Markus Gnirck – Co-founder @ tryb & former COO of Startupbootcamp FinTech- once again summarized the recent updates , opportunities and challenges for the Fintech Community in Asia after visiting multiple Fintech hubs.

Markus Gnirck – Co-Founder and Global COO Startupbootcamp FinTech, Partner & Co-Founder tryb

Over a year ago I wrote the first summary of the FinTech developments in Asia after I travelled to 10 countries to run Startupbootcamp FinTech Pitch Days – most of the time it was the first time ever a FinTech event has happened in each location.

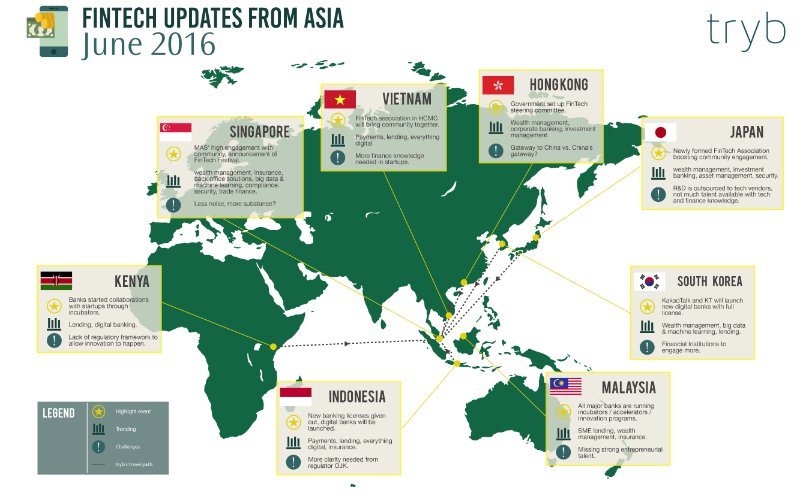

This year around, and as part of my recently set up firm tryb, it was good to visit multiple FinTech hubs again, deepen relationships, make new friends and get a sense of the local scene. As many people ask me what is going on in Asia, here another summary of the recent travelling (in order of travels). If you feel lazy, scroll down to the bottom and have a look at the infographic with the key information.

Vietnam

– Status Update: MomoPay raised US$22M and Timo Bank launched digital bank; local banking accelerators on the way; FinTech groups in Ho Chi Minh City is active to bring community together

– Opportunities: Predicted areas of growth: payments, lending, everything digital; Regulatory gaps and grey zones are encouraging innovation by both startups and incumbents; ADB looking to back FinTech with grants,

– Challenges: We have only registered a few FinTech companies, missing industry knowledge for startups; regulation is used as an excuse not to innovate by incumbents

Indonesia

– Status Update: New banking licenses have been given out to conglomerates; digital banks will be launched; Mandiri Bank setup new US$ 42M VC fund; OJK setup Digital Banking Taskforce to ‘conduct studies of banking & give recommendations on digital banking guidelines’, new guidelines expected Q4 2016

– Opportunities: Predicted areas of growth: payments, lending, everything digital; how to include 100M people spread over 16,000 islands in the financial system?; growing interest amongst investor base to invest in FinTech; Alibaba acquisition of Lazada will have Alipay coming soon

– Challenges: An investor friend’s quote “we looked at 51 FinTech startups, and only found 1 semi-interesting”; regulatory framework by OJK not expected to be startup friendly

Malaysia

– Status Update: Securities Commission setup FinTech group, announced regulatory sandbox; crowdfunding is regulated; p2p consultation paper is out; all major banks are running incubators / accelerators/ innovation programs

– Opportunities: Predicted areas of growth: SME lending, wealth management, cross border payments, corporate banking, back office solutions; investors are ready to invest in FinTech; banks are open for collaboration with fintech and are signing MoUs and LoIs

– Challenges: Haven’t seen many growing and promising startups yet; coordination of FinTech locally

Hong Kong

– Status Update: Finnovasia conference with over 600 attendees from ASEAN and China shows growing ecosystem; WeLend and 8 Securities are most funded companies to data; government set up FinTech steering committee

– Opportunities: Predicted areas of growth: wealth management, corporate banking, back office solutions, investment management; growing number of industry individuals to become angels and/or entrepreneurs; Integration of FinTech into other industries like IoT and Healthcare; strong connections to engineering hubs in China like Shenzhen

– Challenges: Lack of coordination by government bodies; identity: gateway to China vs China’s gateway?

Korea

– Status Update: KakaoTalk and KT got a banking license; still has to be approved by Congress though; two FinTech associations are trying each to get the community together and represent the industry; p2p payment apps Toss raised biggest round in funding so far (US$22M)

– Opportunities: Predicted areas of growth: wealthmanagement, big data & machine learning, lending; strong engineering talent coming into the market to build tech companies; API systems being developed by banks

– Challenges: Lack of sophisticated investors to help FinTech companies to scale outside Korea; banks still have conservative mind set

Japan

– Status Update: Government set up a FinTech steering committee with industry experts; virtual currencies got regulated as alternative currencies; newly formed FinTech Association boosting community engagement

– Opportunities: Predicted areas of growth: wealth management, investment banking, asset management, investment; appetite to fund fintech

– Challenges: R&D is outsourced to tech vendors; not much talent available with tech and finance knowledge

Singapore

– Status Update: MAS announced FinTech Festival (Nov 16) and published 100 problem statements to be solved by community in the Hackcelerator; formation of FinTech Office by SG Innovate and MAS; all local banks run now an accelerator and existence of more than 10 innovation labs

– Opportunities: Predicted areas of growth: wealth management, corporate banking, back office solutions, big data & machine learning, compliance, security, trade finance; strong community with all major stakeholders involved

– Challenges: Less noise, more substance?; how to scale from SG to ASEAN

Kenya (not Asia, but still a great trip)

– Status Update: Mobile money is key for the region (M-Pesa); a few banks have been starting collaborations with startups through incubators; dot Finance event with more than 250 attendees largest event in East Africa to date

– Opportunities: Predicted areas of growth: lending, digital; hungry tech talent to build companies, now got to be matched with finance talent; financial inclusion tech has strong support from foundations

– Challenges: Lack of regulatory frameworks to allow innovation to happen; missing more sophisticated investors to help scale; e-commerce has just started, which has been an enabler of FinTech in China and ASEAN

This article has been first published on Linkedin Pulse

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.