Must-Attend Sessions at the 2022 Singapore Fintech Festival

by Fintech News Singapore October 27, 2022The annual Singapore Fintech Festival (SFF) is returning this year from November 02 to 04, 2022 as an in-person event, promising to bring together tens of thousands of participants to discuss some of the industry’s most pressing challenges and hottest trends.

Organized by the Monetary Authority of Singapore and Elevandi, in partnership with Constellar and in collaboration with the Association of Banks in Singapore, SFF 2022 will be held at the Singapore EXPO under the theme “Building Resilient Business Models amid Volatility and Change”.

This year’s event will feature key stakeholders comprising government leaders, regulators, financial services leaders, entrepreneurs, investors, and technology leaders, who will take stock of the drivers of change and examine how organizations can build and redefine business models to be more resilient, inclusive and sustainable. Key topics to be covered include environmental, social and governance (ESG) standards, financial inclusion, central bank digital currencies (CBDCs) and digital assets.

SFF 2022 will also feature a record of 23 international pavilions aimed at showcasing the hottest and fastest-growing fintech companies from each jurisdiction represented. Nations to be featured this year are Australia, Bahrain, Belgium, Cambodia, Canada, Denmark, France, Hungary, Ireland, Italy, Israel, Japan, Korea, Luxembourg, Philippines, Singapore, Switzerland, Taiwan, the United Arab Emirates (UAE) and the United Kingdom (U.K.).

The conference segment of SFF 2022 will comprise a series of Global Plenary sessions focusing on the leaders and organizations addressing the core construct of resilient business models; Knowledge Plenary sessions, which will explore emerging trends and key topics including web3, ESG, small and medium-sized enterprise (SME) banking, insurance, international growth markets and fintech regulation, as well as the Elevandi Insights Forum, which will consist of invitation-only roundtables bringing together the public and private sector to address challenges faced by the financial sector.

With SFF 2022 just around the corner, we’ve compiled a list of the top sessions to attend. For this list, we’ve focused on public sessions, excluding the Elevandi Insights Forum, and selected the most highly anticipated panel discussions and presentations featuring world-renowned fintech leaders, innovators and policymakers, and tackling some of the hottest trends in the fintech sector, including digital assets, ongoing CBDC projects, the rise of ESG and digital banking.

Day 1 – November 02, 2022

Opening Address

10:15AM-10:35AM | Global Plenary | Hall 1

Lawrence Wong, Deputy Prime Minister and Minister for Finance, Republic of Singapore

Stick, Twist or Fold

11:05AM-11:55AM | Global Plenary | Hall 1

During the “Stick, Twist or Fold” session, Kristo Käärmann, Co-founder & CEO, Wise; Kunal Shah, Founder, CRED; and Julian Teicke, Founder & CEO, wefox, will discuss how organizations are navigating the current market conditions as well as the implications for business models. The speakers will also share what constitutes a resilient business model in today’s market.

This session will be moderated by journalist and broadcaster Manisha Tank.

The Half-Century Sprint: Fintech’s Role in the Net Zero Transition

01:15PM-01:45PM | Knowledge Plenary (ESG & Sustainable Finance) | Hall 3

2050 marks a key milestone in the pursuit of Net Zero, with multiple companies and countries setting that date as a point by which they plan to be carbon neutral. Reaching such a target will involve corporate and societal transformation, not to mention a great deal of innovation.

During the “The Half-Century Sprint: Fintech’s Role in the Net Zero Transition” session, top executives of World Wide Generation, Ping An Group, Terrascope and DBS Bank will discuss the role of the fintech sector in supporting these efforts as well as how these efforts can be increased or compromised through activities like crypto coin mining.

Speakers:

- Manjula Lee, Founder & CEO, World Wide Generation

- Jonathan Larsen, Chief Innovation Officer of Ping An Group, Chairman & CEO of Ping An Global Voyager Fund, Ping An Group

- Maya Hari, CEO, Terrascope Pte Ltd

- Helge Muenkel, Chief Sustainability Officer, DBS Bank

Moderator: Sang Shin, Director, Digital Innovation, Temasek

Redefining Existences: Living Sustainably Through Tech and Finance

01:45PM-02:25PM | Knowledge Plenary (ESG & Sustainable Finance) | Hall 3

The “Redefining Existences: Living Sustainably Through Tech and Finance” session will explore how to adapt modes of living and working to reduce harm caused and help regenerate damaged ecosystems.

The session will be devoted especially to how technology and financial innovation can support such a goal, and will look into new models for business, new technologies and covering the shifting demands of business-to-business (B2B) and business-to-consumer (B2C) customers.

Speakers:

- Lesly Goh, Former Chief Technology Officer, World Bank Group

- Gitanjali JB, Co-founder, Himalayan Institute of Alternatives

- Stephanie Davis, Vice President, Google Southeast Asia, Google

- Rachel Freeman, Chief Growth Officer, Tyme

Moderator: Corrado Forcellati, Managing Director, Paia Consulting

Applying and Adapting IOSCO Principles to Digital Assets Markets

02:10PM-02:50PM | Knowledge Plenary (Digital Assets & Web3) | Hall 2

During the “Applying and Adapting IOSCO Principles to Digital Assets Markets” session, policymakers and regulators from the Monetary Authority of Singapore, the U.K. Financial Conduct Authority and the U.S. Securities and Exchange Commission will discuss the regulatory treatments for crypto and digital assets, market integrity and investor protection, systemic risks, as well as decentralized finance (DeFi) and its interactions with broader financial markets.

Speakers:

- Lim Tuang Lee, Assistant Managing Director (Capital Markets), Monetary Authority of Singapore

- Matthew Long, Director – Payments & Digital Assets, U.K. Financial Conduct Authority

- Valerie Szczepanik, Director, US SEC FinHub, U.S. Securities and Exchange Commission

Moderator: Damien Shanahan, Senior Advisor, Head of Emerging Regulatory Issues, International Organisation of Securities Commissions (IOSCO)

Programmable Money in SG

02:50PM-03:30PM | Knowledge Plenary (Digital Assets & Web3) | Hall 2

Project Orchid and its experiments explores the potential of programmable money and the infrastructure required to support it. This panel will discuss the motivation for programmable money and how it might support a digital asset ecosystem in Singapore.

Speakers:

- Adrian Ong, Managing Director and Group Head of Cash Management Sales, United Overseas Bank

- Talitha Rui Ling Chin, Senior Product Manager, Open Government Products

- Ng Peng Khim, Head of Institutional Banking Group & Future Ready Technology (Technology & Operations), DBS Bank

- Melvyn Low, Head Global Transaction Banking, OCBC Bank

- Wong Wenbin, Head of GrabFin Singapore, Grab

Moderator: Alan Lim, Head, Fintech Infrastructure Office, Monetary Authority of Singapore

Achieving Universal Financial Inclusion with Interoperable, Instant Payment Systems

04:30PM-05:00PM | Knowledge Plenary (ESG & Sustainable Finance) | Hall 3

This session will address how interoperability and open source can play a role in how central banks can advance financial inclusion and ensure that every person can make affordable, instant payments across borders with anyone else in the digital economy using a simple mobile phone.

In this fireside chat, participants will get to learn how open, interoperable, instant payment systems can help achieve universal financial inclusion, lower the cost of transactions both nationally and across borders and increase the frequency of transactions in ways that would boost respective countries’ GDPs.

Speakers:

- Sopnendu Mohanty, Chief Fintech Officer, Monetary Authority of Singapore

- Andrew McCormack, Centre Head, Bank of International Settlement Innovation Hub – Singapore Centre

- Konstantin Peric, Deputy Director, Financial Services for the Poor, Bill & Melinda Gates Foundation

Moderator: Paula Hunter, Executive Director, Mojaloop Foundation

Day 2 – November 03, 2022

Policy Dialogue: Directing ESG Governance for the Financial Industry

11:45AM-12:25PM | Global Plenary | Hall 1

During this policy dialogue session on “Directing ESG Governance for the Financial Industry”, a panel of global policymakers from the U.K. Financial Conduct Authority, the Central Bank of Kenya, and the International Financial Services Centres Authority (IFSCA) will elucidate what robust and effective governance looks like and discuss the operational challenges to implementing it.

Speakers:

- Nikhil Rathi, Chief Executive, U.K. Financial Conduct Authority

- Dr Patrick Njoroge, Governor, Central Bank of Kenya

- Shri Injeti Srinivas, Chairperson, International Financial Services Centres Authority (IFSCA)

Moderator: Jo Ann Barefoot, Co-founder & CEO, Alliance for Innovative Regulation

Regulators Coffee Chat – The Need for New Credit Models for Lending to SMEs

02:10PM-02:40PM | Knowledge Plenary (Banking for Business) | Hall 2

While businesses are often assessed by their ability to pay, micro, small and medium-sized enterprises (MSMEs) in emerging markets often require a different approach to assessing their financing ability. This panel will explore how alternative credit models and the use of intent to pay can be better placed to assess and extent credit to SMEs.

Speakers representing the Bank of Ghana, the Central Bank of Hungary, and Bangko Sentral ng Pilipinas will discuss how regulators can leapfrog current support and lending to MSMEs/SMES, as well as the use of alternative data and models can be used to assess SME credit.

Speakers:

- Dr Maxwell Opoku-Afari, First Deputy Governor, Bank of Ghana

- Dr Mihály Patai, Deputy Governor, the Central Bank of Hungary

- Bernadette Puyat, Deputy Governor, Bangko Sentral ng Pilipinas

Moderator: Jo Ann Barefoot, Co-founder & CEO, Alliance for Innovative Regulation

Driving New Digital Bank Profitability – Comprehensive SME Banking

02:40PM-03:20PM | Knowledge Plenary (Banking for Business) | Hall 2

As digital banks in Asia-Pacific (APAC) takes off and the fight for consumers begins, this panel will hear from the digital banks on the essential products for profitability and how they have adjusted their approach to the local operating context.

Topics will include the main product differentiations of digital banks from traditional financial institutions in the client’s digital banking experience and how digital banks leaders are sharpening the three essential products for them to succeeds, namely loans and credit, insurance, and wealth management and investment advisory services.

Speakers:

- Manish Bhai, Founder & CEO, UNO Digital Bank

- Darren Buckley, Chief Retail Banking Group Officer, Vietnam Technological and Commercial Joint Stock Bank (Techcombank)

- Toh Su Mei, CEO, ANEXT Bank

- Chew Seow Chien, Senior Partner, Bain & Company Inc

- Kharim Siregar, President Director, PT Bank Jago Tbk

Moderator: Saurav Bhattacharyya, CEO, Proxtera Pte Ltd

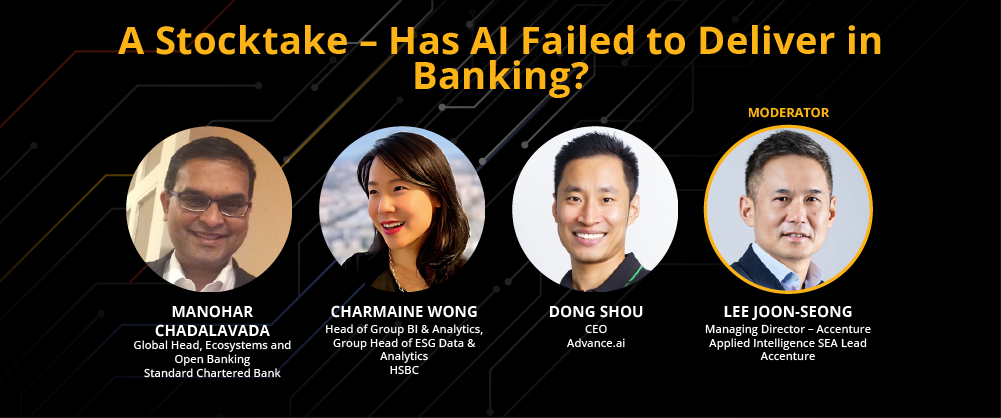

A Stocktake – Has AI Failed to Deliver in Banking?

04:00PM-04:40PM | Knowledge Plenary (Banking for Business) | Hall 2

This session, titled “A Stocktake – Has AI Failed to Deliver in Banking?” will cover advancements in artificial intelligence (AI) for banking and key areas of AI implementation in banks, obstacles to AI implementation in banking, as well as the different use cases banks should focus to apply AI.

Speakers:

- Manohar Chadalavada, Global Head, Ecosystems and Open Banking, Standard Chartered Bank

- Charmaine Wong, Head of Group BI & Analytics, Group Head of ESG Data & Analytics, HSBC

- Dong Shou, CEO, Advance.ai

Moderator: Lee Joon-Seong, Managing Director – Accenture Applied Intelligence SEA Lead, Accenture

Day 3 – November 04, 2022

Balancing Act : Seeing through turbulent times and the Web3 shift

01:15PM-01:45PM | Global Plenary | Hall 1

From short term decision making to long term strategy, industry titans AirAsia, DBS Bank and Paytm will discuss how they are balancing between making tough choices now to respond to the current market volatility and preparing for the fundamental technological shift from web2 to web3, including the practical steps they are taking to remain relevant in a decentralized future.

Speakers:

- Tony Fernandes, Co-founder, AirAsia

- Piyush Gupta, CEO, DBS

- Vijay Shekhar Sharma, Founder & CEO, Paytm

Moderator: Tanvir Gill, Anchor, CNBC International

FX and Liquidity Management in Multi-CBDC Networks

01:30PM-02:05PM | Knowledge Plenary (FinTech Regulation) | Hall 3

As central banks around the world announces interest and development work in CBDC, this panel will explore central banks’ priorities in wholesale CBDC. The panel will touch upon concepts such as liquidity management, automated market makers and interoperability in multi-CBDC networks.

Topics will include their respective priorities when it comes to CBDC, the role of DeFi to support liquidity management and the timeline to scale distributed ledger technology (DLT) solutions into production grade and implement it at a central bank level. The speakers will also explore how wholesale CBDC can be useful for central banks in facilitating cross-border payment and settlement.

Speakers:

- Alan Lim, Head, Fintech Infrastructure Office, Monetary Authority of Singapore

- Dr Alexander Wehrli, Senior Adviser for FX Trading Strategy and Technology, Swiss National Bank

- Claudine Hurman, Director of Infrastructures, Innovation and Payments, Banque de France

- Moderator: Andrew McCormack, Centre Head, Bank of International Settlement Innovation Hub – Singapore Centre

Promoting Innovation in the Financial Sector – What Framework Conditions?

02:00PM-02:10PM | Knowledge Plenary (International Growth Markets) | Hall 2

During the “Promoting Innovation in the Financial Sector – What Framework Conditions?” session, Ueli Maurer, Federal Councilor, Head of Federal Department of Finance, Government of Switzerland – Swiss Federal Council, will discuss how government bodies, in times of uncertainty and in complex systems such as the financial sector, can factor current developments into the design of frameworks. He will explore how governments should focus on continuously adapting to the developments and optimally balancing the promotion of innovation and the preservation of stability.

Venture Capital Investments in Growth Markets – An Asia Focus

02:15PM-02:55PM | Knowledge Plenary (International Growth Markets) | Hall 2

Securing venture capital investment is an important stepping stone to growth for startups, but it can be notoriously challenging.

In the session “Venture Capital Investments in Growth Markets – An Asia Focus”, top executives of Antler, HashKey Capital, Integra Partners and Arbor Ventures will examine how startups can position themselves to win investment. They will look at what venture capital (VC) firms are looking, and what aspects of a business – beyond the numbers – they find persuasive. They will also analyze what young businesses should be looking for from their investment partners, and how to negotiate the best deal.

Speakers:

- Jussi Salovaara, Co-founder & Managing Partner Asia, Antler

- Deng Chao, CEO, HashKey Capital

- Jinesh Patel, Managing Partner, Integra Partners

- Wei Hopeman, Co-founder & Managing Partner, Arbor Ventures

Moderator: Arvind Sankaran, On Secondment by SG Gov (MoF), Asian Development Bank

Is Doubling Down on Cyber and Fraud Regulation Enough?

02:40PM-03:15PM | Knowledge Plenary (Fintech Regulation) | Hall 3

During the “Is Doubling Down on Cyber and Fraud Regulation Enough?” session, experts and officials from FS-ISAC, Amazon Web Services, Callsign and Banque de France will discuss the global cyber threat landscape, how to achieve resilience, bigtechs’ concentration risks, anti-fraud measures and tools, and more.

Speakers:

- Teresa Walsh, Global Head of Intelligence, FS-ISAC

- Phil Rodrigues, Head of Security, APJ Commercial, Amazon Web Services

- Namrata Jolly, General Manager, APAC, Callsign

- Thierry Bedoin, Chief Information Officer & Director General Information System, Banque de France

- Moderator: Julian Gordon, Vice President, Asia Pacific, Open Source Security Foundation, Linux Foundation APAC

Spotlight on Fintech Founders from Emerging Markets

02:55PM-03:35PM | Knowledge Plenary (International Growth Markets) | Hall 2

Emerging markets have become home to new and successful fintech firms in recent years, which have helped transform emerging economies through servicing the once unmet needs of individuals and SMEs. This success story has built on technological and business model innovation, but there have also been unique challenges along the way.

In the “Spotlight on fintech founders from emerging markets” session, top executives of Moove, Pine Labs, Turtlemint, and Xendit will unpack some of these challenges and discuss the potential of this sector over the upcoming years. They will look into which business models are proving most successful, and which new technologies seem set to shape development of the sector.

Speakers:

- Ladi Delano, Co-founder & Co-CEO, Moove

- Amrish Rau, CEO, Pine Labs

- Dhirendra Mahyavanshi, Co-founder & CEO, Turtlemint

- Tessa Wijaya, Co-founder & COO, Xendit

Moderator: Ben Gilbey, Senior Vice President, Digital Consumer Solutions, Asia Pacific, Mastercard

Are Financial Institutions Ready for ESG Regulation?

03:50PM-04:25PM | Knowledge Plenary (Fintech Regulation) | Hall 3

During the “Are Financial Institutions Ready for ESG Regulation?” session, academics, government officials and bankers will discuss the transition to Net Zero, ESG standards and disclosures, greenwashing, macroeconomic risks, and more.

Speakers:

- Zbigniew Wiliński, Director of Fintech Department, Polish Financial Supervision Authority

- Dr Ben Caldecott, Director, Oxford Sustainable Finance Group and the Lombard Odier Associate Professor of Sustainable Finance; Director, U.K. Centre for Greening Finance & Investment, University of Oxford

- Sacha Sadan, Director of Environmental, Social and Governance, Financial Conduct Authority (FCA)

- Jane Ho, Head of Stewardship, APAC, BNP Paribas Asset Management

Moderator: Pauline Wray, Head of New Ventures, Stealth Start-Up

Building a Bank from Scratch: Is There a Path to Profitability?

04:25PM-05:00PM | Knowledge Plenary (Fintech Regulation) | Hall 3

During the “Building a Bank from Scratch: Is There a Path to Profitability?” session, top executives of WeLab, Techcombank, Trust Bank and Boos will discuss the introduction of digital license frameworks and the key differences between incumbent banks and challenger banks. The speakers will also share success stories, insights and learnings from their experience.

Speakers:

- Simon Loong, Founder & Group CEO, WeLab

- Pranav Seth, Chief Digital Officer, Techcombank

- Dwaipayan Sadhu, CEO, Trust Bank

- Sheyantha Abeykoon, Group CEO, Boost

Moderator: Elizabeth Neo, Presenter, CNA (Mediacorp)

Get an exclusive 15% off your entrance ticket to the Singapore Fintech Festival. Click here to register.