Despite limited access to traditional banking services, rising smartphone penetration and rapid e-commerce growth have led to an increase in the use of digital financial services in Southeast Asia. Today, the region is emerging as a hotspot for fintech innovation across all major areas including payments, lending, insurance and investing.

Adoption of fintech had been on the rise prior to COVID-19, but the shift to digital channels brought about the pandemic has further accelerated the use of digital financial services.

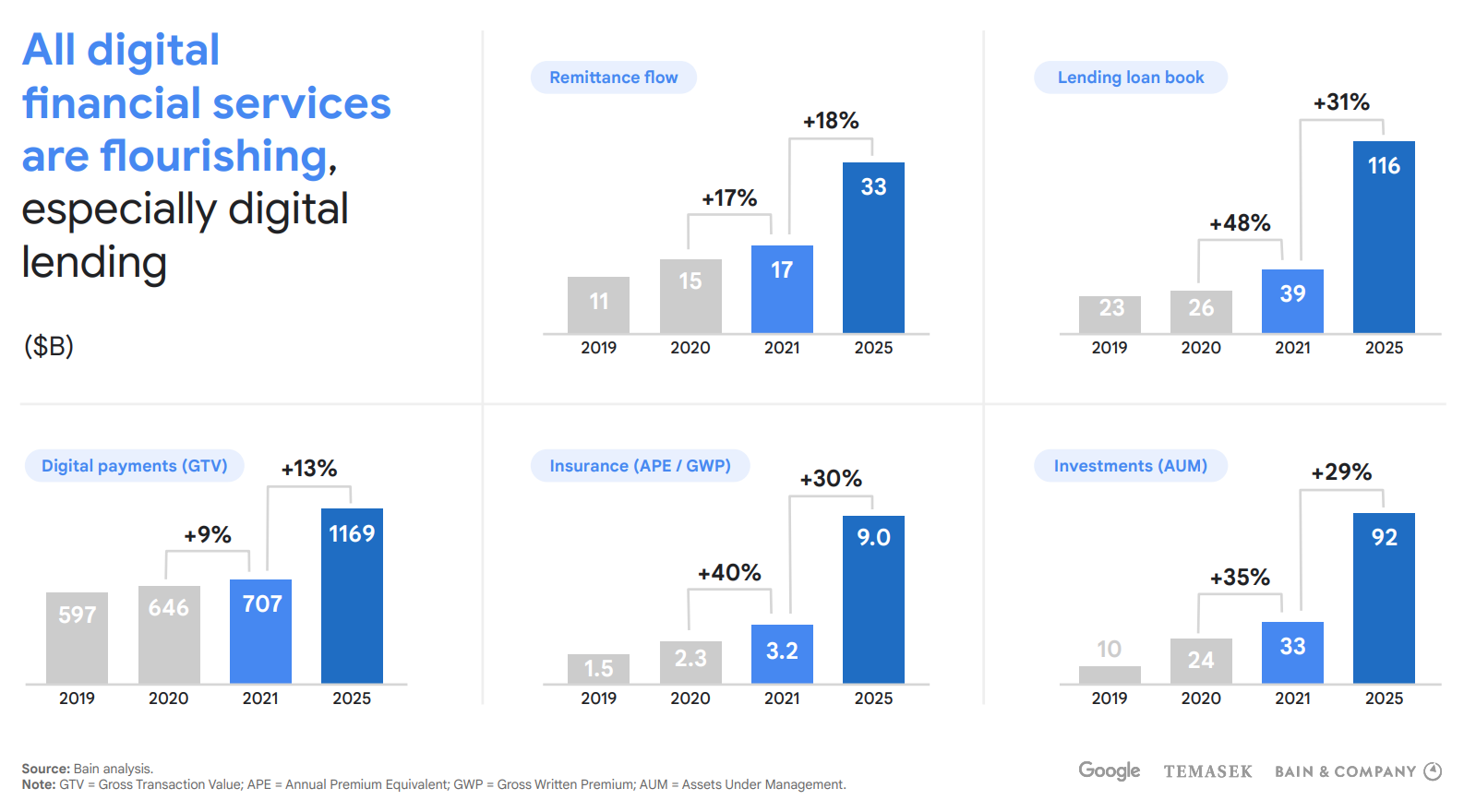

The eConomy Southeast Asia Report 2021, produced by Google, Temasek and Bain & Company, found that across all major digital financial services, usage has increased between 2020 and 2021, recording an annual growth rate ranging from 9% up to 48% depending on the sub-segment.

Digital financial services in Southeast Asia, Source: The eConomy Southeast Asia Report 2021, Google, Temasek and Bain & Company, Nov 2021

According to Thomas G. Tsao, Co-Founder, Gobi Partners, ASEAN is entering “its golden age,” driven by an influx of innovation from new entrants seeking to solve customers’ pain points.

“Southeast Asia is a great place to be in the next ten years,” Thomas said during Fintech Fireside Asia’s latest virtual panel discussion.

“There’s cutting-edge innovation, on-ground innovation happening here, and I think one day, entrepreneurs around the world will be copying from Southeast Asia.”

Thomas G. Tsao, Co-founder, Gobi Partners

Improving financial inclusion

Southeast Asia’s large unbanked population underpins the market potential. At the end of 2020, the region’s top-six economies comprised a population of over 580 million, of which more than half were unbanked.

“Southeast Asia is a mix of developed and developing markets,” said Winsley Bangit, Chief Customer Officer, Mynt, the operator of GCash, the Philippines’ largest e-wallet.

“We [at GCash] see fintech as a tool for greater tool for financial inclusion. In the Philippines, 70% of the adult population are unbanked. GCash enables Filipinos to not only have a wallet but also enables an inclusive digital lifestyle.”

GCash has more than 50 million registered users in the Philippines, Winsley said, and most of them are excluded from the traditional banking system.

Winsley Bangit, Chief Customer Officer, Mynt

“A lot of [our customers] would not even think about going to a bank. It would take them hours and [a lot of] money just to travel to get to the nearest bank branch,” Winsley said.

“That’s where a lot of the [fintech] disruption is happening … [to] democratize access [to financial services].”

Rapid uptake of some of GCash’s latest products, including GInvest and GInsure, showcase the critical role fintech companies are now planning in supporting financial inclusion.

Launched in 2020, GInvest is an investment marketplace feature of the GCash app that allows users to invest in various investment funds from partner product providers. In just six months after its launch, GInvest managed to capture 70% of the domestic market of total Unit Investment Trust Fund (UITF) accounts.

Similarly, GCash’s microinsurance offering, GInsure, now accounts for more than 50% of new policy signups, Winsley said, showcasing how through a digital platform and a mobile app, GCash was able to bring banking, insurance and investment services to untapped markets and underserved demographics.

Southeast Asia’s super apps

GCash is one of Southeast Asia’s so-called super apps, a breed of tech giants emerging out of the broader Asian region. Super apps essentially serve as a single portal to a wide range of virtual products and services, bundling together online messaging, marketplaces and services.

A clear market leader in Southeast Asia is Grab, one of the region’s largest super apps. Grab went public in December 2021 after a US$40 billion merger with a special purpose acquisition company (SPAC).

“We see that pure-play fintechs and regional app players have evolved and expanded to become fintech-led super apps, for example Grab, GoTo and GCash in the Philippines,” Winsley said.

“Super apps are about solving problems. Consumers always gravitate towards the solution that solves their problems the best. In Southeast Asia, there is a lot of categories ripe for digital disruption. Super apps have a big role to play in making things accessible in one space or transactions seamless across categories.”

Uptake of super apps in Southeast Asia has been strong, with around 310 million people using these services across the region, according to Grab.

Now banks from all parts of Southeast Asia are jumping on bandwagon, reinventing their business models to capitalize on the shift. In Indonesia, Bank Rakyat Indonesia (BRI) is working on establishing its mobile banking app, BRImo, into a super app and finance ecosystem, said Dhoni Ramadi, Executive Vice President, BRI.

Dhoni Ramadi, Executive Vice President, Bank Rakyat Indonesia

BRImo currently has more than 100 features but is still actively pursuing more collaborations with fintech companies and other third parties to expand its ecosystem.

“As a bank, we are very open to working with fintech players,” Dhoni said. “We implemented a two-sided platform strategy with, for example, banking-as-a-service (BaaS). We want to create an ecosystem this year and go beyond banking.

“We have roughly around 100 million users for our banking account product. By slicing the profile of our customers, we can find the solutions that fit their needs best and connect them with the players running those solutions.”

Although all major organizations appear to be chasing the super app status, highly-specialized fintech services will remain of relevance.

While in the past, people tended to use one bank for most of their financial service needs, habits have changed and today’s consumers are using different providers for different products, Thomas said.

With technological capabilities growing and barriers to entry falling, large numbers of highly specialized companies are emerging. By focusing narrowly on improving specific parts of the banking value, these startups are able to create solutions that traditional financial service providers often struggle to match.

“[Banking] is getting totally unbundled,” Thomas said. “With open banking and decentralized finance (DeFi), everyone is focusing on particular part of the entire financial services ecosystem and becoming great at that.

Looking ahead

Looking ahead, Jirayut (Topp) Srupsrisopa, Founder and Group CEO, Bitkub Capital Group Holdings, the operator of Thailand’s biggest cryptocurrency trading platform, said DeFi will play a critical role in enabling financial inclusion across Southeast Asia.

“ASEAN is one of the most suitable places for DeFi because of the large population of financial underserved people,” Topp said.

“In the next few years, the infrastructure will be more and more ready and we will see integration between the decentralized world and the centralized world.”

DeFi is an umbrella term for peer-to-peer (P2P) financial instruments that use smart contracts on a blockchain to bypass the need for intermediaries such as brokerages, exchanges, or banks. DeFi revolves around decentralized applications, also known as DApps, that perform financial functions on distributed ledgers. Rather than transactions being made through a centralized intermediary or a traditional securities exchange, transactions are directly made between participants, mediated by DeFi protocols.

For unbanked populations, DeFi solutions present an opportunity to circumvent the barriers imposed by traditional financial institutions and overcome existing framework limitations by employing decentralized technology and governance.

In the future, Topp sees traditional banks embrace DeFi and play a key role in bringing these services to the mainstream.

“Banks will be humanizing all of these technologies on the back end [to help customers use DeFi and blockchain], similarly to people today using Skype without knowing what the TCP/IP protocol is, or Gmail and Hotmail without knowing what the SMTP protocol is,” Topp said.

The 2021 cryptocurrency bull run has led to renewed interest in blockchain technology, fueling the dramatic rise of DeFi in Southeast Asia. 2021 saw Sky Mavis, a Vietnam-based video game developer and blockchain startup, achieve a US$3 billion valuation. Two cryptocurrency exchanges, namely Bitkub and Singapore-based Matrixport, also reached unicorn status.

Topp, a former investment banker turned crypto entrepreneur, told the Financial Times in January 2022 that his company will be focusing on expanding into other Southeast Asian countries this year, targeting nations without a clear, established leader like Cambodia, Myanmar, Laos, the Philippines and Malaysia.

Bitkub said its 2021 net profit reached THB 5 billion (US$152 million).