GXS Bank Introduces Savings Account Ahead of Launch Next Monday

by Fintech News Singapore August 31, 2022The Grab-Singtel digital bank consortium, now branded as GXS Bank, announced the roll out of its savings account ahead of its launch next Monday.

The consortium was among the four successful applicants having secured a full digital bank license from the Monetary Authority of Singapore in December 2020.

The GXS Savings Account offers a yearly interest of 0.08 percent that will be accrued daily and customers will be able to deposit up to S$5,000 at launch.

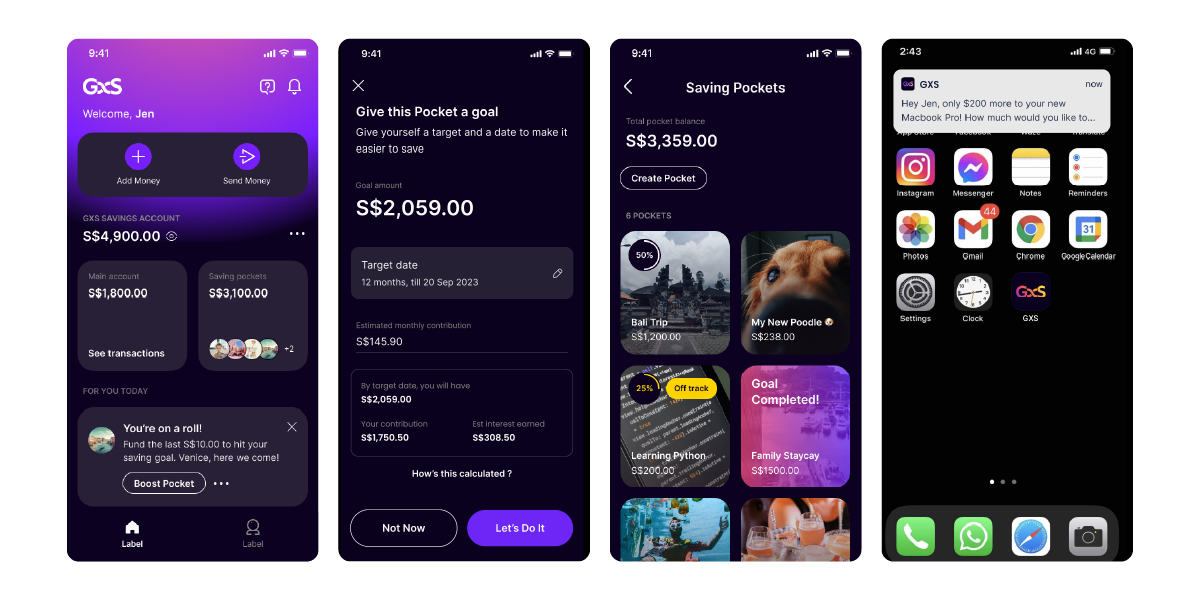

Customers will be able to create up to eight pockets from their savings account which allows them to save for specific financial goals which can be customised with names and pictures.

According to GXS, customers will receive smart nudges to encourage them to meet their goals and cheer them on when they are able to do so. Each of these pockets will earn a daily interest of 1.58 percent.

GXS claims that it is the fist digital bank in Singapore to be awarded the Data Protection Trustmark by the Infocomm Media Development Authority (IMDA).

The GXS Bank’s app will be available on the Apple and Google Play Store apps on 5 September.

The bank’s services will be rolled out progressively to consumers thereafter, starting with selected employees and underbanked customers within the GXS, Grab and Singtel ecosystem.

Charles Wong

Charles Wong, Singapore CEO of GXS, said,

“GXS is a homegrown bank on a mission to support the needs of the entrepreneurs, gig economy workers and early-jobbers in our community. To start, we are challenging the notion of what a basic savings account could do to support their goals and dreams.

Over the coming months, we will also tackle other obstacles that hinder consumers and small businesses from reaching their goals sooner, such as growing their wealth or accessing credit.”