Posts From Fintech News Singapore

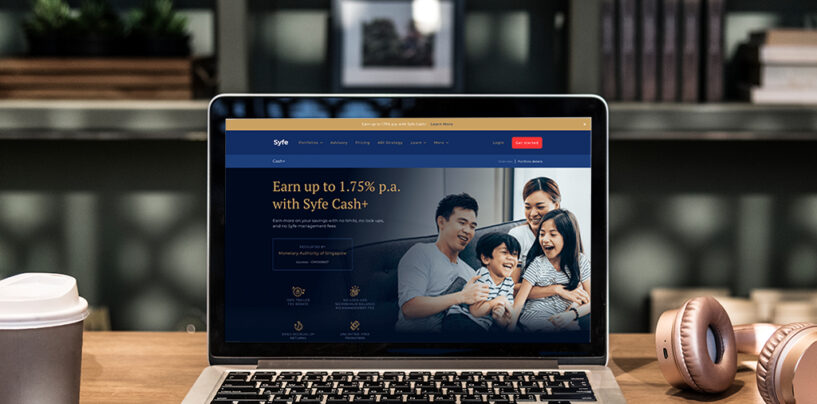

Digital Wealth Manager Syfe Rolls Out New Cash Management Solution

Syfe, a digital wealth management company licensed by the Monetary Authority of Singapore (MAS), has launched the Syfe Cash+ portfolio which is its latest cash management product that aims to enable all Singaporeans to grow their savings and still have

Read MoreSilent Eight Bags Multi-Year Partnership to Help HSBC Combat Financial Crime

Silent Eight, a Singaporean regtech using Artificial Intelligence (AI) to combat money laundering and terrorism financing, announced a multi-year partnership with HSBC that will support the bank in enhancing its compliance operations. HSBC selected Silent Eight to improve its manual

Read MoreSingapore Wealthtech Sector Continues to Grow; Sees Signs of Consolidation in 2021

In Singapore’s burgeoning 1,000+ strong fintech industry, the wealthtech subsegment continues to grow and mature on the back of increased appetite from investors, acquisition deals, and rising demands for automated financial advisory services, notably from the younger generations. But as

Read MoreAgoda Rolls Our Buy Now, Pay Later Payment Solution With Atome

Digital travel platform Agoda has launched a regional partnership with Singaporean buy now, pay later platform Atome to offer flexible instalment payment options for accommodation bookings first in Singapore and Malaysia, before rolling out to include eight additional markets in

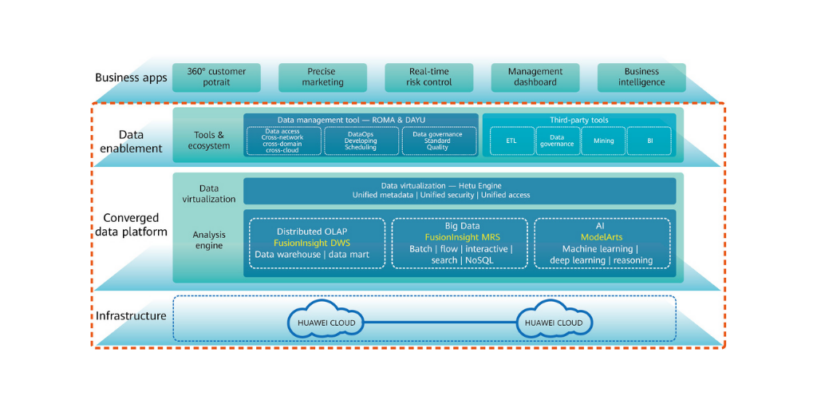

Read MoreFinancial Institutions Turn to Huawei’s Converged Data Lake Solution to Accelerate Banking Innovation

Like many other areas of the economy, the financial services sector is undergoing a data revolution. Every day, the global banking industry generates massive amounts of data by processing hundreds of billions of financial transactions as well as through interactions

Read MoreiSTOX Launches Unicorn Fund in Digitised Securities Form

Digitised securities platform iSTOX announced that it has listed a unicorn fund in digitised securities form, allowing the creation of security tokens where manual processes can be automated and minimum investment ticket sizes to be reduced to US$20,000. This expands

Read MoreYear End Message to Our Readers – Offline from 24th December to the 3rd January

Fintech News Singapore would like to take this opportunity to wish all our readers a Merry Christmas and a very Happy New Year. We will be taking a break from the 24th December 2020 to the 3rd January 2021. Until

Read MoreHow Data Privacy Affects Engagement in Financial Services

It may be a challenge for brands in highly-regulated spaces, but meeting customer expectations is both possible and essential. To get there, marketers need to ensure that they strike the right balance between data privacy/security and innovation. Let’s explore the

Read MoreKorean Unicorn Toss Join Forces With CIMB Vietnam to Launch CIMB-Toss Debit Card

CIMB Bank Vietnam and Viva Republica, the operator of Toss app, has jointly introduced the CIMB-Toss Debit Card following the success of the CIMB and Toss virtual card launched in July 2020. Launched in early December 2020, the debit card

Read MoreBrunei’s Fintech Industry Continues to Grow Amid Rising Demand and Government Push

Though still in its early stages, Brunei Darussalam’s fintech ecosystem is developing quickly on the back of rising demand for low-cost fintech products, increasing number of entrepreneurs and startups, and supportive government initiatives, according to a new report by the

Read More