In recent years, the financial services industry has undergone a significant transformation. Traditional financial institutions face new competition from startups leveraging technology to offer innovative financial products and services, broadly referred to as the fintech landscape.

But there is a distinction between traditional finances offering newer digital products to be competitive in a dynamic marketplace.

In an uncertain economic climate, consumers are increasingly looking to digital platforms and apps to help them save a buck.

At the same time, businesses (including banks and other financial institutions) want to optimise their digital transformation investments to ensure quality investment returns.

The demand for financial services has changed in recent years

Consumers now want more personalized and convenient services that meet their shifting needs, especially post-pandemic and as newer innovative solutions appear.

This outlook has led to the rise of embedded finance, a new way of providing monetary services support.

Traditional finance is often not equipped to offer these trendy new services, such as ‘Buy Now Pay Later‘ (BNPL) options or cashback/loyalty points for transactions using their platform, out of the box.

This is often down to how archaic mainframe-based banking systems could be — they’re not built with the ability to quickly adapt emerging digital solutions on top of their analog systems.

Overhauling their in-house architecture will be costly and likely lead to critical services being offline while the transition is carried out.

So modern banks are often ironically turning to fintechs supplying banking-like digital resources to provide third-party financial services that the B2B and B2C markets are increasingly demanding.

These digital financial services are termed as embedded finance, aiding the classical financial services industry (FSI) to quickly onboard emerging digital banking capabilities that fast-track their digitalisation journey.

Adopting embedded finance options pleases both consumers and shareholders simultaneously since users want the ease of knowing their banking institution offers fintech-like services.

At the same time, the board can rest assured that the bank is modernising rapidly without consuming too much cost.

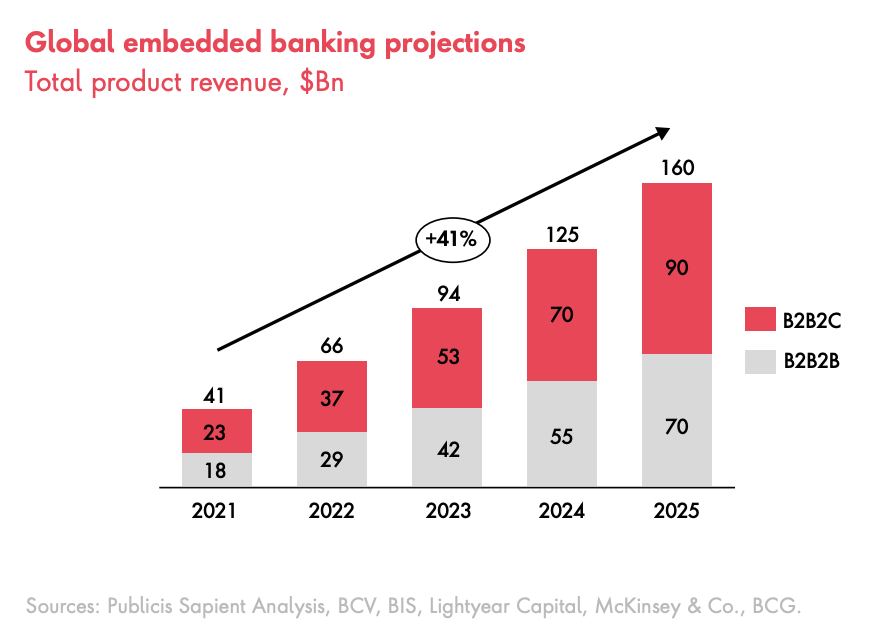

The trend is expected to continue exploding in widespread adoption among FSI, with digital consulting company Publicis Sapient forecasting an annual growth rate of 41% in global embedded banking revenues from 2021 to 2025.

Global embedded banking projections, total product revenue, $Bn, Source: Publicis Sapient, 2022

BaaS rising for merchant sites’ to be like banks

On the flip side of rising embedded finance growth, organisations not traditionally affiliated with the FSI want to offer bank-like financial services to simplify customer experiences on their digital-native platforms.

Going outside of their core competencies to offer in-demand financial services, such as embedding payments on their web or mobile platforms easily via APIs, or providing branded payment cards for valuable customers to shop at offline locations, could be disruptive to a lot of platforms if they didn’t have the option of offering banking as a service (BaaS).

In a nutshell, BaaS are bundled offerings, often white-labeled or cobranded services to carry the firm’s branding instead of the financial service provider, that nonbanks can use to serve their customers.

BaaS enables nonbanks to offer financial products and services without obtaining a banking license or developing the necessary infrastructure.

While BaaS is still in its early stages, it has the potential to disrupt the traditional banking model and create new opportunities for nonbanks to enter the financial services industry.

On the other hand, banking as a service (BaaS) enables companies to offer services and financial products to their customers without having to be a financial institution.

This is accomplished through APIs, which allow companies to access the needed financial services from a provider quickly and without building everything from scratch.

BaaS providers offer financial services that can integrate into a company’s existing product or service. This allows companies to provide customers with offerings on their platforms without having to build their bank-like infrastructure.

Examples of BaaS offerings could be supplying financing options, such as microcredit lines for consumers on e-commerce sites — so they can shop at their ease without paying immediately — and small loans for businesses, such as what all-in-one smartphone superapps like Singapore’s Grab and Indonesia’s Gojek offer to merchants who leverage other services on their platform.

The rise of embedded finance and BaaS is changing the financial services landscape. Financial institutions must adapt to this new trend to remain competitive.

Featured image credit: edited from Freepik