Tag "Crowdo"

What Happened to Fintech Singapore’s Previous Pick of Hottest Fintech Startups?

In mid 2016, after sifting through copious amounts of reports, studies and our own internal evaluations we’ve come up with a definitive list of the 30 hottest fintech startups in Singapore. (an updated list for 2019 is also available here)

Read MoreP2P Lending and Digital Lending Fintechs Active in Southeast Asia

The size of the Southeast Asian alternative financing market grew from US$46.65 million in 2015 to a whopping US$215.9 million the following year. That’s almost a fivefold leap in market value in just the span of a year, according to a study

Read More15 Inspiring Fintech Founders from South East Asia to Follow

Southeast Asia’s financial services industry is rapidly evolving as a result of disruption from new-age fintech companies and the rapid adoption of fintech solutions. The rise of fintech in the region has been fueled by Southeast Asia’s expanding economies, young-urban-digitally-savvy

Read MoreSingapore Fintech Association Unifies Crowdlending Platforms

The Singapore Fintech Associationannounces the launch of the Marketplace Lending committee in response to the rapid growth in the sector. The SFA subcommittee is dedicated to ensuring the local crowdlending industry is a trusted, credible and viable mode of financing for

Read MoreThe State of Equity Crowdfunding Malaysia

Equity crowdfunding is a mechanism that enables the general public to invest in typically early stage businesses. In return for the investment the investors are typically given a small piece of equity in return (think Kickstarter but instead of rewards

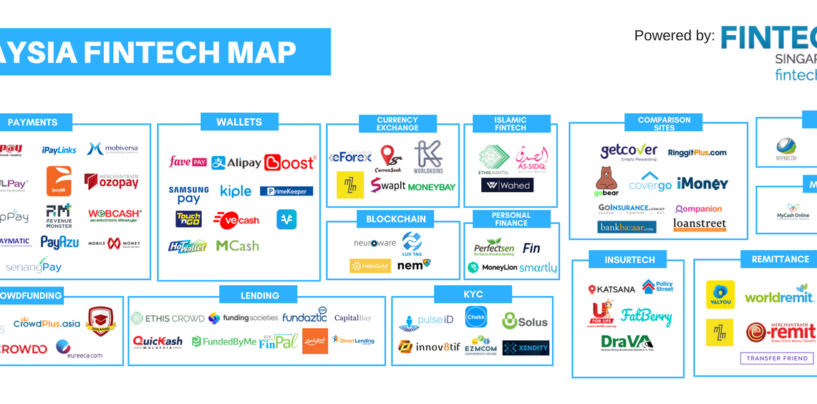

Read MoreFintech Malaysia Report 2017

Note: We’ve update this report, the 2018 edition of the Fintech Report can be found here In the context of conversations surrounding fintech opportunities in South East Asia, Malaysia is often overlooked in lieu of Singapore. While it is true

Read MoreTop 10 Fintech (Startups) in Malaysia

Striving to establish itself as a prominent fintech player, Malaysia has committed to provide clear guidance and regulation to the new, innovative products and business models entering the financial services industry. In October, Bank Negara Malaysia (BNM), the country’s central

Read MoreSingapore’s Crowdfunding Scene

In Asia, crowdfunding is still relatively new and in early stages of development when compared with the likes of Europe or North America. In Singapore, however, crowdfunding appears to have taken off, becoming a popular way for entrepreneurs to raise

Read MoreSingapore Fintech Awards 2016 Announces 40 Finalists

Singapore FinTech Awards 2016, comprising the MAS FinTech Award and ABS Global FinTech Award, will be part of the inaugural Singapore FinTech Festival that will be held during 14 – 18 November 2016. The Awards recognise innovative FinTech solutions that

Read MoreAsia’s Top 7 Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending is the loan of money to individuals or businesses through online services that match lenders directly with borrowers without going through a traditional financial intermediary such as a bank. P2P lending first appeared in 2005 with the

Read More