered a score of 74.1, higher than Malaysia (72.2) and Indonesia (66.9, the second-lowest score globally).

Liew Nam Soon, EY Asean Financial Services Leader, says:

“Traditional banks need to reconsider current practices to maintain relevance with an increasingly disenchanted consumer base. Globally, 42% of consumers have used non-bank providers in the last 12 months, and 21% who have not yet used them plan to do so in the near future.”

The report further reveals that the majority of Singapore consumers (63%) have accounts with three or more financial services companies. As such, it is no surprise that 64% of the Singapore respondents have difficulty in getting a holistic view of their finances across different banks.

As well, Liew observes from the report that the digitally and financially savvy consumer are more open to try out new providers, creating an opportunity for new players in the marketplace.

Liew says: “Within Southeast Asia, we’re in the age of the millennials with a fast-growing base of digitally savvy banking customers. For example, our survey shows that 82% of Indonesia customers are open towards the emergence of new online only financial services providers that compete with traditional banks, followed by 64% for Malaysia and 60% for Singapore. This compared with the global average of 54% shows that the emerging markets are seen to be embracing the product offerings by the FinTechs more so than the established ones.”

The EY report outlines four ways for traditional banks to improve relevance among consumers:

1. Build and earn trust, not only in a bank’s ability to securely look after customers’ money, but in the ability to always do the right thing for the consumer and provide unbiased, high-quality advice.

2. Better understand individual customer behaviors and attitudes and apply analytics to tailor personalized propositions to different types of customers to serve a “customer of one.”

3. Rethink distribution and customer engagement, in particular the role of branches and customer journeys across channels.

4. Innovate like FinTechs to radically simplify products and deliver on exceptional customer experiences.

Highlights from the survey found that:

In line with the global trend, customers in Southeast Asia are notably migrating from physical towards digital channels with Indonesia having the digital adoption in online and mobile banking at 50.5% followed by Malaysia at 37.5% and Singapore at 36.5%. These countries have used online and mobile banking more frequently over the past year compared to the global peers at 37%.

Nonetheless, while it is clear that banks need to deliver on a digital experience, there remains a need to offer different ways of financial engagement. Given that 44% of global respondents (and a much higher corresponding percentage of 54% in Malaysia, 52% in Singapore and 51% in Indonesia) would not trust a bank without branches, digital cannot replace, but should complement human interaction.

Customers in Southeast Asia also indicated the importance of having multiple channels to connect with their banks, with Indonesia valuing it the most at 70% followed by Singapore and Malaysia at 68% as compared to the global average of 62%. Such statistics illustrate the importance of a truly omni-channel experience where banks need to think beyond siloed channels to create a distribution network that enables customers to interact and transition seamlessly and consistently across multi-channels.

Liew concludes: Despite these challenges, banking customers still see the intrinsic value of traditional retail banks though they recognize that the advance of technology has made it much easier to gain access to different financial products offered by multiple providers. In order to discourage customers from defecting to alternative financial providers, banks need to understand and address consumers’ needs and expectations for personalization, convenience, simplicity and transparency.”

View the report online at www.ey.com/bankrelevance