13 Upcoming Fintech Webinars and Virtual Events to Attend Live

by Fintech News Singapore February 20, 2022Though in-person, physical events are back in full force this year, many organizers have embraced virtual events, attracted by their ability to reach a broader world from all parts of the world.

For those located in Asia-Pacific (APAC), we’ve selected 13 fintech webinars and virtual events that are just around the corner to watch live.

Innovate Your KYC to Combat Identity Crimes in the Financial Industry and Beyond

February 23, 2022, 11:00 – 12:00 (GMT+8)

As more Filipinos shift to digital banking, there has also been a significant rise in scams and fraud cases. From 2019 to 2021, Bangko Sentral ng Pilipinas (BSP) reported 2 billion pesos lost by consumers to fraudulent financial transactions. As this worrying trend keeps up, authorities are ramping up the fight against fraud.

With new guidelines implemented to Designated Non-Financial Business and Professions (DNFBPs), and the introduction of the Financial Consumer Protection Act, it is now high time for businesses and financial institutions to re-imagine their financial crime management to better protect themselves and their customers.

In this virtual panel discussion, experts from GBG, CIBI, Dow Jones and PwC Consulting will explore the latest trends surrounding identity crime typologies such as mules and pass through, how banks and financial institutions should re-imagine their KYC, CDD and AML monitoring, and how they can leverage the latest technology and data innovation to gear up their financial crime management.

Speakers for this virtual panel discussion are:

- Joel Del Valle, Managing Director, CIBI

- Prabandari Murti, Senior Manager, PwC Consulting

- Sachin B Singh, Director, Risk & Compliance APAC, Dow Jones

- Michelle Weatherhead, Director, Customer Experience and Innovation APAC, GBG

Register here: https://bit.ly/33uvRnm

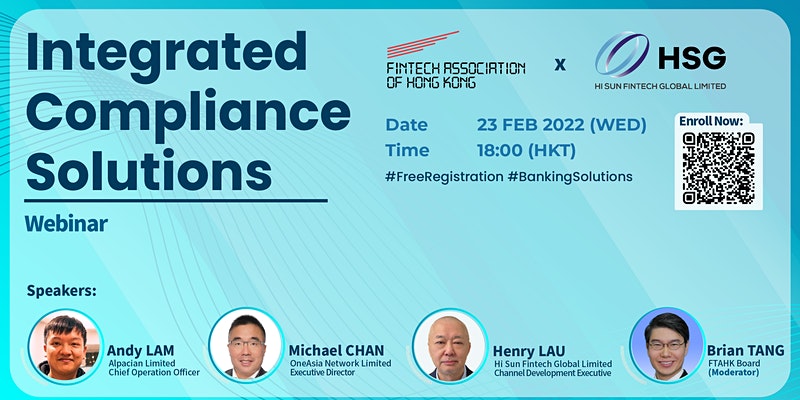

FTAHK x HSG Present: Integrated Compliance Solution

February 23, 2022, 18:00 – 19:30 (GMT+8)

The theme “integrated compliance” is related to the idea of constructing an end-to-end solution for financial institutes. It combines fintech applications for digital and virtual banking operations, a secured cloud platform with security operations center (SOC) services to run the applications 7×24 for customers at any time from anywhere, and the implementation of a wraparound regtech framework to address compliance and regulatory requirements and to enforce security management and controls collaboration.

The solution construct is empowered by the strengthened partnership of HiSun Global, OneAsia, and Alpacian, each a devoted player in their respective arena.

In this virtual panel discussion, Henry Lau, Channel Development Executive, HSG; Michael Chan, Executive Director, OneAsia Network Limited; and Andy Lam, Chief Operation Office, Alpacian Limited, will explore this topic and explain why this model is relevant in this age of digital banking.

Transforming The Customer Journey: Virtual Summit

February 24, 2022

Insurance has many strong points but customer experience excellence isn’t one of them. Long unsophisticated claim processes, manual underwriting, and old-fashioned communication channels have not helped with customer engagement and retention. However, insurance is adopting technology fast and with that, new digital communication channels and tools.

During the Transforming The Customer Journey: Virtual Summit, participants will get to learn how insurtechs and digital insurers are changing the way insurance is done, how they can connect with their customers to increase customer retention, and how they can create intelligent workflows for both agents and policyholder. They will also get to hear about the latest developments in the fields of artificial intelligence (AI), smart contracts, and more.

Confirmed speakers for the event include top executives representing organizations such as the India Insurtech Association, the Fintech Association of Hong Kong (FTAHK), CoverGo, Bain & Company, Mastercard, AXA, Capgemini Asia, Singlife with Aviva, Munich Re, Plug and Play, and Policybazaar.com.

Register for a complimentary pass: https://bit.ly/3BeMAHQ

Rise Presents: Tokenization & its Impact on Payments

February 24, 2022, 16:30 – 17:30 (GMT+8)

Earlier in September 2021, the Reserve Bank of India (RBI) authorized card payment networks and issuer banks to offer card tokenization services to merchants that use cardholder data for transactions.

This move has been lauded as a progressive regulation with potential benefits of improved security, faster transactions, and enhanced consumer experience. India’s payment industry is getting ready to adopt the new system.

For this virtual panel discussion, industry experts will be exploring the impact of tokenization and delve into how India’s payment industry is getting ready to adopt this new solution.

Panelists for this session are:

- Sampath Kumar Rangasamy, Chief Online and New Products Development, NPCI

- Rajesh Londhe, Co-Founder and Business Head, Payments, PayPhi

- Arnav Bakshi, Head of Cards Business, PhonePe

- Pramod Mulani, Head of Digital, India & South Asia, Visa

- Ayush Singh, Fintech Platform Manager, Rise India (Moderator)

FTAHK Wealthtech & Insurtech Committee: Convergence of Wealth & Insurance

February 24, 2022, 18:30 – 20:00 (GMT+8)

This panel discussion, featuring Ken Lo, Co-Founder and CSO, HKbitEx, and Alvin Kwock, Founder, OneDegree, will explore the development of digital wealth and insurance platforms, and will dissect collaborative opportunities between wealthtech and insurtech.

She Invests by StashAway: Investing in Female Leaders

March 8, 2022, 19:00 (GMT+8)

In this virtual panel discussion organized by Singapore founded digital wealth manager StashAway, Piruze Sabuncu , Partner at Square Peg Capital, Sherene Ban, Managing Director, CEO for Singapore and Southeast Asia at JP Morgan Asset Management, and Nandini, COO at StashAway, will address gender disparity in leading industries, such as finance, consulting, and more.

Viewers will get to hear them speak about their career journeys as they navigated traditionally male-dominated industries, taking them to where they are today. They will also get to find out from the women themselves how to impact workplace culture today through personal anecdotes of challenges that they faced with boldness and grit.

Fintech Festival India 2022

March 1-3, 2022

After travelling for eight months across various cities in India to deliver fresh, unheard fintech conversations, Fintech Festival India 2022 will be hosting its Mega Event (Digital Edition) from March 1 to 3, 2022.

The Mega Event will feature top executives representing organizations such as Coinswitch Kuber, the Dubai International Financial Centre (DIFC) Authority, ConsenSys, the Amber Group, and Airtel who will discuss some of the hottest trends in the fintech space including decentralized finance (DeFi), central bank digital currencies (CBDCs), embedded finance, insurtech, and regtech.

Asia Business Conference 2022: Disruptions in Asia

March 8-11, 2022

For more than 25 years, the Harvard Asia Business Conference has served as a hallmark event for business leaders, entrepreneurs, professionals, policymakers, and thought leaders across Asia.

Harvard Business School, with its partners, will be bringing to another year meaningful conversations on the trends, policies, challenges, and opportunities that currently face the Asian region.

Paying homage to the flurry of activity and bold initiatives that have arisen as a response to COVID-19, the 2022 conference theme is Disruptions in Asia.

The conference will comprise six panels ranging from capital markets, fintech, social innovation, future of work, media, and healthcare and feature speakers from across Asia.

The 2022 lineup of speakers includes:

- Laurence Lien, Co-Founder and Founding CEO, Asia Philanthropy Circle

- Dr. Krishna Ella, Chairman and Managing Director, Bharat Biotech

- Dr. Santitarn Sathirathai, Group Chief Economist, Sea

- Chatri Sityodtong, CEO, ONE Championship

- Pritha Venkatachalam, Partner, The Bridgespan Group

- Seung Yoon Lee, Global Strategy Officer, Kakao Entertainment

Central Bank Digital Currencies: From Concept to Reality

March 10, 2022

With more movement on central banks prioritizing digital currencies, this virtual event will feature the trailblazers behind the latest initiatives and developments in CBDCs, including Banque de France, Bank of Jamaica, AWS, HSBC, Token Intelligence, eToro, the Bank for International Settlements (BIS), FIS and Deutsche Bank.

Participants will gain unique insights into global retail and wholesale CBDC trends, including the latest in innovations delivered by the CBDC community. They will also better understand the macroeconomics, global policy, regulation and politics around CBDC, and will learn about what is required for the ideally designed CBDC, with interoperability, integration and efficient payment systems in mind.

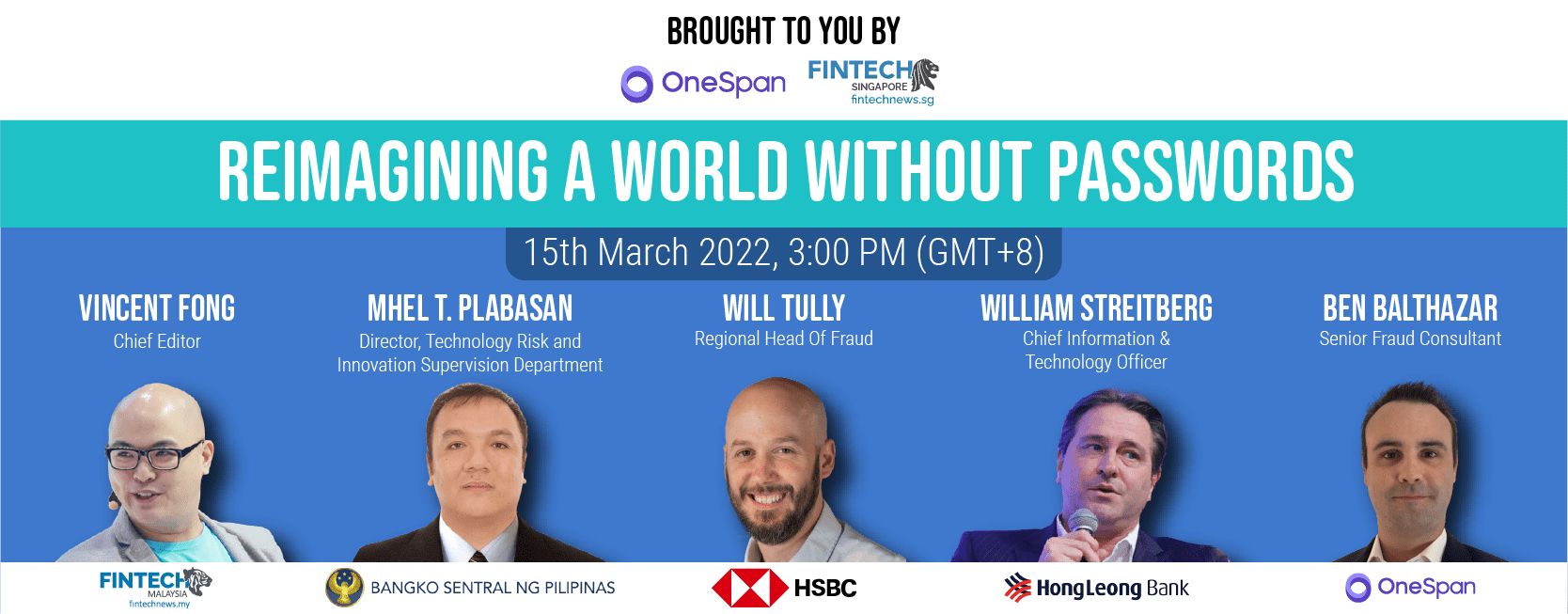

Reimagining a World Without Passwords

March 15, 2022, 15:00 (GMT+8)

Outdated yet ubiquitous, passwords are inconvenient, risky, and costly for banks to maintain. So what’s the best way for banks to modernize authentication with secure and user-friendly password-less technologies?

From best practices to the latest technologies, this webinar will explore what it will take for the digital economy to get from here to a password-less world.

Participants will get to learn about the evolution of passwords and authentication, the best practices for deploying password-less solutions that satisfy customer needs, and the range of authentication technologies available out there that support true password-less login

Panelists for this virtual panel discussion are:

- Mhel T. Plabasan, Director, Technology Risk and Innovation Supervision Department, Bangko Sentral ng Pilipinas

- William Streitberg, Chief Information and Technology Officer, Hong Leong Bank

- Will Tully, Regional Head Of Fraud, HSBC

- Ben Balthazar, Senior Fraud Consultant, OneSpan

Register Here: https://bit.ly/OneSpanWebinar

Adobe Summit: The Digital Experience Conference

March 15–17, 2022

Adobe Summit: The Digital Experience Conference, taking place from March 15 to 17, 2022, is the premier digital experience conference where attendees gain valuable insights and techniques for keeping customers engaged, driving brand loyalty and growth.

This year, the event is expected to attract more than 100,000 attendees who will come together to share, learn and make meaningful connections that will allow them to create better, more personalized digital experiences. The summit will feature 400+ sessions and training workshops across 11 tracks.

How the Innovation and Technology Venture Fund (ITVF) Supports Fintech Companies in Hong Kong

March 16, 2022, 11:00 – 12:00 (GMT+8)

With a view to attracting more venture capital (VC) funds to co-invest in local innovation and technology (I&T) startups and creating a more vibrant start-up ecosystem in Hong Kong, the government has set up a HK$2 billion Innovation and Technology Venture Fund (ITVF) in 2017.

The ITVF will co-invest with selected VC funds (also known as co-investment partners (CPs)) in eligible local I&T startups. The CPs are responsible for recommending suitable investment targets to the Government for co-investments. As of end December 2021, the ITVF’s investment to fintech companies has amounted to over HK$36 million, attracting around HK$352 million of private investment.

For this webinar, speakers from CPs that has key investment sectors covering fintech will come together to share their valuable insights and views on what they would like interested fintech companies to know. The speakers will help audience better understand how the ITVF is one of the channels to help fintech companies in Hong Kong to scale and succeed.

Speakers for this webinar are:

- Tina Huang, Executive Director, Greater Bay Area Homeland Development Fund

- David Zhang, Managing Director, Isola Private Equity Venture Capital Fund

- Shu Ming, Partner, Lingfeng Capital Partners Fund

- Jeffrey Wu, Director, MindWorks Ventures Fund

- Yolanda Yang, Investment Director, Radiant Tech Ventures Fund

Finastra Forum (Asia Pacific)

March 29, 2022, 12:00 – 17:45 (GMT+8)

The Finastra Forum Live Stream is a global event series that aims to bring the latest in fintech innovation through sessions on cloudification, environmental social governance, payments, lending, treasury, and banking-as-a-service (BaaS).

The Finastra Forum (Asia Pacific) will take place on March 29, 2022 and will explore the US$7 trillion BaaS opportunity, sustainable finance, cloud technology, digital treasury, the regulatory landscape, cryptocurrencies, and more.

Register Here: https://bit.ly/3I460Sc