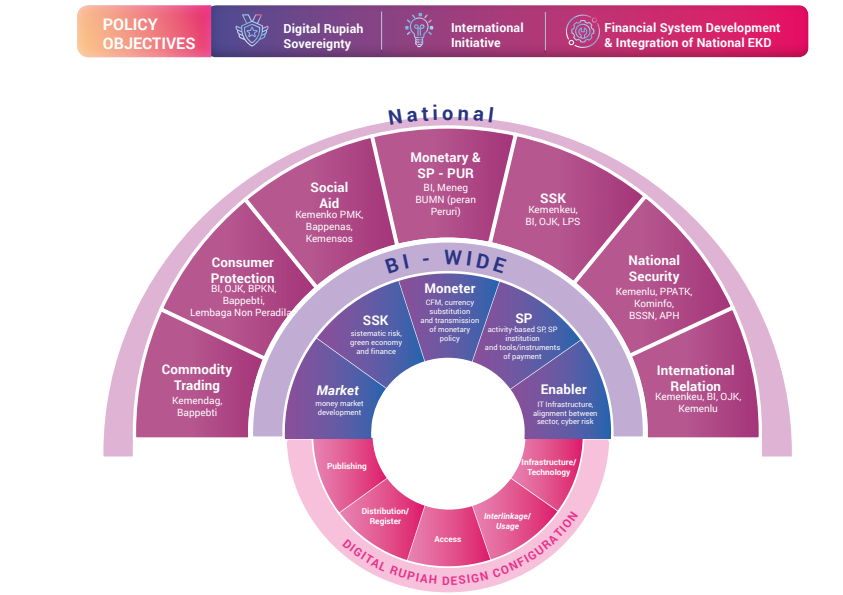

Bank Indonesia announced the country’s very own central bank digital currency (CBDC), named the “digital rupiah,” to move forward with the country’s initiative of “advanced digital transformation.”

Dubbed “Project Garuda,” named after Indonesia’s legendary bird, Bank Sentral Republik Indonesia or Bank Indonesia (BI), said it is an initiative that encompasses the endeavours in exploring the optimal design for Indonesian CBDC, or Digital Rupiah.

Bank Indonesia also participates in CBDC projects, including the international Project Dunbar and Project mBridge. The move will keep Indonesia at the forefront of efforts to develop a CBDC.

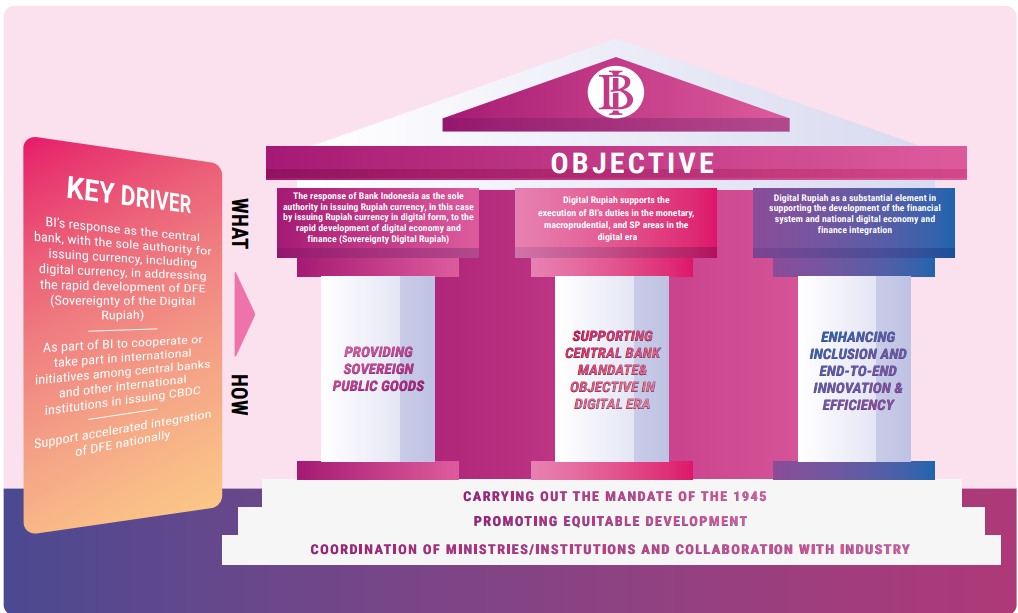

Three key factors of developing the digital rupiah

Developing the digital rupiah as Indonesia’s CBDC is driven by three factors.

First, BI will be the only institution with authority to issue Indonesian digital currency. It will enable BI to respond to the rapid digital economy and finance development by issuing the rupiah in digital form. This is also to preserve the sovereignty of the rupiah in the digital age.

Second, BI seeks to strengthen its role on the international stage via the issuance of the digital rupiah and put Indonesia on the world’s radar for its CBDC development alongside other countries. This will also help BI’s engagement with other CBDCs regarding interoperability initiatives.

Third, by launching the digital rupiah, BI hopes to accelerate the integration of the national digital economy and finance. The digital rupiah will ensure an effective and integrated money supply process between the digital economy and finance ecosystem and the existing economic structures.

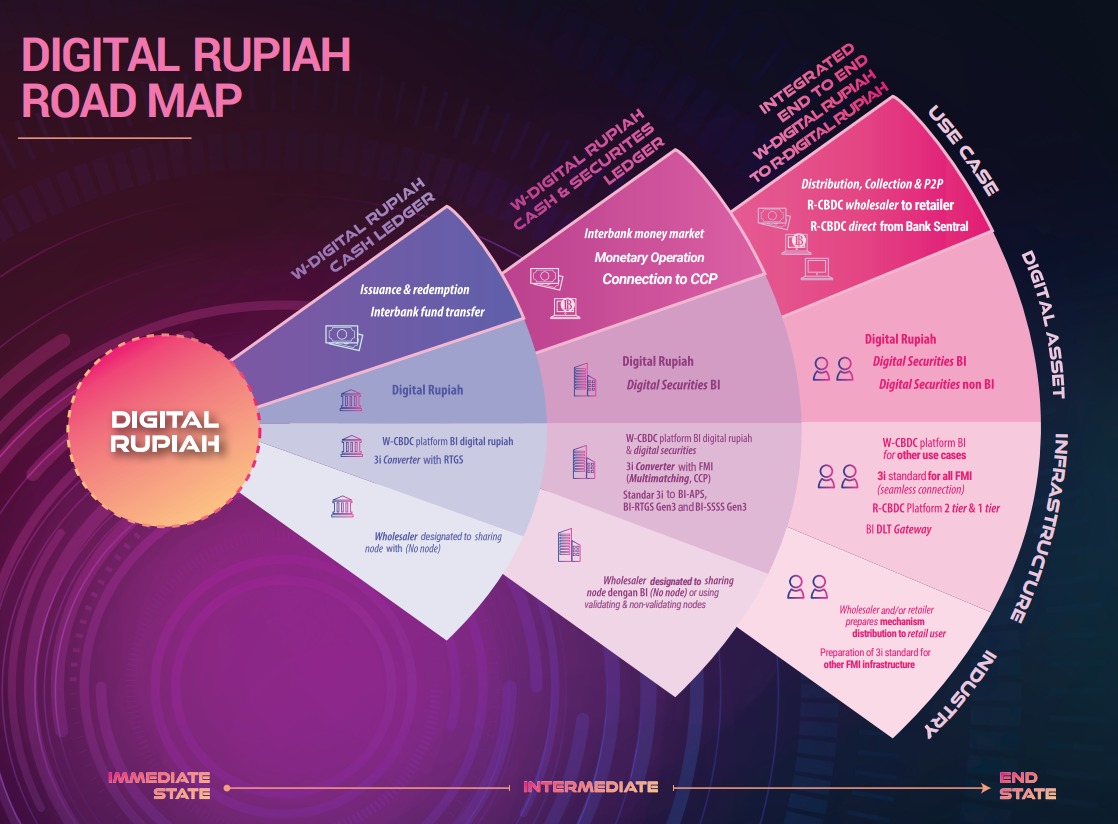

Three stages of gradual implementation of the digital rupiah

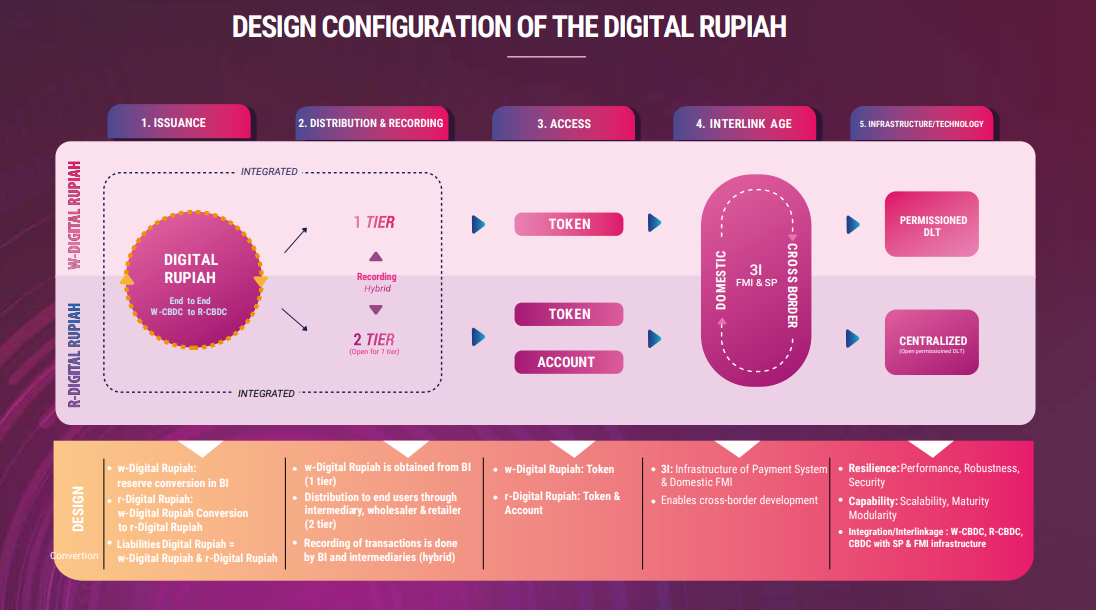

The development of the digital rupiah is going to be gradual and test-heavy, and it is divided into three stages, immediate stage, intermediate stage, and end-state stage.

The stages are arranged based on the four criteria of feasibility: importance, urgency, readiness, and impact, starting with public consultations, followed by technological experimentation, and concluding with a policy stance review.

Immediate stage

In the immediate stage, BI will explore the idea of wholesale digital rupiah with functions limited to issuance, redemption, and transfer of funds.

At this stage, the usage of the digital rupiah is relatively straightforward as it only involves a limited ecosystem, has less transaction-related complexity, and minimal system adjustments required.

Participants don’t have to prepare their nodes; instead, they can utilise sharing nodes prepared by BI. This stage serves as an essential foundation for the development of subsequent uses.

Intermediate stage

In the intermediate stage, financial market transactions and monetary operations will be tested and may stand to benefit from this digital currency.

Delivery versus Payment (DvP) will all be tested with the digital rupiah. This method guarantees that the transfer of securities only happens after payment has been made for interbank money market and monetary operations, as well as Central Counterparties (CCP) fund settlements.

The tokenization of securities will also be developed. In this stage, the parties involved now must prepare their nodes according to their transactional needs.

End State stage

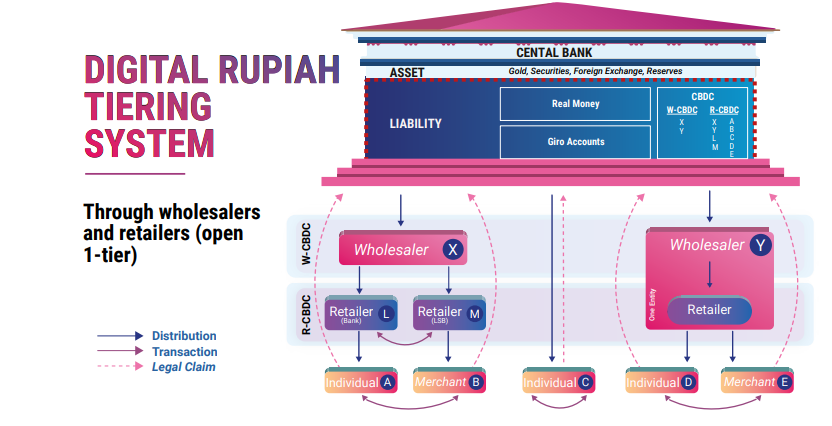

During the end state, the concept of integrated end-to-end w-digital rupiah to r-digital rupiah will be tested, which is the digital rupiah for wholesale and retail markets, respectively. The general public will have access to digital currency to make payments and peer-to-peer transfers, along with broader expansions of wholesaling and distribution.

Wholesalers need to develop a distribution mechanism, and the w-digital rupiah will be used more extensively, including issuing digital securities by parties outside the central bank. W-digital rupiah will be used as collateral in monetary operations and the money market.

Mitigating Cybersecurity Risks

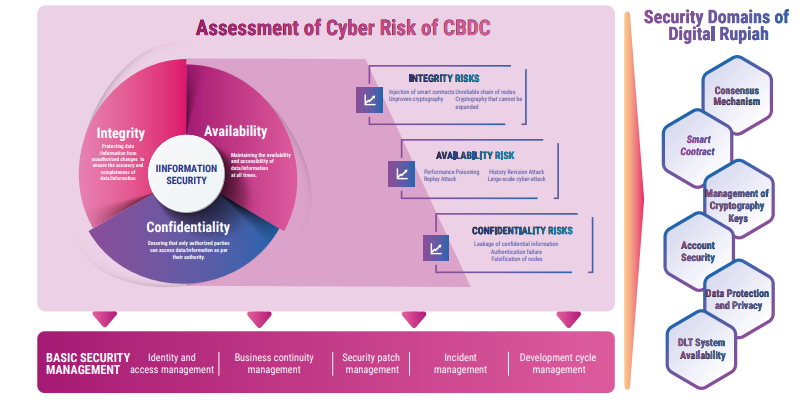

One factor determining the effectiveness of adopting the digital rupiah is the fulfillment of cyber security requirements.

Digital Rupiah faces typical cybersecurity risks as with any other IT system. Hence, similar security standards are also applied to digital rupiah consisting of identity and access management (authentication and authorization), business sustainability management, security patching management, incident management, and development cycle management.

Assessment and identification of risks arising from people, processes, and technology will be made accordingly to produce safe, reliable, and resilient digital rupiah technology design. Based on these notions, the development of the system will refer to three basic principles of information system security, i.e., confidentiality, integrity, and availability.

No disruption to existing banking and digital payment systems

According to the country’s central bank, banking and digital payment systems in Indonesia will not be disrupted by introducing (CBDC).

In a statement on Monday, BI said its plans to launch a CBDC would not offer interest rates to avoid competing with products offered by banks, such as savings and time deposits.

BI added that the digital rupiah would not affect the liquidity required by the banking sector, as the currency would be similar to physical banknotes in the financial system.

CBDC: A future-proof solution

BI sees developing a CBDC as a future-proof solution and a suitable tool to connect the central bank’s role in sustaining a financial system to the public demand while maintaining monetary and financial system stability within the digital ecosystem.

This is attributed to the COVID-19 pandemic and the accelerated mass digitalisation occurring globally,

Although interoperability between CBDC from different countries remains challenging, BI seeks to cooperate with the International Monetary Fund (IMF), the Bank for International Settlements (BIS), and the World Bank, amongst other global central bank communities and international organisations, in developing the digital rupiah.