BNPL Predicted to Be Singapore’s Fastest Growing Online Payment Method by 2025

by Fintech News Singapore March 17, 2022In Singapore, alternative payment methods including buy now, pay later (BNPL) arrangements and digital wallets, are surging in popularity. By 2025, fintech software provider FIS projects that these payment methods will make up half of online payments, with BNPL forecasted to be the fastest-growing option.

Between 2021 and 2025, BNPL arrangements are expected to grow at a compound annual growth rate (CAGR) of 40% and double their share of e-commerce transaction value from 4% to 8%, figures shared in the 2022 Global Payments Report by Worldpay from FIS show.

In Singapore, BNPL arrangements have emerged as a popular alternative to credit cards for consumers, and an appealing payment method for merchants that promises higher conversion rates and basket size.

A 2021 study by consumer data and analytics firm Milieu Insight found that about 19% of Singapore’s population above the age of 16 had tried a tech-enabled BNPL service with readiness being relatively higher amongst younger generations.

Homegrown BNPL startups including Atome, hoolah and Grab PayLater have seen strong growth since the start of the pandemic.

hoolah was acquired in November 2021 by cashback platform ShopBack after experiencing more than 1,500% growth in transactions, over 800% increase in sales value, and more than 400% merchant and consumer growth during the pandemic.

Rival Atome, which has only been around for just two-three years, has already amassed more than 20 million registered customers and disbursed S$1.35 billion (US$1 billion) over 15 million transactions, CEO David Chen told the Paypers in September 2021.

And ride-hailing leader Grab said in its first earnings call on March 3, 2022 that total payment volume for BNPL grew five times between Q4 2020 and Q4 2021. Grab currently offers BNPL arrangements for the Malaysian and Singaporean markets but plans to launch the service in additional markets in 2022.

The projected growth of BNPL arrangements in Singapore will be observed on a global scale as well. By 2025, FIS projects that BNPL will make up 5.3% of global e-commerce transaction value, from just 2.9% in 2021. This will be part of a broader trend where e-commerce payment preferences will continue to shift away from cash and credit cards towards alternative payment options, and most particularly digital wallets and BNPL.

In Asia-Pacific (APAC), BNPL accounted for only 0.6% of e-commerce transaction value in 2021, showcasing that penetration remains very low compared to other regions. Looking deeply into key markets shows that the region is quite heterogenous with adoption varying from one location to another.

Australia, New Zealand, Malaysia and Singapore were found to have the highest BNPL penetration rates in 2021, which ranged from 4% for Malaysia and Singapore to 11% for Australia.

In India, Hong Kong, Indonesia, Japan, Taiwan and the Philippines, penetration was relatively low, ranging between 1% and 3%. Meanwhile, no figures were made available for South Korea, Thailand, China and Vietnam, implying that BNPL remains an underdeveloped area in these markets.

APAC leads in digital wallet usage

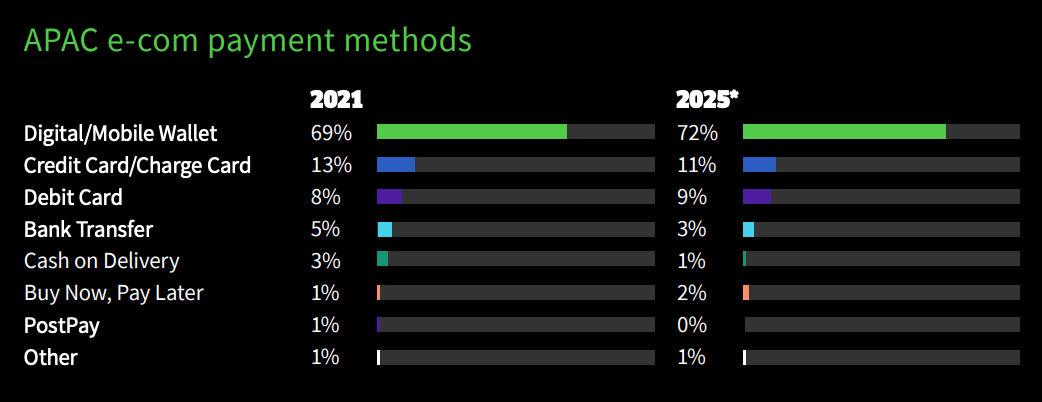

In 2021, APAC continued to lead in digital wallet usage. Last year, digital wallets represented 69% of regional e-commerce transaction value, a figure that’s projected to expand to over 72% of transaction value in 2025.

APAC e-commerce payment methods, Source: 2022 Global Payments Report by Worldpay from FIS

The number makes APAC the biggest adopter of digital wallets for e-commerce, ahead of North America, where digital wallet market share stood at 29% in 2021, Europe (27%), Latin America (19%), and the Middle East and Africa (17%).

In China, Alipay and WeChat continue to be the undefeated leaders, accounting for nearly 83% of 2021 e-commerce transaction value. Digital wallets were also the leading e-commerce payment method in India (45.4%), Indonesia (38.8%), the Philippines (30.5%) and Vietnam (25%), with popular brands that include GCash, GrabPay, LINE Pay, OVO, Paytm and MoMo.

Bank transfers represented 4.7% of regional e-commerce transaction value in 2021, and remained the leading e-commerce payment method among consumers in Malaysia (29.8% of 2021 share) and Thailand (36.6%).

Credit/charge cards were the favored e-commerce payment option in Japan (58%), South Korea (56%), Taiwan (45%), Hong Kong (43%), Singapore (42%) and Australia (33%).