Vietnam’s Mobile Payments App MoMo With 50% Transaction Volume Growth per Month

by Fintech News Singapore September 28, 2015Mobile payments app MoMo is experiencing rapid growth and currently stands as the most downloaded application in the Apple Store Vietnam. According to Manh Tuong Nguyen, Vice President at M_Service, the company behind MoMo, the app has been seeing 30 to 50% growth per month in terms of transaction volume and user base.

MoMo logo

“MoMo is growing beyond expectations,” Nguyen told VNExpress.

“MoMo serves over one million customers monthly who use our money transfer services and mobile payments.”

As mobile payments apps are quickly increasing in number, with large tech firms already releasing products such as Apple Pay and Samsung Pay, competitive pressure has forced many young startups to close down their businesses. But Nguyen remains confident.

“Currently both Samsung Pay and Apple Pay are using NFC technology as the basis for payments,” he said.

“However, there are problems that arise with NFC technology, including the phone battery consumption; not to mention that NFC payments aren’t user-friendly. Through the study of domestic users’ habits, we noticed that QR code technology is very convenient and simple for Vietnamese people.”

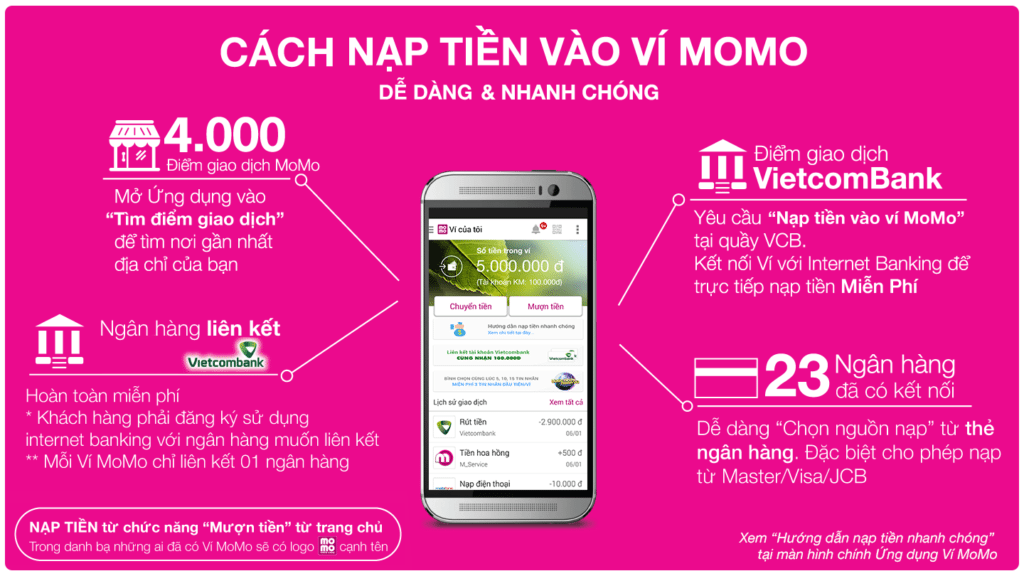

MoMo infographic – Image credit: https://momo.vn

MoMo, a service of M_Service launched in partnership with Vinaphone, is an e-wallet and mobile payments app. Released in June 2014, MoMo enables users to pay online and make peer-to-peer transfers in just a few seconds.

With MoMo, users can make transactions such as buy games credit, top up, as well as pay their utility bills. MoMo currently supports payments to nearly 100 services providers and online businesses.

The payment system is integrated with 24 domestic banks, as well as international payments networks including Visa, MasterCard and JCB.

Standard Chartered partnership

Most recently, M_Service has teamed up with Standard Chartered to develop Straight2Bank Wallet payments in Vietnam.

The new mobile wallet will enable corporations, governments and development organizations to transact with both banked and unbanked individuals cashlessly.

“The Vietnamese government is seeking to boost non-cash payments as the country is shifting away from a predominantly cash-based economy,” Nirukt Sapru, CEO at Standard Chartered Vietnam, said.

“As a leading international bank here, we are working with our partners to help develop infrastructure for the use of cashless payment methods. […] We continue to be at the forefront of innovation and providing our clients with solutions that help them run their business in a cost effective and efficient manner.”

The app will enable Standard Chartered corporate clients in Vietnam to make payments directly into their beneficiaries’ MoMo mobile wallet via the bank’s Straight2Bank online platform.

Prior to the launch announcement in Vietnam, Straight2Bank has been operating in other key markets including Thailand, Indonesia, the Philippines, Kenya, Nigeria, Tanzania, Zambia, Pakistan and Bangladesh. The bank plans to expand the platform to additional markets during the end of the year, Standard Chartered said.

———-

Information from Fintechnews.sg:

For Fintech Vietnam we have setup

a separate Facebook Page and Group

a Twitter Channel: check @FintechVN

and the first Vietnam Fintech Meetup Group:

Please join us!

Image credit: IPhone, Visa; Pixabay.