For small and medium-sized enterprises (SMEs), dealing with their finances and ensuring appropriate funding can be a real struggle. The reasons are manifold: finances of SMEs are characterized by high complexity, yet are low scale.

Thankfully, the rise of fintech has led to the introduction of solutions that are efficient and effective at lower scale.

“This trend has the potential to become a game changer for small businesses,” according to a report by the World Economic Forum. “The overall potential of fintech for small business and thus for the economy as a whole seems tremendous.”

Now, it is easier than ever for smaller businesses to use disruptive new technology to find and engage with trading partners, gain funding and utilize data to maximize sales and customer retention.

In Singapore in particular, SMEs constitute a major driver of the economy, accounting for 99% of Singapore’s enterprises, employing 70% of the city-state’s workforce and contributing almost 50% of Singapore’s income, according to Dollars and Sense.

Considering their importance in the economy, we focus today on the top fintech solutions for SMEs in Singapore.

Peer-to-Peer Lending

Financial institutions in Singapore have an important role in helping SMEs grow and prosper. However, the strict regulations can discourage banks to lend to SMEs, which often struggle to gain access to short-term credit.

Peer-to-peer (P2P) lending can be a long-term solution for SMEs capital requirements.

Platforms available in Singapore include MoolahSense, known for being the first marketplace lending platform to be granted a full capital markets services license by the Monetary Authority of Singapore.

![]() MoolahSense is a P2P lending platform that connects local SMEs and investors. It allows businesses to raise funds from S$100,000, and investors to earn up to 21% interest rate per annum.

MoolahSense is a P2P lending platform that connects local SMEs and investors. It allows businesses to raise funds from S$100,000, and investors to earn up to 21% interest rate per annum.

Another reliable marketplace lending platform is Funding Societies, known for being the first P2P lender in Singapore to engage an escrow agency to independently and safely manage investors’ funds. It was founded in 2015 by Kelvin Teo and Reynold Wijaya while studying for their MBA at Harvard. As of June 2016, the company had originated S$7.8 million worth of loans through the platform.

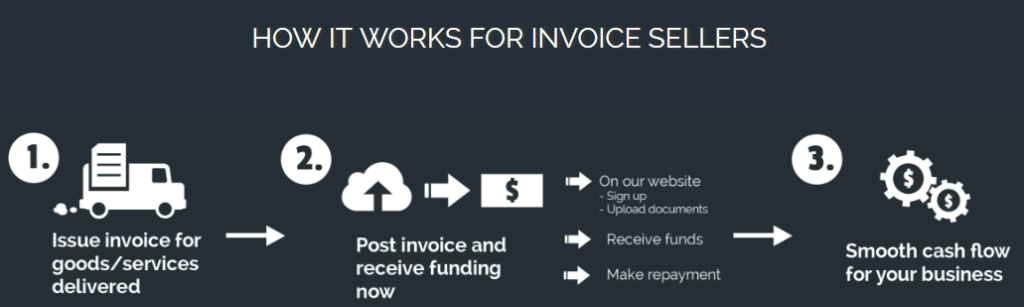

P2P Invoice Financing

Invoice financing is a way for businesses to receive cash based on amounts due from customers. Invoice financing helps businesses improve cash flow, pay employees and suppliers, and reinvest in operations and growth earlier than they could if they have to wait until their customers paid them.![]()

One solution that’s available in Singapore is Smartfunding, a platform that connects SMEs in Singapore who want to sell their unpaid invoices with

local investors. Smartfunding’s mission is two-pronged: to create an alternative investment platform that delivers higher returns to investors, and to provide more funding options for SMEs in Southeast Asia and support their growth. For investors, Smartfunding provides returns of between 1.7% and 2.5% a month, or between 20% and 30% return a year.

Capital Match is another platform that provides invoice financing to Singaporean SMEs. Capital Match provides both invoice financing and SME loans, ranging between S$50,000 and S$200,000. Investors enjoy returns between 15% and 25% annually, which is similar to what’s Smartfunding is proposing. Also Invoice Interchange is offering similiar solutions.

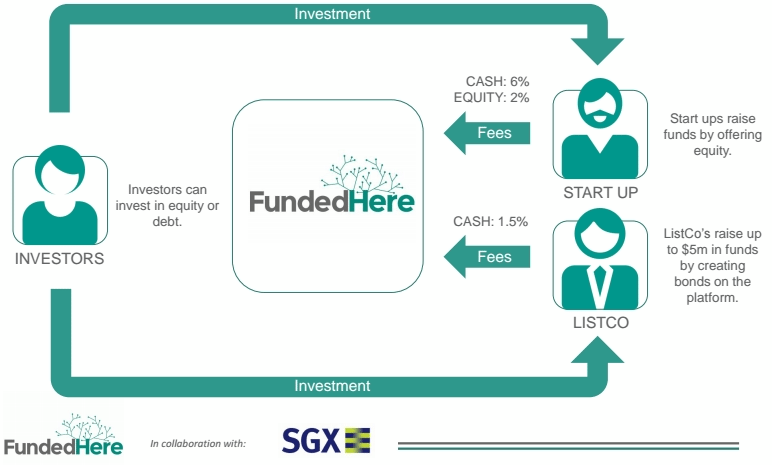

Equity Crowdfunding

Equity crowdfunding is the mechanism that enables broad groups of investors to fund startups and small businesses in return for equity. Equity crowdfunding is a good option for companies that need money to grow.

In Singapore, FundedHere provides an equity and lending-based crowdfunding platform that connects investors with startups in Asia looking to raise between S$100,000 and S$1 million. The platform facilitates investments or venture debts from as low as S$5,000 each.

Accounting and Bookkeeping

Xero is a cloud-based accounting software serving over 800,000 subscribers worldwide. Founded in 2006 in New Zealand, Xero is a market leader in New Zealand, Australia and the UK in cloud accounting. The platform allows for easy invoicing, inventory, and comes with over 500 third party app. Plans go from US$20 to US$40 a month.

Xero is a cloud-based accounting software serving over 800,000 subscribers worldwide. Founded in 2006 in New Zealand, Xero is a market leader in New Zealand, Australia and the UK in cloud accounting. The platform allows for easy invoicing, inventory, and comes with over 500 third party app. Plans go from US$20 to US$40 a month.

Other similar platforms include Intuit Quickbooks Online, one of the leading online accounting solution world with over 1.4 million subscribers.

Electronic and Digital Payments

One company that is worth mentioning is Mobile Credit Payment (MC Payment), a firm that specializes in electronic transaction processing headquartered in Singapore.

One company that is worth mentioning is Mobile Credit Payment (MC Payment), a firm that specializes in electronic transaction processing headquartered in Singapore.

MC Payment provides online payments, mobile payments and in-store payments capabilities, offering solutions that are multi-country, multi-sales channel and multi-currency.

The firm operates a number of other brands including Xaavan, MatchCab and ffastpay. Xaavan is a business-to-business supply chain and e-invoicing platform for merchants and suppliers, and the first MasterCard-certified Level 3 enhanced data processing solution in Asia. MatchCab is a platform built for taxi transport providers that integrates into existing booking systems. ffastpay is a mobile point of sale solution used by retailers and merchants to support consumer payments on-the-go.