Fintech for Good – Leaders Weigh In on ESG, Data Role in Creating Sustainable Enterprise

by Johanan Devanesan February 21, 2023One of the big talking points gripping business leaders since the COP26 and COP27 climate summits in Scotland and Egypt, respectively, has been the role the fintech industry can play in creating a more sustainable business environment.

The United Nations and other bodies lamented the lack of clear action from corporations and industries, not to mention the “litany of broken climate promises”, according to UN Secretary-General António Guterres.

The COVID-19 pandemic, supply chain constraints and a subsequent war in the Ukraine have all been derided for causing corporations to pull back on their environmental commitments such as targeting to reach net zero emissions by 2050,and keeping global temperatures to below 1.5 degree Celsius.

Thanks to the industry’s twin prowess in financial services and in the technology sector, many influential voices spoke at the Singapore Fintech Festival (SFF) 2022 about what fintech could contribute to global sustainability efforts. According to KPMG Partner and Global Head of Fintech, Antony Ruddenklau, regulatory changes mean that KPMG expects the global fintech market to grow from US$21 billion last year to over US$160 billion in the next five years.

Sopnendu Mohanty

“FinTech can play an essential role in breaking a legacy of inertia and marshalling the resources needed to bridge the substantial gap between current funding of sustainability and environment, social, and governance (ESG) initiatives and the projected investment required to meet global aspirations,” wrote Sopnendu Mohanty, the Chief FinTech Officer of the Monetary Authority of Singapore (MAS) and the Chairman of the Board at Elevandi, in his foreword of the SFF 2022 Insights report ‘Enlisting FinTech to help create a sustainable future’ by McKinsey & Company, MAS, and Elevandi.

Fintech can foster capital movement

Positively, sustainable industry and climate-conscious practices was high on the agenda of fintech decisionmakers. Eric Lim, Chief Sustainability Officer for United Overseas Bank, highlighted that 100 countries and about a third of world’s largest companies had committed to green goals, and financing for sustainability projects had grown 100x over the previous decade.

Eric Lim

“We are trying to pull off the largest industrial revolution known to man, estimated to be worth US$100 trillion in investments all within the next 28 years,” Eric said. “And we’re going to need all of our ecosystem partners to be pulling in the same direction in a coordinated manner.”

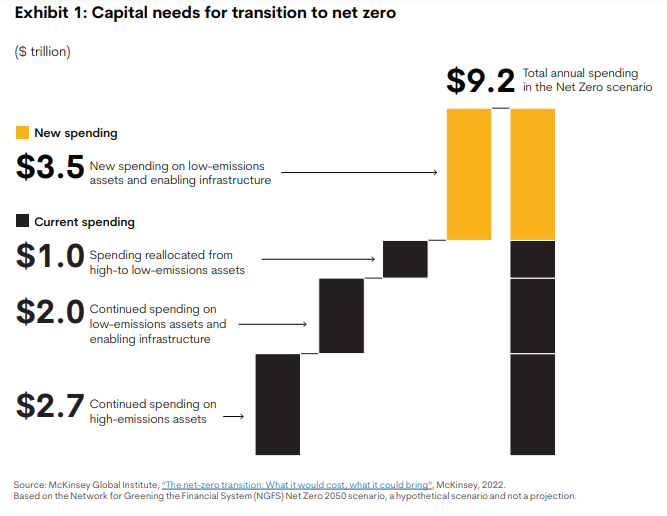

A January 2022 report by the McKinsey Global Institute (MGI) estimated that capital expenditure of around US$9.2 trillion per year would be needed between 2026 and 2050 to move towards a carbon-neutral future. That would total US$275 trillion to reach the 2050 target.

Helping to mobilise the capital for this transition is where fintech could play a definitive role, according to the Insights report. The MGI study found that currently US$4.7 trillion is being spent on a combination of expenditure reallocated from high- to low-emission assets, continued spending on low-emission infrastructure, and continued spending on high-emission assets. Only US$3.5 trillion of new funding is going into low-emissions assets and enabling infrastructure.

Encouraging sustainable innovation from the fintech sector

Meanwhile, the geopolitical and economical instability of the past year or so tempted a lot of organisations to push back or delay greener alternatives such as renewable energy for the tried-and-tested, and cheaper fossil fuels they have been consuming for decades.

Kattiya Indaravijaya

Innovative fintech solutions can harness their technical advantage to incentivise the use of more sustainable options – with resilient use eventually seeing those options become more affordable and less likely to impact the bottom line over time. “We have to balance the speed of execution, the cost of it, and other aspects such as energy stability,” said Kattiya Indaravijaya, the CEO of Thailand’s Kasikornbank.

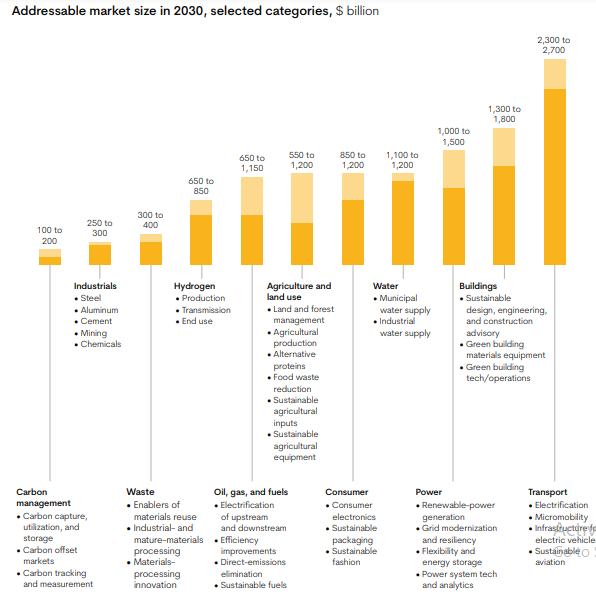

“There will always be trade-offs between transition costs and speed or the availability of raw materials,.” she proclaimed. But the opportunities are promising for businesses that take advantage, with McKinsey analysis of 11 industrial categories showing that green output could surpass US$12 million in annual sales by 2030.

Incentivising carbon accountability

Jonathan Larsen

Jonathan Larsen, the Chief Innovation Officer of Chinese insurer Ping An, spoke of carbon accountability technology. Ping An now offers its 110 million card holders the option to create personal carbon accounts, and track the accumulative effect of their carbon footprint via their purchasing history.

That’s just one method to examine carbon offsets, others being to receive carbon credits when selecting the greener option, and providing ratings services for tracking responsible carbon expense.

Jonathan pointed out that climate change ratings create profitable opportunities for service providers that are able to gather the right data, provide the right structure. and create the right alignment with governments and supranationals.

2021 financing in fintech outfits with a sustainable agenda (those that embed ESG mechanisms directly into their products and operations, often labelled ‘Fintechs for Good’) surpassed US$2 billion. Funding levels have doubled on average yearly since 2017, with more than half of fintech ESG financing going towards sustainable daily banking practices, as per the McKinsey Global Retail Banking Survey 2021. The greatest growth area has been in ESG data intelligence and analytics around carbon tracking and offsetting, however, with the average funding in this doubling yearly since 2017.

Fragmented green data landscape

Data in fact will be crucial to ascertain if fintech innovation can effectively support sustainable outcomes, but usable info is in scarce supply. KPMG’s Antony decried the lack of actionable data and insisted that “[w]e need system change, and it must be data- and behaviour-led.”

Ravi Menon

“Good data is foundational to driving the green and transition-finance agenda,” agreed Ravi Menon, Managing Director of MAS. “Quality data is key in the fight against greenwashing and enabling stakeholders to make well informed ESG investment decisions.”

One of the stumbling blocks to good ESG data is the long lead time needed to record and compile usable data, spot trends and study anomalies. Efforts to record this information needs to get underway now, as they will be immeasurable to quantify how useful it will be in more ways than one, as pointed out by Helge Muenkel, Chief Sustainability Officer for DBS Bank.

Helge believes organisations need better data to make informed decisions on how to allocate capital, which is when they engage data and new analytical tools over decarbonisation.

Manjula Lee

Having the data is one thing, having the data identify, gather, store, and present the right information can be another challenge altogether. “We all need to be looking at the same golden source of trusted and comparable, verified data,” said Manjula Lee, Founder and CEO of World Wide Generation, the creator of the G17Eco sustainability tracker platform.

“We need greater comparability. We need to create a greater mechanism and standard,” added Prudential CEO Mark Fitzpatrick.

Fintech innovation can accelerate sustainable business growth

Liu Feng Yuan

Standardised data is an advantage, and its accuracy and reliability can be augmented further with other innovative technologies such as AI, blockchain, and automation. “You can only commit to what you can measure, and that’s where big data and AI can play a big role,” commented Liu Feng Yuan, Business Development Vice President at AI solutions provider Aicadium Singapore.

Blockchain tech is great for preserving immutable records, and now the distributed ledger tech is embracing traceable data that can be paired with green bonds to verify how climate-friendly the records indicate. With this, visibility and transparency of the information has already radically increased, and by definition the cost will be reduced according to John Lee, the Managing Director and Global Lead of Digital Assets for Accenture.

Wu Shiwei

Wu Shiwei, the Chief Technology Officer of Huawei Cloud APAC, brought up how fintech can help slash costs for smaller and mid-sized enterprises (SMEs) so they become more sustainable by automating reporting. SMEs make up around 70% of employment and economic output internationally, but with significantly less resources than their corporate counterparts to make informed sustainability decisions, automating processes can help fill that information void while expending less human capital.

“If SMEs are running their business processes on a [standard] platform,” Shiwei said. “You can actually analyse every step of the business process and set up benchmarks to compare their standards to best practice. In that way, resource requirements will be much less compared to manual verification by humans.”

Such technological breakthroughs are not advantageous just for other industries either; the fintech space also needs to explore its sustainable consumption practices. Blockchain, for instance, has generated sizable backlash for how much electricity it uses, especially within the cryptocurrency mining industry.

Vitalik Buterin, the superstar co-founder of mainstay crypto Ethereum, was happy to announce that by switching from the industry standard ‘Proof of Work’ algorithm to the less power-intensive Proof of Stake algorithm min September 2022, Ethereum had managed to drastically drain its energy consumption to nearly 100%.

“Now, Ethereum consumes less energy than basically most mainstream, even centralised web services that everyone uses today,” Vitalik stated.