Though cloud adoption in the banking industry has increased steadily over the past years, adoption is projected to accelerate significantly as bank seek to automate processes, apply advanced analytics to data, and enhance their ability to embed partners like fintechs.

These are the findings of a study conducted in 2021 by digital consulting company Publicis Sapient, in collaboration with Google Cloud.

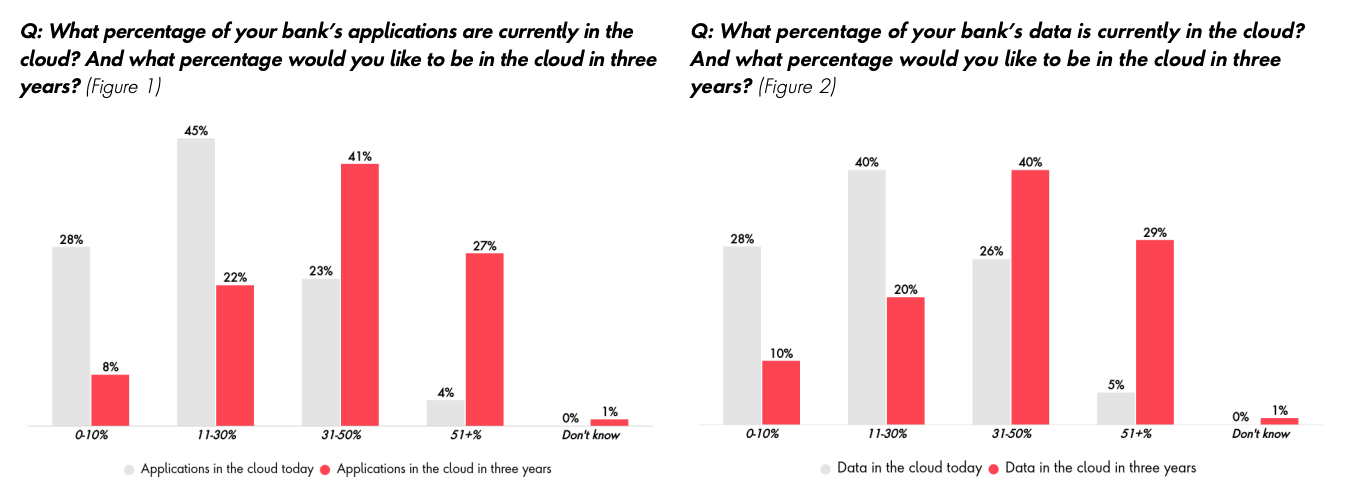

The study, which polled 250 senior banking leaders around the world to better understand where they are on their cloud and business transformation journeys, found that over two thirds of the banks surveyed want at least 31% of their applications and data to be in the cloud in three years’ time.

The figure is close to triple the number of banks who have achieved that today, where only about a third of the institutions surveyed indicated having more than 30% of their applications and data on the cloud.

Banks’ cloud ambitions, Source: Future of Cloud Banking Report, Publicis Sapient/Google Cloud

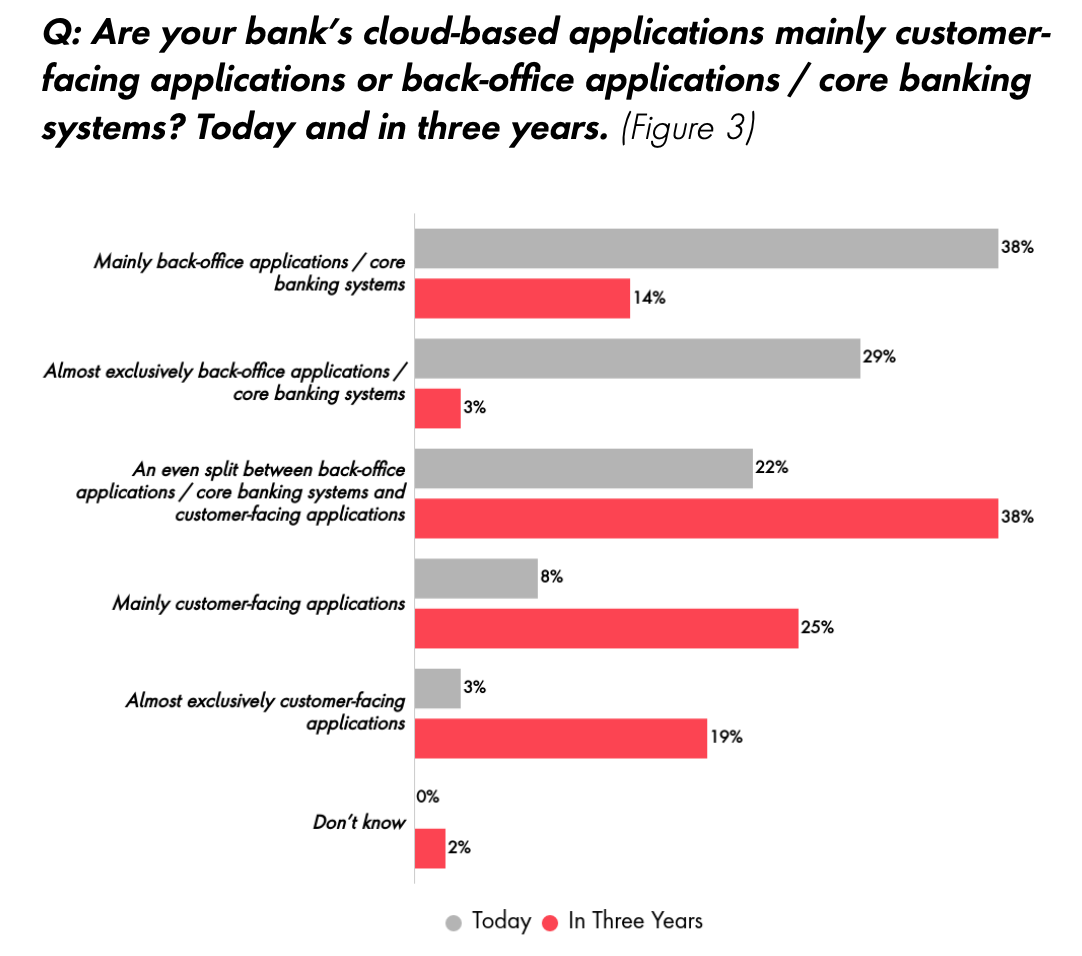

Currently, banks’ cloud-based applications are mainly (38%) or exclusively (29%) back-office applications or core banking systems, but moving forward, they wish for their cloud-based applications to be mainly (25%) or almost exclusively (19%) customer-facing.

Banks’ cloud-based applications, Source: Future of Cloud Banking Report, Publicis Sapient/Google Cloud

APAC banks show strong commitment to cloud

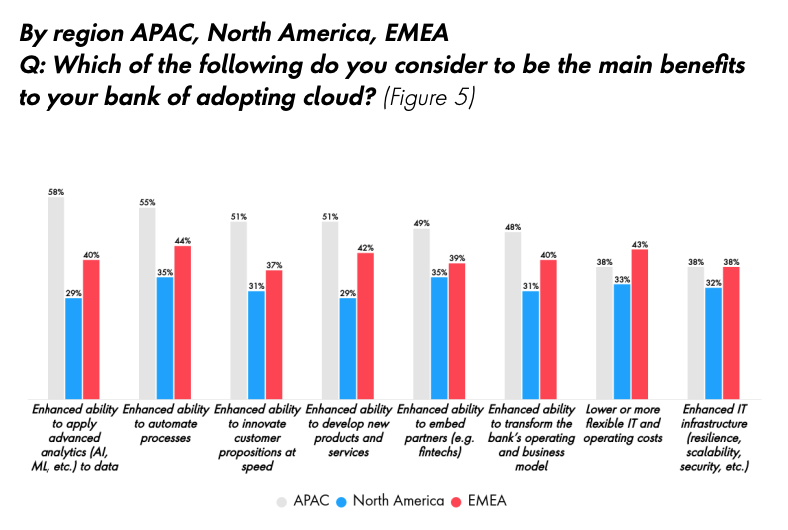

Looking at regional differences, the study found significant disparities. In particular, banks in Asia-Pacific (APAC) were found to be the most enthusiastic about the benefits of cloud-enabled business transformation, highlighting the opportunities brought by advanced analytics (artificial intelligence/machine learning (AI/ML), process automation, new products/services at speed, and embedded partners.

Regional differences on cloud-enabled business transformation benefits, Source: Future of Cloud Banking Report, Publicis Sapient/Google Cloud

North American banks, on the other hand, showed the least ambition on cloud adoption, with a mere 29% of banks in the region wanting their customer-facing apps in the cloud within three years.

Unsurprisingly, banks in North America also showed the least willingness to invest in cloud computing moving forward. Only 60% of North American banks indicated planning to increase investment in cloud over the next three years, compared to 82% in APAC and 83% in Europe, the Middle East and Africa (EMEA).

Obstacles to banks’ cloud adoption

Among the key obstacles hindering banks’ adoption of the cloud, the research identified a lack of internal understanding of the business benefits of adopting cloud computing as one of the top roadblocks.

Only 44% of participants said their business leaders understood the business-related possibilities and opportunities of cloud, and just 34% said the same about their non-executive board.

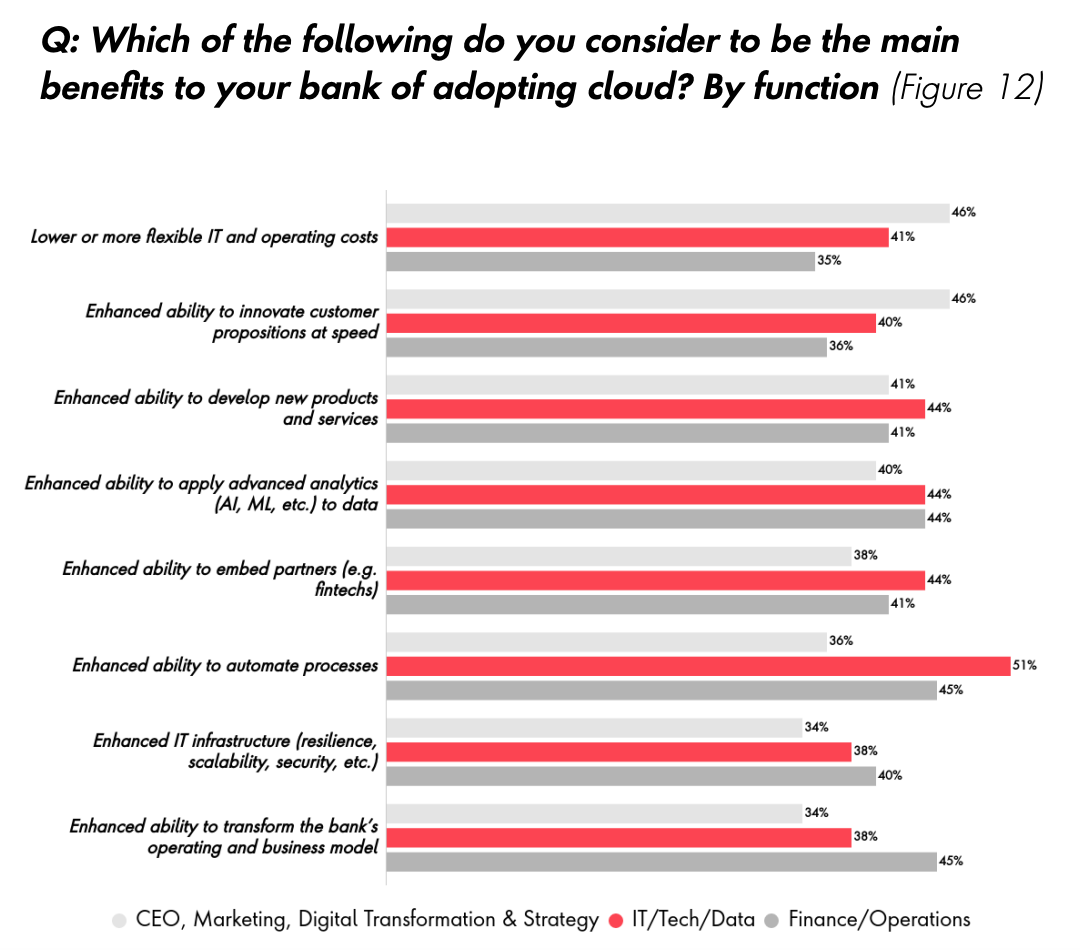

In particular, the report outlines a significant gap between the benefits perceived by business stakeholders, including CEOs and those working in strategy, digital and transformation, and those working in the IT and finance teams.

For example, 51% of respondents that work in IT functions indicated seeing the ability to automate processes as a primary benefit of cloud computing, against only 36% of business stakeholders.

Similarly, 45% of finance function leaders said they considered the cloud’s ability to transform business and operating models as a main benefit, compared with just 34% of business leaders.

Main benefits of adopting cloud, Source: Future of Cloud Banking Report, Publicis Sapient/Google Cloud

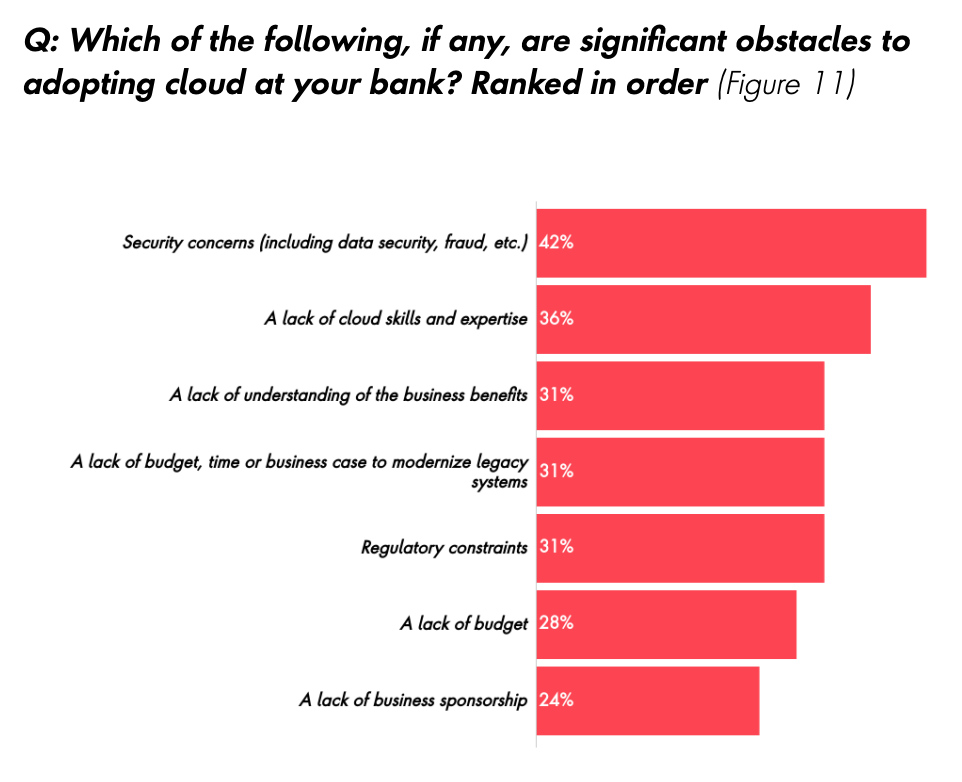

Besides the lack of internal understanding (31%), respondents also indicated security and fraud concerns (42%), as well as difficulties in hiring people with the right skills (36%), as other major barriers to cloud adoption.

Banks’ top obstacles to adopting cloud, Source: Future of Cloud Banking Report, Publicis Sapient/Google Cloud

Findings from the Publicis Sapient/Google Cloud survey echo those drawn from other research. A February 2022 report by the International Data Corporate (IDC) expects accelerated adoption of cloud computing in APAC as banks pursue their modernization projects triggered by the COVID-19 pandemic and the corresponding technology-driven shift.

IDC projects that, by 2026, 75% of trade finance systems will be cloud based, and by 2025, it expects the use of shared industry cloud data will improve decisioning time on commercial loans by 40%.

Public cloud spend of financial services institutions in APAC, excluding Japan, is expected to grow at a compound annual growth rate (CAGR) of 29.9% between 2019 and 2024, surging from US$4.9 billion to US$18.1 billion.

Featured image credit: Freepik