Posts From Fintech News Singapore

5 Key Drivers Behind Thailand’s Fintech Growth

Fintech Thailand is poised for significant growth and development in areas including digital banking, open finance, and startup support. Digital banking is on the horizon, with the first digital banking licenses slated to be issued by mid-2025 and expected to

Read MoreFinbotsAI Expands Footprint to Myanmar via KBZ Bank Partnership

FinbotsAI, a Singapore-based fintech company specialising in AI credit scoring, has partnered with KBZ Bank, one of Myanmar’s largest privately-owned bank. This marks KBZ Bank as its first client in the country. KBZ Bank operates over 500 branches and serves

Read MoreBridgewise Lands US$21M Funding Led by SIX Group

Bridgewise, an AI-based analysis platform for global securities, has raised US$21 million in a new funding round, bringing its total funds raised to US$35 million. This investment round was led by SIX Group and joined by Group11 and L4 Venture

Read MoreOCBC Reports Sixfold Increase in Eco-Care Car Loans Amid Rising EV Popularity

OCBC has reported a major increase in its Eco-Care Car Loans, with numbers surging over sixfold in 2023 compared to their launch year in 2021. This rise coincides with a growing environmental consciousness among Singaporeans and a governmental push towards

Read MoreNium’s Global Expansion Continues with New Zealand Registration

Nium, a real-time cross-border payments platform, has officially become a registered Financial Services Provider in New Zealand. This marks Nium’s first formal entry into New Zealand’s financial market, enhancing its global footprint which now spans over 40 countries. The company’s

Read MoreMoomoo Singapore Reaches One Million Users in Three Years

Moomoo Singapore, an investment platform and wholly owned subsidiary of Futu Holdings, has surpassed one million users, just three years after its launch and initial expansion into Southeast Asia. According to Moomoo, among the various offerings that have garnered attention

Read MoreTemenos Claims Its Independent Review Debunks Hindenburg Allegations

Banking software provider Temenos announced the completion of an independent review on 15 April 2024, addressing allegations made by Hindenburg Research in February. The investigation was led by a special committee under Temenos’ Non-Executive Chairman Thibault de Tersant and supported

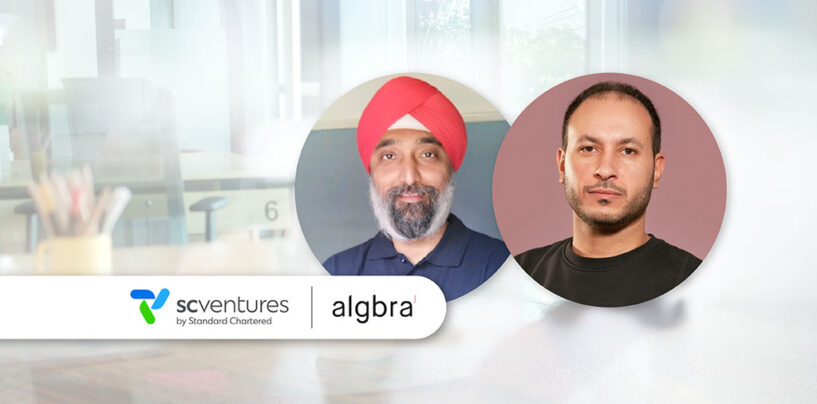

Read MoreSC Ventures Invests in Sharia-Compliant UK Fintech Algbra

SC Ventures, the innovation and ventures unit of Standard Chartered, has made a strategic investment in Algbra, a UK-based fintech that focuses on ethical and sharia-compliant finance. The financial details of the investment have not been disclosed. Shoal, which is

Read MoreRevolut’s Youth-Focused Financial App Surpasses 2 Million Users Globally

Global neobank Revolut announced today that its youth-focused financial app designed for individuals aged 6-17, has surpassed two million users worldwide. The <18 app, part of a suite aimed at empowering the next generation with financial literacy, now counts more

Read MoreMoney20/20 Asia Set to Spotlight APAC Regulators for Fintech Growth

Money20/20 Asia, set for 23-25 April at the Queen Sirikit National Convention Center in Bangkok, will prominently feature regulators from Asia’s financial sector among its speakers. This addition of Bangkok marks it as the third city to host the event,

Read More