Singapore’s P2P Lending Platforms and Industry: an Overview

by Fintech News Singapore December 19, 2017Southeast Asia’s alternative lending space, although relatively small when compared with the likes of the UK, the US, or China, has witnessed significant growth in recent years, led predominantly by increased activity Singapore.

Alternative lending refers to financial channels and instruments that have emerged outside of the traditional finance system such as regulated banks and capital markets. Alternative financing activities through online marketplaces are reward-based crowdfunding (e.g. Kickstarter, Indiegogo), equity crowdfunding, peer-to-peer (P2P) consumer and business lending, and invoice trading.

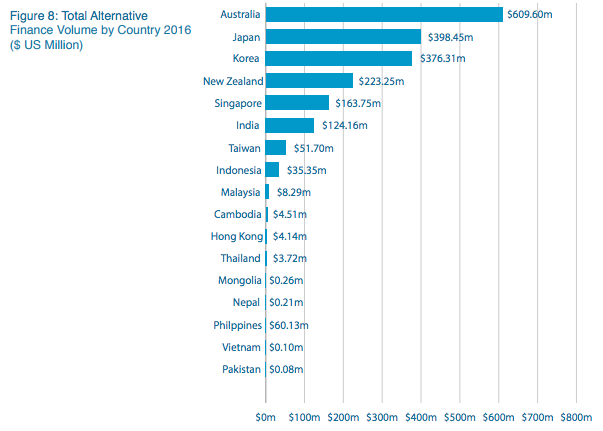

In 2016, more than US$245 billion of funding was channeled through online alternative finance platforms across Asia Pacific (APAC), according to a report by the University of Cambridge, the Australian Centre for Financial Studies and the Tsinghua University.

Although Mainland China still dominated the market with over US$243 billion raised in 2016, many other countries such as Australia, South Korea, Malaysia and Thailand also saw considerable growth. Singapore was ranked the sixth largest market in APAC with a total of US$163.75 million raised in 2016.

Cultivating growth, the 2nd Asia Pacific Region Alternative Finance Industry Report, September 2017

Alternative finance in Southeast Asia

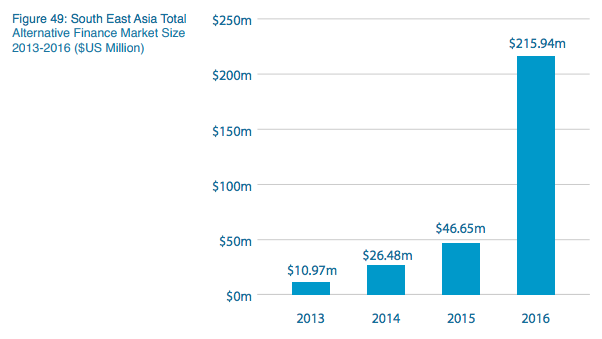

Southeast Asia’s total alternative finance market reached a record of US$215.94 million in 2016, a 362% growth compared with 2015’s market size of US$46.65 million.

Cultivating growth, the 2nd Asia Pacific Region Alternative Finance Industry Report, September 2017

Southeast Asia has one of the fastest growing economies in the world, but small and medium-sized enterprises (SMEs) that make it up have limited access to financial credit.

For this reason, the majority of Southeast Asia’s recorded market activity was generated by P2P business lending, with a total of US$115.01 million. This accounted for more than half of total market share in 2016.

P2P lending in Singapore

According to the Singapore Fintech Association, a cross-industry non-profit initiative, there are 60 startups in the online lending and crowdfunding space.

The city state’s three major alternative finance players are peer-to-company (P2C) lenders which specialize in providing loans for SMEs. These are Funding Societies, MoolahSense and Capital Match.

Funding Societies had raised S$95.4 million in loans through 1,606 campaigns, as of December 2017. The company, which also operates in Indonesia and Malaysia, has received US$7.5 million in funding so far.

MoolahSense, which is backed by East Ventures and Pix Vine Capital, had raised S$41.3 million in loans through 359 campaigns as of December 2017. MoolahSense has over 11,920 registered investors.

Capital Match, which was established in 2014, provides business and SME loans and invoice financing facilities of S$50,000 to S$200,000. The platform had funded S$62 million in loans, as of December 2017. Capital Match has raised S$1 million in funding so far from Innosight Ventures, Crystal Horse Investments and CE-Tech Invest.

Other platforms offering alternative funding options to SMEs include Crowdo, which provides P2P and equity crowdfunding services in Singapore and Malaysia, and Capital Springboard, the largest P2P invoice finance platform with more than S$170 million worth of invoices transacted as of October 2017.

FundedHere is known for being the first registered private equity and lending-based crowdfunding platform to launch in Singapore. The platform connects promising tech startups in Southeast Asia and Greater China with professional and accredited investors. Launched in March 2015, FundedHere obtained its CMS license from MAS in 2016.

Other innovative ventures in the online lending and crowdfunding space in Singapore include Skolafund, an education financing platform in Asia that matches undergrads with funders to make higher education affordable and accessible to deserving students, and EthisCrowd, an Islamic crowdfunding platform for real estate headquartered in Singapore with offices in Jakarta, Kuala Lumpur and South Africa.

Crowd Genie, a startup founded in early 2016, is one of Singapore’s newest entrants in the space. Crowd Genie aims to provide capital access to SMEs that cannot meet the requirements of traditional financial institutions.

Instead of using just financial metrics, the platform leverages a hybrid of machine-based learning algorithms combined with hands-on groundwork to assess the credit risk profile of potential borrowers.

Crowd Genie was granted a securities license by MAS in March 2017.

Featured image: Businessman pushing web button with dollar sign, MaximP, Shutterstock.com.