Singapore’s Fintech Deals Skyrockets to Its Highest in Three Years at US$614.2 Million

by Fintech News Singapore August 10, 2021Singapore’s fintech industry has proven resilient with deal numbers for the first half of 2021 skyrocketing to its year-on-year highest in three years.

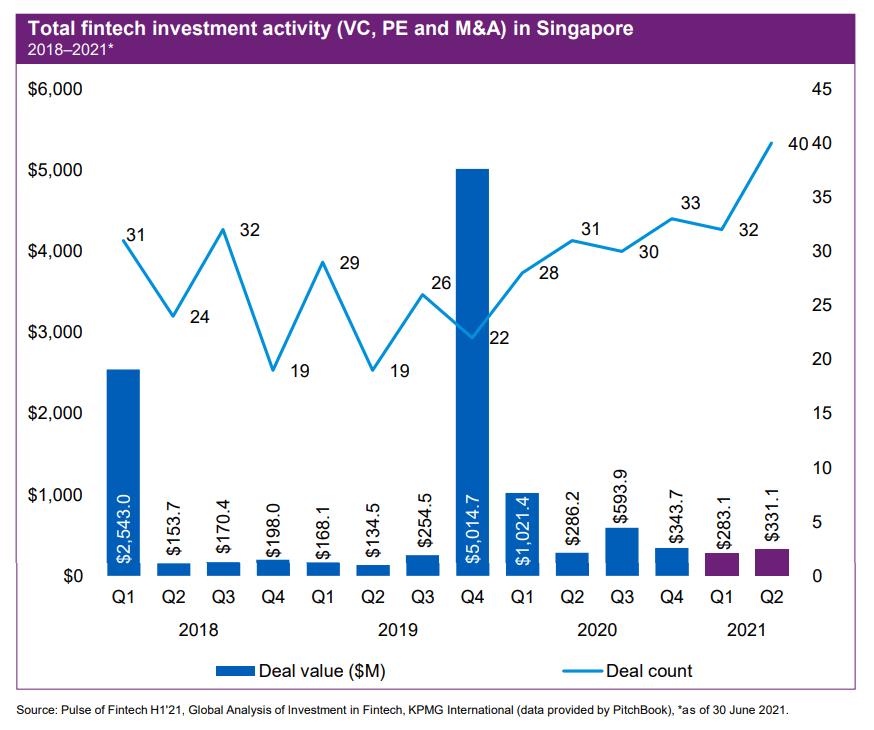

A total of 72 deals amounting to US$614.2 million were transacted for Singapore fintechs from January to June this year – this is a 22 percent increase from 59 deals in 1H 2020 and 50 percent higher than the 48 deals in 1H 2019, according to data from the KPMG Pulse of Fintech Report H1’21.

After falling to US$4.7 billion across 357 deals in 2H 2020, investment amount in the Asia-Pacific soared to US$7.5 billion across 467 deals in 1H 2021– largely driven by venture capital activity.

India led the way with US$2 billion in total fintech investment, followed by China at US$1.3 billion, Australia at US$900 million, while Singapore is not far off at US$614 million.

Singapore fintechs transacting smaller deals now but SPACs may help push valuations

While the number of deals transacted has certainly gone up, Singapore fintech firms are transacting smaller value deals compared to last year. Investors are still willing to broker deals at strong valuations for companies, but not to quite the same extent as they did in the past.

Transactions in 1H 2021 for Singapore fintechs totaled US$614.2 million, which is half of 1H 2020’s total deal value of US$1.02 billion.

A large part of 1H 2020’s total deal value had been from the US$856 million deal scored by Singapore-based superapp Grab during that period.

That said, 1H 2021’s showing for Singapore is still an improvement from two years back – the deal value is double that of 1H 2019’s US$302.6 million.

The smaller sized deals are in part due to pull back in financing from corporates and their venture arms year on year, given the degree of consolidation and emergence of clear category leaders across countries and regions.

While corporates and their venture arms are still engaging in a decent number of rounds, these deals are smaller in size because the corporates are no longer joining in the mega-rounds of some of the largest companies.

SPACs could steal the spotlight

The explosion of US-based special purpose acquisition companies (SPACs) in recent months may help push valuations for the Singapore fintech landscape.

A case in point is Singapore-based super-app company Grab which announced the largest SPAC merger ever in 1H 2021.

Aside from Grab, Indonesia-based Gojek has also raised US$300 million in 1H 2021 and announced a merger with e-commerce platform Tokopedia for US$18 billion to create the GoTo Group.

Payments remain top choice for fintech investors as BNPL gains traction

Payments sector keeps top spot for fintech investment globally

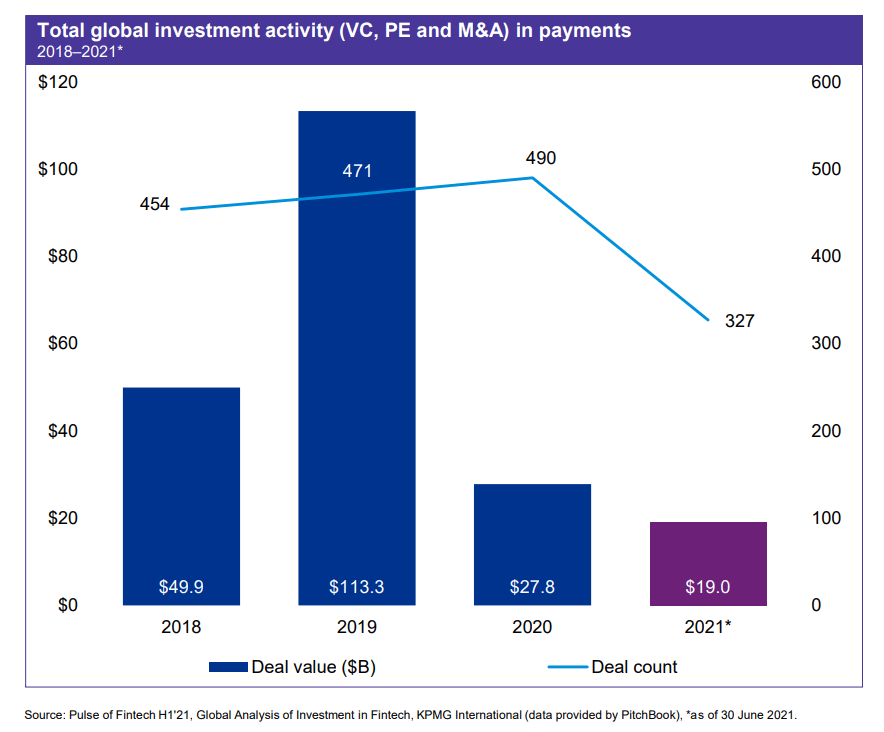

Fintech investments in the payments space have kept up momentum, retaining the top spot for investors’ wallets globally at US$19 billion for 1H 2021 – compared to $27.8 billion for the entire year of 2020.

Deal values for payments globally exceeded that of other fintech segments in 1H 2021 such as blockchain and cryptocurrency (US$8.7 billion), insurtech (US$7.1 billion), regtech (US$6.6 billion), cybersecurity (US$3.7 billion) and wealthtech (US$1.4 billion).

Among the fintech investments into payments in Asia-Pacific for 1H 2021, ‘buy now pay later’ was one of the fastest growing sub-sectors in the payments space.

The strong interest of investors in the payments space has been attributed in part to an increasingly diversified payments space, which is now going beyond person-to-person and bill payments.

Cryptocurrency and blockchain is a space to watch

Investment in blockchain and crypto in H1’21 more than double all of 2020

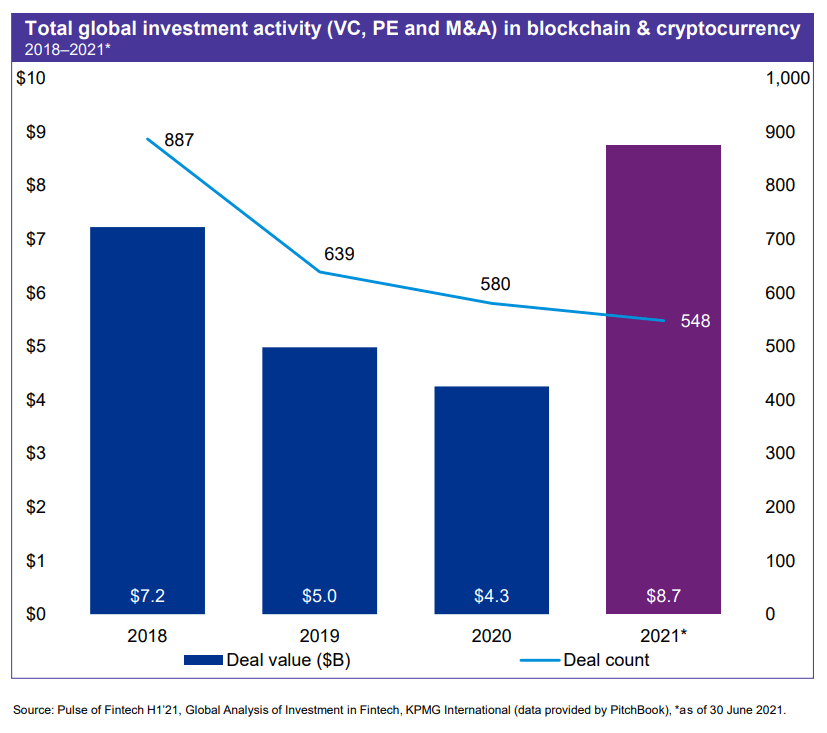

Cryptocurrency and blockchain is another space to watch. Global investments in these fintechs in 1H 2021 totaled US$8.7 billion, which is more than double the entire 2020’s investment figure of US$4.3 billion.

In 1H 2021, a significant amount of institutional money flowed into the crypto space, highlighting the broadening of the investor base.

Investor awareness and knowledge of the sector is growing in crypto assets, as well as the operational and procedural side of crypto – from custody and storage to storekeeping and the competitiveness and maturity of service providers.

VC investments have also been very strong in the blockchain and crypto space globally. Numerous companies raised US$100 million+ funding rounds, including BlockFi (US$350 million), Paxos (US$300 million), Blockchain.com (US$300 million) and Bitso (US$250 million).

Anton Ruddenklau

“Fintech is an incredibly hot area of investment right now—and that’s not expected to change anytime soon given the increasing number of fintech hubs attracting investments and growing deal sizes and valuations.

As we head into H2’21, we anticipate more consolidation will occur, particularly in mature fintech areas as fintechs look to become the dominant market player either regionally or globally.”

said Anton Ruddenklau, KPMG’s Global Fintech Co-Lead.

Featured image credit: Unsplash