Singaporeans Still Visit ATMs and Branches Despite Using Banking Apps, Survey Says

by Fintech News Singapore October 17, 2022Many Singaporeans are still using ATMs and visiting bank branches even though close to nine in 10 Singaporeans (88 percent) use mobile banking at least a few times a month.

An inaugural national survey on digital inclusion and resilience conducted by Lee Kuan Yew School of Public Policy (LKYSPP) in partnership with UOB found that three in four Singaporeans use ATMs several times a month while one in four visits their bank’s branches several times a month.

Surveying over 2,000 Singapore residents this year, the research provides insights on inclusive banking by examining Singaporeans’ attitudes and behaviours on digital banking adoption and digital resilience.

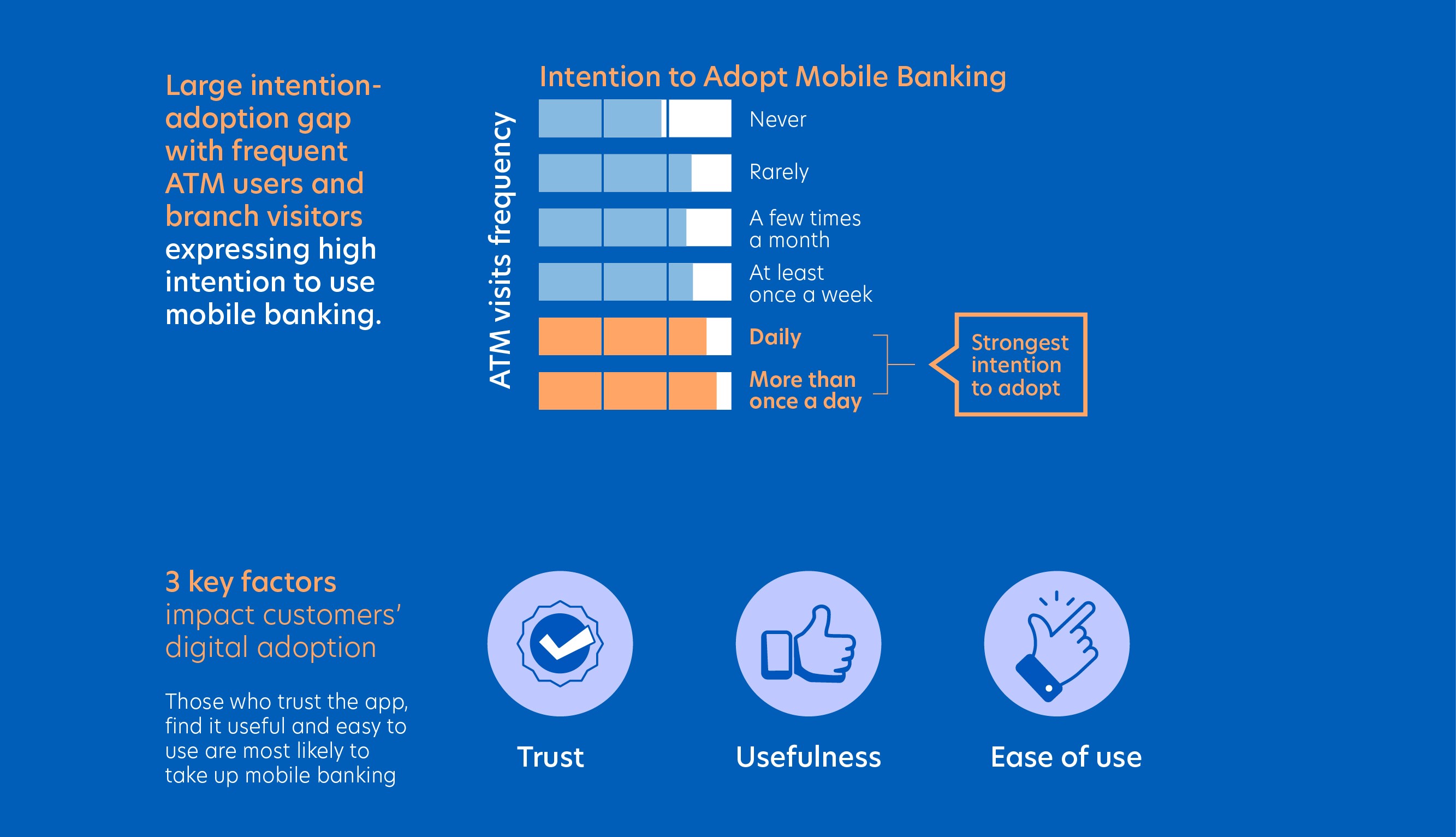

The survey found that those who frequent ATMs and bank branches are not resistant to adopting mobile banking but in fact have the highest intention to use mobile banking.

Meanwhile, customers who never visit bank branches also indicate high intention to adopt mobile banking (5.6), indicating that there are distinct population segments keen on banking digitalisation.

The intention-adoption gap indicates that more could be done to nudge digital banking adoption.

Dr. Reuben Ng

Dr. Reuben Ng, Assistant Professor at the Lee Kuan Yew School of Public Policy and Principal Investigator for the national study said,

“Individuals who use ATMs and visit bank branches frequently have expressed a strong desire to adopt digital banking but have not done so.

This is the segment that banks need to focus their efforts. Trust ranks first among key considerations on whether customers will adopt digital banking.”

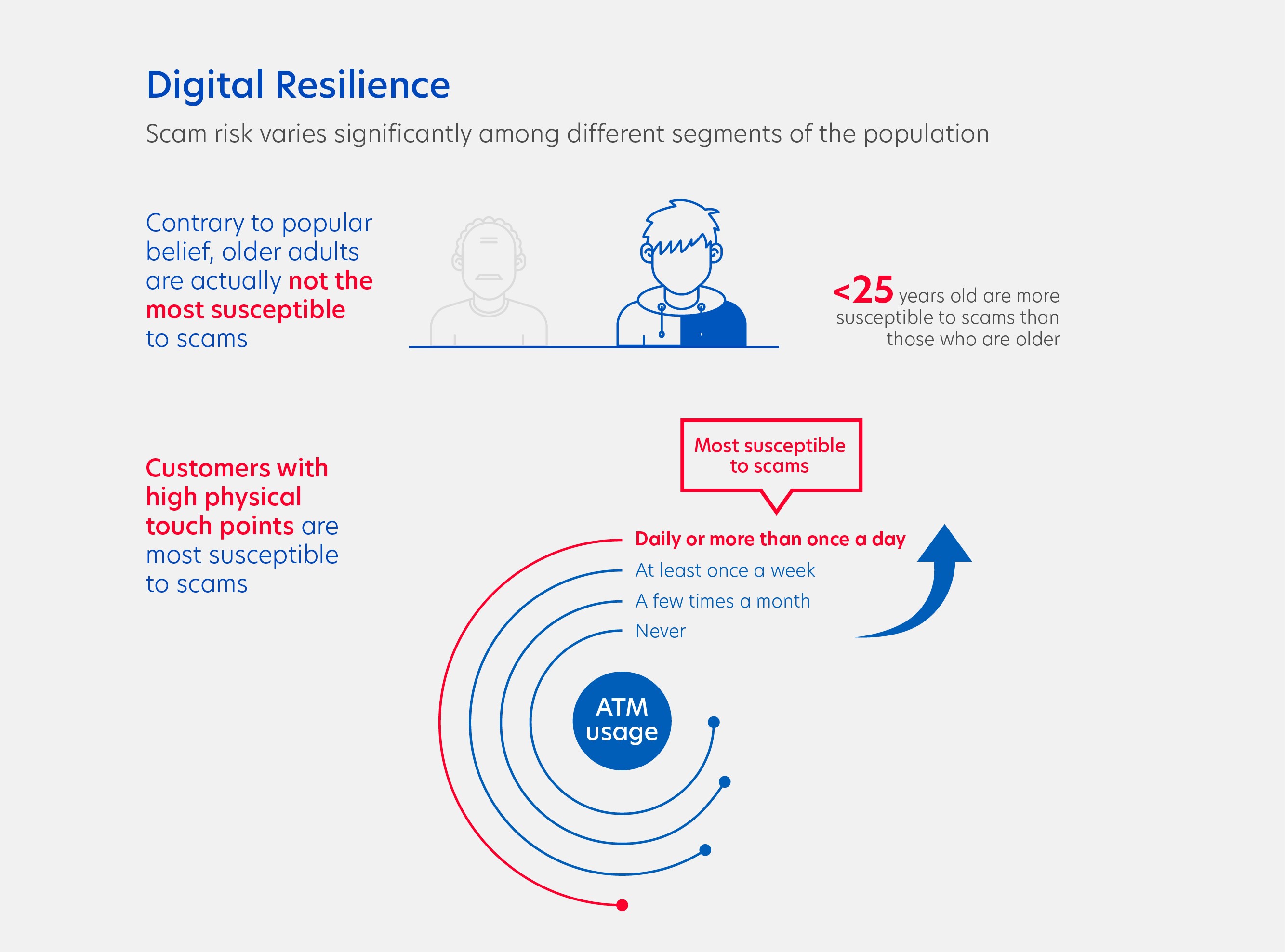

Given the trend of rising and evolving scams in Singapore, another aspect of the survey was to better understand the digital resilience of Singaporeans and how susceptible they are to scams.

Contrary to popular belief, older adults are not the most susceptible to scams with those under 25 years old being 10 per cent more susceptible to scams than those 65 years and above.

Prof. Ng explained that “youths being digital natives are most vulnerable as their ease with technology may have lowered their guard towards scams.”

Kevin Lam

Kevin Lam, Head of TMRW and Group Digital Banking said,

“We believe that financial and digital literacy are essential in the world we live in today, particularly for the young.

This is why we will be launching the UOB TMRW’s #BetterTMRW financial literacy (FinLit) initiative, an ongoing programme to educate and guide our customers to be financially strong and digitally savvy, so that they can have the knowledge to move towards their goals and achieve financial security.”

UOB TMRW’s #BetterTMRW FinLit initiative aims at improving financial literacy among customers by employing various formats adapted to suit each age group, including quizzes and videos.

Aside from UOB TMRW’s #BetterTMRW FinLit initiative, UOB launched the My Digital Space programme in 2020 to provide children from disadvantaged backgrounds with digital learning tools and skills to ensure that their learning was not disrupted by the pandemic.

As part of the programme, a dedicated online learning resource center was also created to host enrichment resources in areas such as Digital Citizenship, Financial Literacy and Art to enable the children to stay future-ready and financially savvy.

As of December 2021, UOB said that it has helped meet the digital education needs of more than 1,350 children and youth beneficiaries with over S$1.65 million worth of digital devices and educational resources.