Migrating to a Cloud-Native Core Helps Banks Reduce Core Spend by 76% Over 5 Years

by Fintech News Singapore September 28, 2022Across the globe, financial institutions are under increasing pressure to remain competitive in a rapidly changing financial services landscape.

Challenger banks and fintechs are leveraging modern technology stacks and agile operating models to innovate at speed and build modern, customer-centric financial solutions that consumers have come to expect.

Meanwhile, many incumbents remain in a holding pattern, running legacy core platforms which, apart from being expensive and time consuming to maintain, can seriously hamper their ability to remain competitive.

And it’s not only pressure from within the financial services industry causing sleepless nights for many incumbents; tech giants with seriously deep pockets are also eyeing the space with propositions that will continue to push customer expectations.

The business case for core migration – reduce cost base by 76%

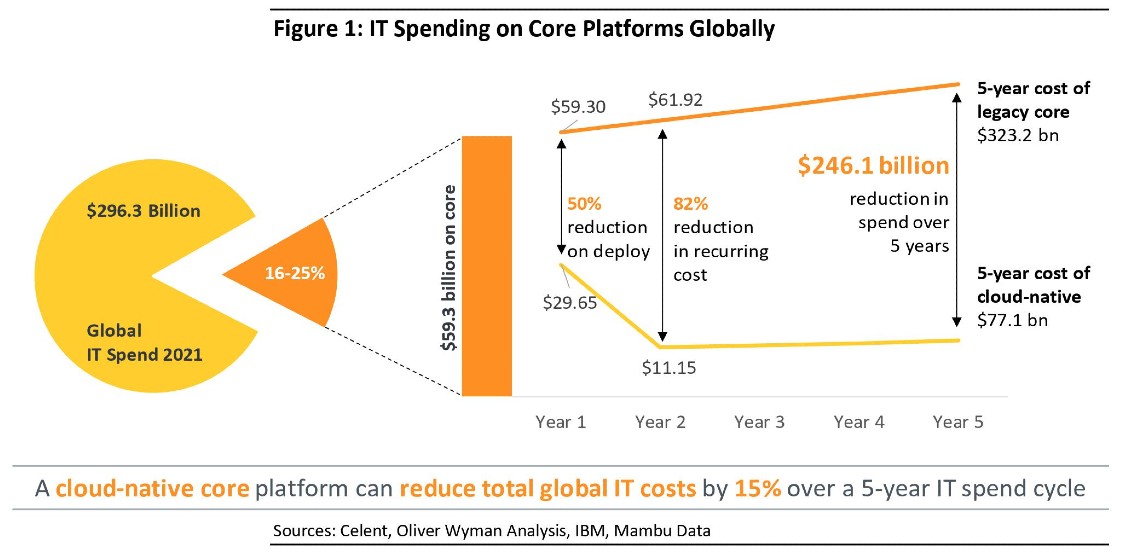

Central to a bank’s tech operating model, core platforms are a major source of organisational spend.

Challengers have focused on next-generation cloud-native core platforms, which in the case of banks like OakNorth have reduced the cost base by 76% compared to traditional incumbents.

So, what’s the tipping point for core migration for financial institutions?

The risks of large-scale transformation projects, cost of transformation, and organisational inertia are barriers to core migration.

However, as negative consequences of legacy technology become more pronounced, the cost of doing nothing will overshadow the risks of migration.

According to an analysis by Celent and Mambu, banks globally may save up to US$246.1 billion running a cloud-native core over five years, a 76% reduction in core spend and 15% savings in total IT costs over the same period.

Modern, cloud-native core technology to replace traditional large-scale transformations

According to Celent, as the benefits of a cloud-native core becomes more apparent on a wider scale, the business case for a cloud core migration will become easier for banks to make.

Large transformation initiatives come with significant cost and risks, and have an extended timeframe before the ROI is seen, so banks would be wise to move away from these to a cloud-native approach.

With a cloud-native approach, the time to get a platform operational decreases substantially, and select stacks can be migrated over time, with the flexibility of the platform and resiliency of the cloud allowing banks to be more cost-effective.

Once operational, the recurring costs to maintain can drop by more than 80%, based on Mambu’s benchmark figures.

Cost benefits of a cloud-native core

The advantages of a cloud-native core are many. Below, Celent has identified some of the benefits of a cloud-native core over a legacy core:

- Easier product or system changes – Mambu estimates around 85% reduction in time to launch new products on a cloud-native core.

- Ecosystem integration and simplified architecture – simple and seamless integration with third parties via a cloud-native core.

- Usage-based cost models for predictable spend – cloud-native core platform delivered on a per-use basis controls the spend and allows institutions to scale at their own pace.

- Reduction in internal resources – Mambu estimates a 30-40% reduction in specialist skills required to maintain legacy platforms.

- Reduced business risk – migrating to a cloud-native core significantly decreases the business risks associated with legacy technology, including outages and manual processes that hinder performance.

Mambu is the market leader in cloud-native core banking and lending technology. To explore the benefits of cloud-native banking platforms and gain a better understanding of the challenges incumbents face due to legacy technology, download the report from Mambu and Celent now.