A Guide to Launching Payment Innovations in Record Time

by Rudy Gunawan, Managing Director of OpenWay Asia April 13, 2023In the digital payments industry, everyone is competing like Olympic sprinters. It took digital bank Timo in Vietnam only 4 months to launch an award-winning API-based payment system on AWS, with a unique human-touch concept that targets 5 million cardholders.

South-Korean conglomerate LOTTE entered a new market as a BNPL disruptor with near-instant loan approval. Enfuce, which offers Card-as-a-Service (CaaS), onboarded B2B clients in 8 weeks. What do these winners have in common?

Digital banking and payment software vendor OpenWay has analysed the best practices of digital banks and cloud processors, both disruptors and incumbents, whose cards are issued on its Way4 platform.

Below is a checklist for those who need the competitive advantage of launching payment innovations in record time.

Optimised customer experience and cost savings

Everything about digital cards, loans and payments should be near-instant – from onboarding and transaction processing to accounting, personalised offers, and data exchange via APIs. This requires a 24/7 fully online payment processing system.

With a unified front and back office, data processing encounters no delays. The system can analyse any transaction and accounting data — both its own and those from integrated systems — and immediately apply all rules, completing each transaction according to the optimal scenario.

This gives a significant competitive advantage in customer experience. The problem? Most payment players still use legacy systems with separate back and front offices.

Way4 is the only platform with a unified online back and front office, real-time front-to-back reconciliation, and online accounting. This architecture helps banks and processors to launch innovations, improve ROI, and minimise costs.

“We got rid of a lot of unnecessary duplication, checks and business processes, and freed staff from routine procedures”, stated Balzhan Baisheva, Managing Director of Tsesnabank (now Jusan Bank) which migrated from BPC’s SmartVista to Way4.

Flexible payment offerings

Just as athletes need cheering spectators to get a second wind, fintechs need loyal followers to give word-of-mouth and peer-to-peer recommendations. Ideally, all aspects of the customer payment experience should be custom-tailored, preferably without costly hard coding. The issuer should be able to monetise multiple business models.

Prepaid cards are just one example of Way4 adapting to the vision of the payment player. The National Bank of Oman bundles its Badeel prepaid cards with a multi-currency feature for traveling cardholders.

Banesco Panama promotes prepaid cards to governments, as a tool for economic relief programmes. Enfuce and fintech Welcome Place are piloting prepaid cards for refugees arriving in France.

Another example is the flexibility of onboarding. You may try different workflows for the same customer segment and see what works best. In Vietnam, Mirae Asset Finance Company delivers Way4-powered loans via smartphone.

LOTTE Finance offers BNPL products during e-commerce checkouts. And Timo introduced a half-digital, half in-person approach: once initiated via mobile, user registration is completed securely and conveniently at a Timo Hangout, a café-like space.

Cross-border expansion

With multiple regional hubs and projects implemented in 83 countries, OpenWay has valuable insights for those entering new markets. Most recently, its support in launching payment products in Vietnam was requested by South Korean brand LOTTE and Japanese brand JACCS.

“We believe that to become a leader in a new market and keep your leadership, we need to work with trusted leaders,” commented Taniguchi Noboru, General Director of JACCS International Vietnam Finance Company.

Early-bird innovations

For ambitious payment players, it makes sense to select a platform already used by market leaders and disruptive startups. Its vendor can proactively include industry trends in its roadmap. This ensures early-bird access to innovation for all existing and new clients.

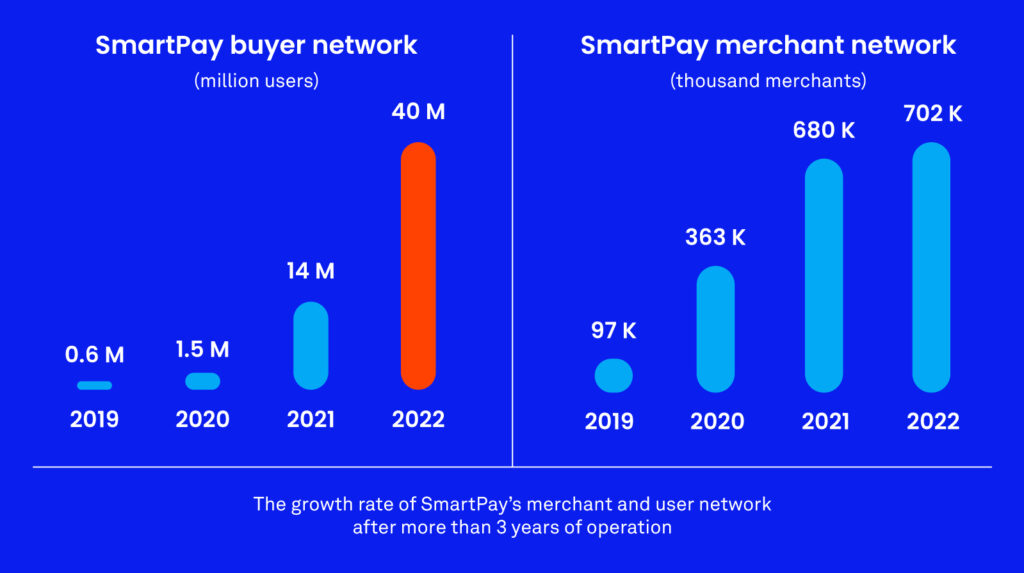

This win-win approach explains how Way4 came to be a pioneer among white-label digital wallet software solutions. SmartPay in Vietnam built a wallet payments ecosystem with Way4 to serve 40 million consumers and 700,000 merchants.

“Way4 enables us to operate more efficiently, react to new market trends quickly, and be more competitive in the open banking environment,” said Pericles Papaspyropoulos, Sector Head of Cards Division, National Bank of Greece.

Agile delivery and post-launch diversification

OpenWay has developed a unique holistic approach which, according to Forbes, “can increase your chances of success when delivering complex digital transformation projects in fast-changing environments.”

The vendor and the client work together to clarify the goals and form the project team, solution blueprint, MVP and detailed scope. Delivery is handled stage by stage, and can be done in an entirely remote mode, or with OpenWay’s experts working on the client’s premises. The client team receives online and in-person training in OpenWay Academy.

To launch projects even faster, clients can receive product configuration pre-sets that are based on best practices and modify them quickly to their chosen business model.

When it’s time to diversify revenue, new features can be activated on the same Way4 platform. An issuer can transform into a CaaS player or wallet provider, expand into merchant acquiring, or select other payment domains.

OpenWay has analyzed the best practices of Timo, Enfuce, LOTTE, French card providers Memo Bank and Welcome Place, provider of QR-based credit products Mirae Asset, and other brands whose cards are issued on OpenWay’s Way4 platform. Read this case study to get more insights.