2022’s Devastating Crypto Breaches: Multi-Million Dollar Hacks Shake the Industry

by Rebecca Oi February 9, 2023Several high-profile cryptocurrency hacks occurred in 2022, causing significant financial losses for businesses and individuals who held digital assets.

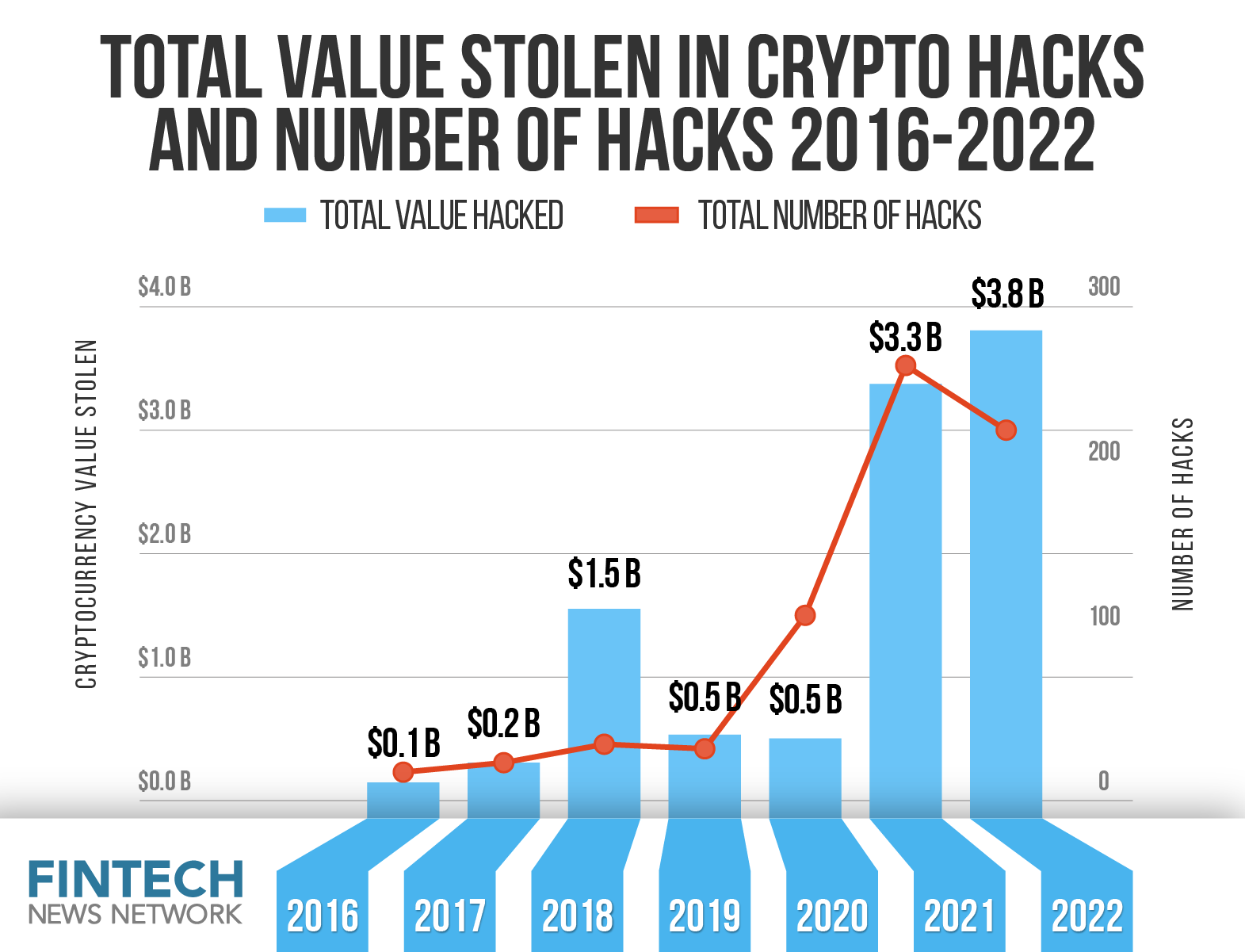

According to a recent analysis, the estimated loss from these attacks was a staggering US$3.8 billion, making it the biggest year ever for crypto hacking, with significant spikes in March and October.

October was particularly devastating for the industry, as it saw a record-breaking US$775.7 million stolen in 32 separate attacks, making it the most significant single month ever for cryptocurrency hacking.

This surge in hacking attacks brought attention to the vulnerabilities of the decentralized systems, underscoring the need for increased security measures to protect against future threats.

Decentralized finance Protocols: The Biggest Targets of Cryptocurrency Hacks

Decentralized finance (DeFi) protocols have become increasingly popular in the cryptocurrency industry and are among the fastest-growing applications of blockchain technology.

However, due to their popularity and the large amounts of assets being stored on their platforms, DeFi protocols have become the biggest victims of cryptocurrency hacks.

In 2022, DeFi protocols accounted for a staggering 82.1 percent of all cryptocurrency stolen by hackers, with a total of US$3.1 billion stolen from these platforms.

This marks an increase from 73.3 percent in 2021 and highlights the growing threat to DeFi protocols. Of the total US$3.1 billion stolen from DeFi protocols, 64 percent came from cross-chain bridge protocols, making them a prime target for hackers.

These vulnerabilities were often hard to spot, allowing attackers to steal large amounts of assets undetected. In particular, bridge services were a popular target for hackers due to their role in facilitating cross-chain transactions and connecting different blockchain networks.

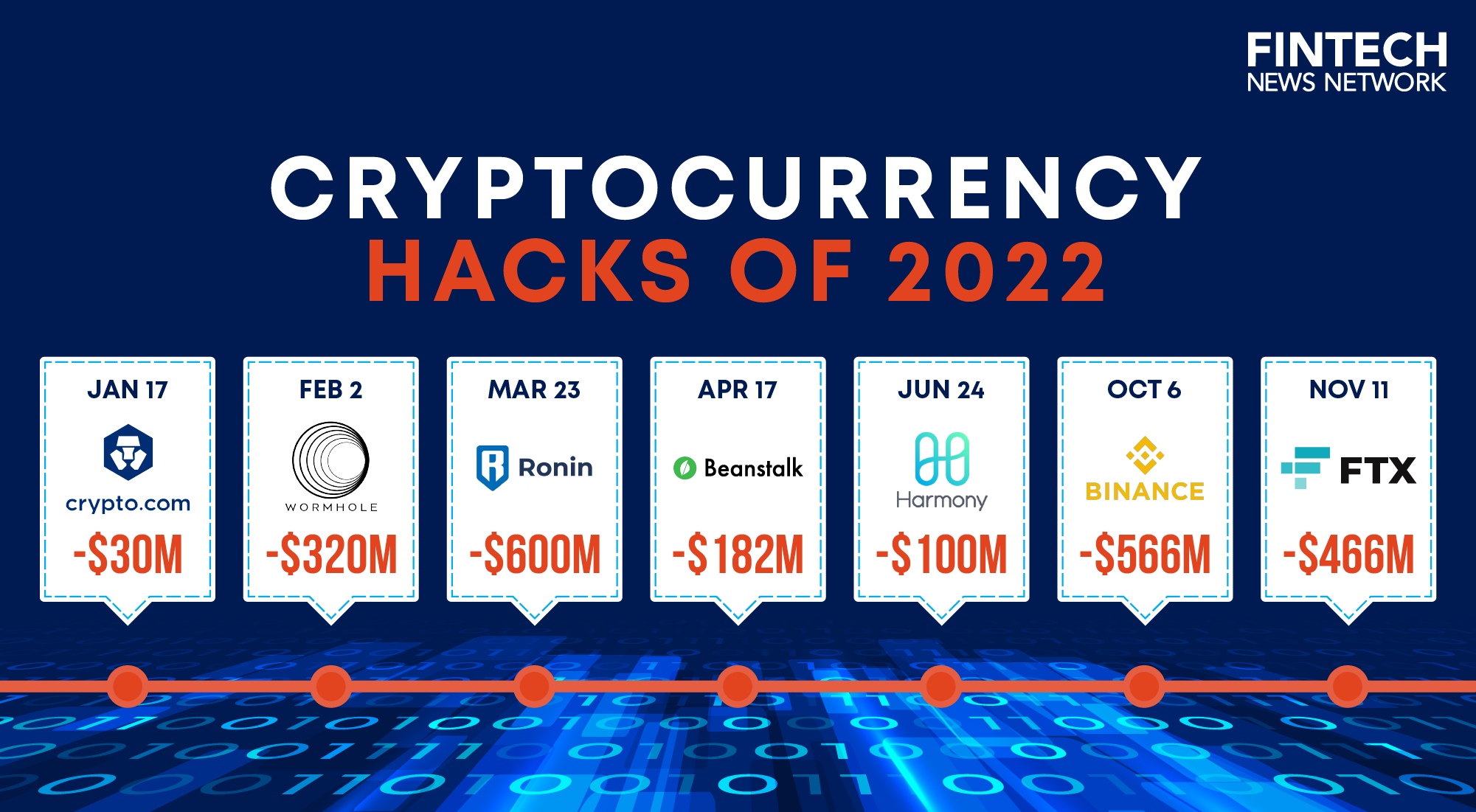

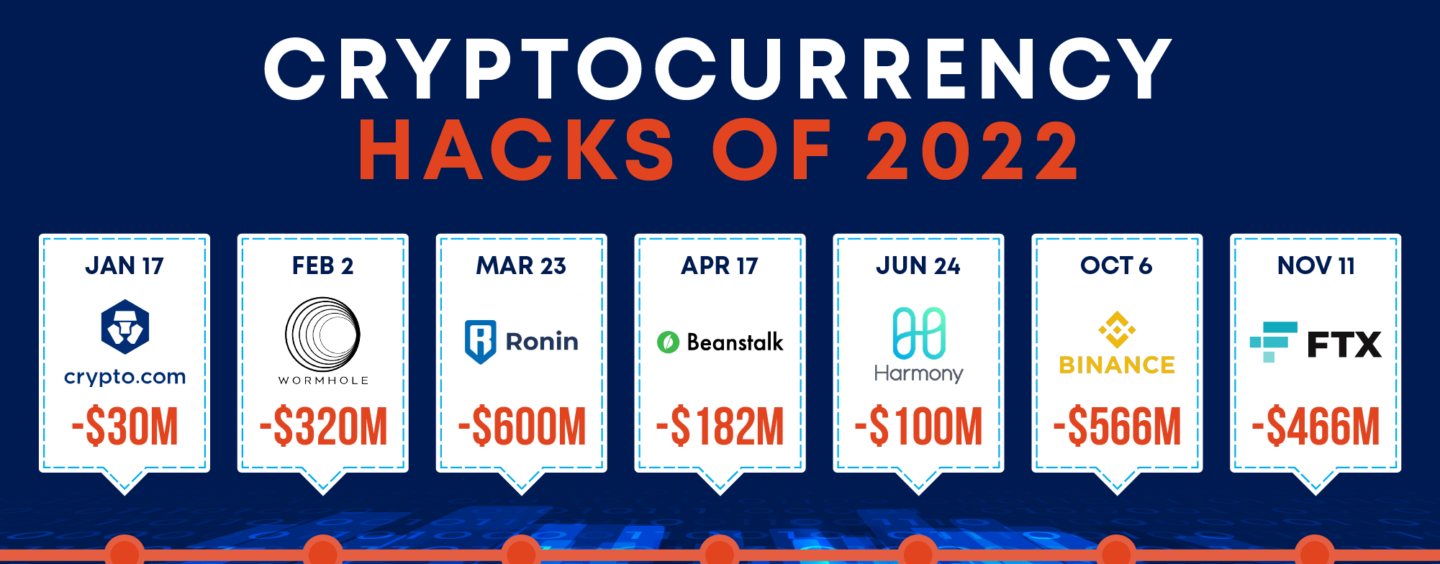

Notable Cryptocurrency Hacks of 2022

Crypto.com

On January 17, the hacking breach resulted in the theft of over US$30 million, with the hackers taking 4,836 ETH and 443 BTC.

A report released by the company revealed that 483 users had their accounts compromised during the attack.

Wormhole

The Wormhole Portal, a bridge connecting Solana (SOL) to other blockchains, was hacked on February 2. This incident marks the second-largest DeFi hack.

The attackers stole approximately 120k wrapped ETH, with a total value of around US$320 million.

Ronin Network

On March 23, the Ronin Network, an Ethereum-linked blockchain platform for the non-fungible token-based video game Axie Infinity, suffered a massive hack, resulting in the theft of US$600 million worth of ETH.

The incident, which was said to be orchestrated by North Korea’s Lazarus Group, significantly impacted the platform’s users and caused a decline in the value of the AXS token.

According to Ronin, 173,600 Ether tokens and US$25.5 million coins were stolen.

Despite the considerable theft from Axie Infinity, investigators recovered some of the stolen funds, amounting to US$30 million.

Beanstalk Protocol

The Beanstalk Ethereum DeFi protocol suffered a hack on April 17, where the attacker made off with $182 Million worth of Ethereum, BEAN stablecoin, and other assets.

The hack was accomplished through a flash loan, which enables rapid borrowing and trading of assets within a single complex transaction across multiple protocols.

Harmony Bridge

Hackers linked to the Lazarus Group were able to exploit a vulnerability in the Horizon Bridge, a connection between the Harmony blockchain and other networks, to steal US$100 million worth of various tokens on June 24.

The stolen tokens were then swapped for Ether on Uniswap, a decentralized exchange built on the Ethereum network.

Binance Hack

On October 6, a hack targeted a blockchain associated with the largest cryptocurrency exchange in the world, Binance, resulting in the loss of US$566 million worth of BNB.

The attack targeted the cross-chain bridge BSC Token Hub and saw the hackers create tokens through artificial withdrawal proofs. Despite the breach, no users of Binance or its blockchain suffered any financial losses.

FTX Hack

The collapse of FTX, a celebrity-endorsed cryptocurrency platform, resulted in billions of dollars in losses and ultimately led to the company filing for bankruptcy.

In addition, FTX was also hit by a mysterious hack, with attackers making off with US$446 million.

Strengthening Security in the DeFi Space to protect against cryptocurrency hacks

Making DeFi safer requires a comprehensive approach that addresses various risks and vulnerabilities in the ecosystem.

This can be achieved through technical solutions, regulatory measures, and community efforts. For instance, ensuring that the underlying smart contract code is secure and free from bugs and exploits is crucial to avoid stolen funds.

Additionally, providing sufficient liquidity and monitoring market activity to address issues arising from market manipulation or other malicious activities can help reduce the risk of price slippage and market crashes.

Developing a transparent and fair regulatory framework can also help reduce the risk of fraud and financial crimes while raising user awareness and education can encourage more safe usage practices.

Strong security measures to protect against cyber-attacks, data breaches, and other security incidents are also crucial for maintaining the security and stability of the DeFi ecosystem.

Regular auditing and ensuring complete transparency in DeFi protocols can also help increase the sector’s trust and accountability. DeFi code auditing conducted by third-party providers could ensure the security of applications. These audits comprehensively evaluate the code and its underlying systems, helping identify potential vulnerabilities that malicious actors could exploit.