Digital wallets in Singapore have enjoyed a bumper year.

With lockdowns catalysing the growth of online shopping, the local e-commerce market reached US$7 billion in 2020.

And growth is expected to stick. 9 in 10 new digital consumers intend to continue using digital services going forward. As the digital economy grows, online payments will follow, fuelling the growth of digital wallets.

According to the 2021 global payments report by FIS, digital wallets accounted for 20 per cent of local online payments in 2020, trailing behind credit cards (45 per cent). However, the pecking order is expected to change by 2024, with digital wallets poised to overtake credit cards as the most popular online payment method in Singapore.

As digital wallets find themselves increasingly embedded within the daily lives of Singaporeans, there has been no shortage of companies wanting in on this lucrative market.

Google Pay’s foray into P2P payments in Singapore

Google Pay Launches All-In-One P2P Payments Solution in Singapore, Fintech News Singapore

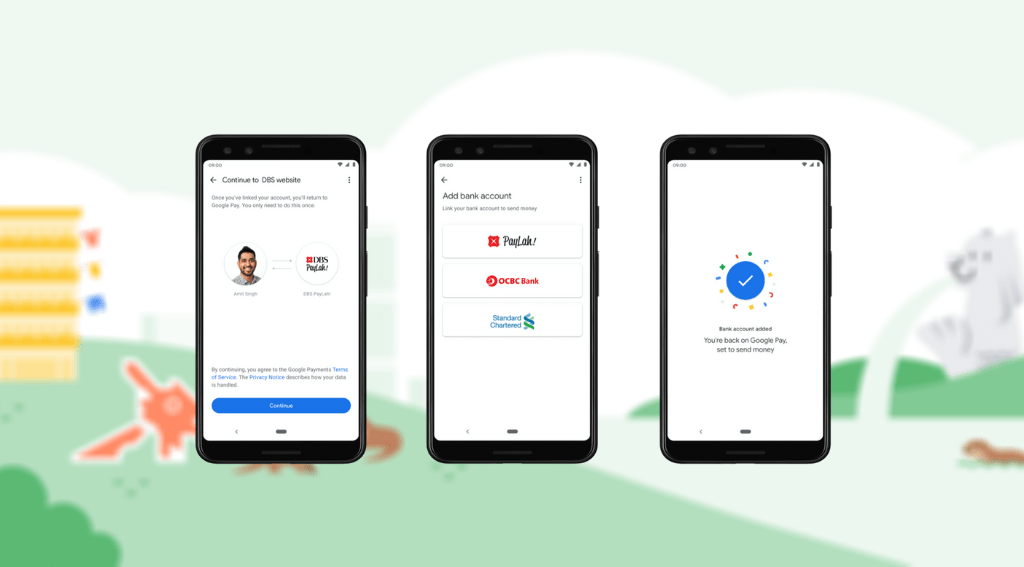

The largest entrant into Singapore’s digital wallet ecosystem was Google’s launch of GPay in September 2020. Fresh off its launch in India, the city-state was Google’s second launch country for its relatively nascent payments offering.

Interestingly, the tech giant adopted a different strategy for its digital wallet. Instead of functioning as a conventional digital wallet storing different credit cards on it, GPay focused on allowing its users to make money transfers through their bank accounts.

Built upon Singapore’s existing payment infrastructure and leveraging PayNow (a service offered by local banks that allows users to send and receive money from one bank to another using a mobile number), Google was able to eliminate the need to built its payment rails from scratch.

Crucially, it allowed users to not hold a balance on their digital wallet. This improved the app’s usability by removing the need for users to top up their wallets, a challenge regularly cited by users

Driven by an aggressive sign-up campaign comprising referral bonuses and cash backs, GPay was able to climb to third in app download rankings for pure-play digital wallets (without digital banking functions), behind DBS’s PayLah and Singtel’s Dash.

Huawei Pay lackluster fanfare

Chinese tech behemoth Huawei also made its foray into the local digital wallet industry at the height of the pandemic in April last year. It partnered with UnionPay to launch its mobile payment tool that provides contactless, cashless payment service for its device users.

However, its launch did not generate as much fanfare as Google’s. This could be attributed to the fact it was only provided for Huawei users, unlike GPay which was available across different mobile providers and operating systems.

In January 2021, Huawei announced it partnered with local fintech firm Aleta Planet to introduce NFC and QR code payments for its digital wallet app, claiming it offered an improved in-store payment experience.

HSBC digital wallet for SMEs

image via HSBC

Just last week, HSBC announced its foray into the digital wallet scene, albeit in the small and medium enterprise (SME) space. The bank announced the release of a digital wallet for businesses to send, receive and hold cash in multiple currencies.

The bank, which concurrently launched the wallet in the UK and US, noted it removes the need for businesses to use third-party providers for international transactions.

Although its efficacy remains to be seen, the rollout of a B2B digital wallet marks an interesting development as banks seek to make their first forays into SME payments. DBS launched a QR-code based B2B payments application targeting Singapore SMEs in January last year.

Fave’s Acquisition by PineLabs

Apart from the new entrants in 2020, Fave’s acquisition by India-based Pine Labs was also a notable development. In a deal valued at US$45 million, Fave noted the acquisition would see it “reinforce market position in SEA” and launch services in India. Its digital wallet solution FavePay was ranked as the third most popular digital wallet app (by monthly active users) in 2019.

The acquisition could mark the start of merchant giants acquiring digital wallets in a bid to offer payment services within their platform, as part of the growing embedded finance trend.

Apart from new entrants and mergers, these were other notable developments within Singapore’s digital wallet scene in the last year.

PayNow integration for GrabPay, LiquidPay and Singtel Dash

Non-Bank E-Wallets GrabPay, LiquidPay and Singtel’s Dash to Offer PayNow, Fintech News Singapore

The Association of Banks in Singapore (ABS) announced in February local digital wallets GrabPay, LiquidPay and Singtel Dash would offer PayNow capabilities. This allowed users to top up their respective digital wallets directly from their bank accounts and transfer funds between wallets, both of which was not possible before the integration.

This streamlines a fragmented digital payments sector by enabling digital wallets to co-exist alongside banking apps, creating a more seamless user experience.

Singtel Dash adds financial services

Local telco Singtel announced in June last year it was adding financial services to its mobile wallet Dash, through an insurance savings solution underwritten by Etiqa.

In a sign Dash is looking to expand its suite of financial services, it also signed a Memorandum of Understanding (MOU) with UOB in November to offer “dynamic and personalised” robo-advisory investment solutions for individual investors through its mobile wallet app.

By making its foray into insurance and wealth management, Singtel is sending a clear signal it plans to develop Dash into a financial “super-app”, pitting it against GrabPay.

The future

As an industry, digital wallets are only expected to increase in popularity as growth in the digital economy accelerates across the region.

We can expect more new players to emerge as global companies want in on the lucrative pie that is Southeast Asia. M&A activity could also pick up as industry leaders such as Grab and Singtel seek to build financial super apps.

Featured image: Photo by Ketut Subiyanto from Pexels