Posts From Fintech News Singapore

India’s Top 30 Blockchain Influencers

Over the last several years, blockchain has been gaining traction in India especially with the financial institutions undergoing massive digital transformations. According to Tracxn, a startups and private companies tracking platform, there are 218 blockchain startups in India as of

Read MoreMoneythor Nets Undisclosed Amount of Investment From Navis Capital Partners

Asia-based private equity firm Navis Capital Partners has made an investment in Singaporean fintech startup Moneythor for an undisclosed amount. Founded in 2013, Moneythor provides financial institutions and fintech firms with solutions to enhance their digital banking services. Navis was advised

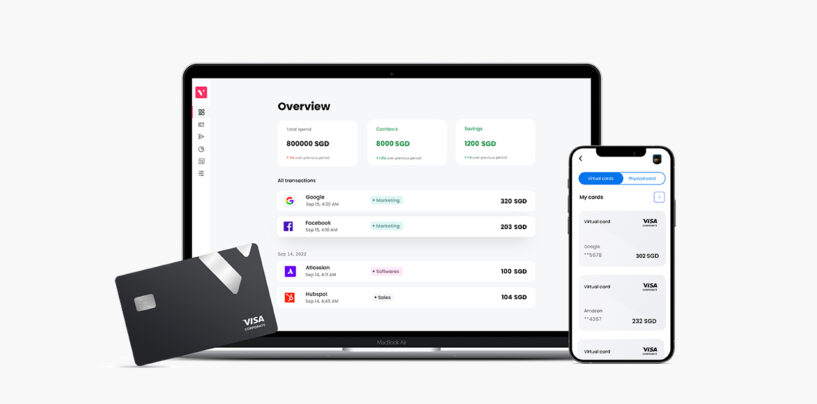

Read MoreVolopay Raises US$2.1 Million Ahead of APAC and Australia Expansion Plans

Volopay, Singaporean AI-based real-time expense management software, has raised US$2.1 million during its seed round funding. The investment round was led by Tinder founder Justin Mateen. Other investors joining the round were Soma Capital, CP Ventures, Y Combinator, VentureSouq, the

Read MoreTrading Platform MarketAxess Appoints Raj Paranandi as COO for EMEA and APAC

MarketAxess Holdings Inc., New York-headquartered operator of an electronic trading platform for fixed-income securities, announced the appointment of Raj Paranandi as its Chief Operating Officer for EMEA and APAC. The appointment will come into effect on March 1st, 2021. Based

Read MoreCompetition Heats up in Southeast Asia’s Buy Now Pay Later Market

In Southeast Asia, buy now pay later (BNPL) is becoming an increasingly popular way for shoppers to pay for purchases and players including Grab, GoJek, Razer and Oriente have all jumped at the opportunity. BNPL allows customers to make purchases

Read MoreBroadridge Names BNY Mellon’s Former Exec as APAC COO

Broadridge Financial Solutions, a US-based technology solutions provider, announced the appointment of David Ingleson as Chief Operating Officer (COO) for APAC effective immediately. The appointment was made to meet the growing demand for delivering technology solutions to financial institutions in

Read MoreMAS Revises Tech Risk Guidelines Amidst Heightened Cyber Attack Threats

The Monetary Authority of Singapore (MAS) has issued a revised Technology Risk Management guidelines in light of the recent spate of cyber attacks dominating the headlines. The revised guidelines focuses on addressing technology and cyber risks in financial institutions (FIs)

Read MoreSingaporeans Encouraged to Hand Out E-Hong Baos for Lunar New Year

The Monetary Authority of Singapore (MAS) is encouraging Singaporeans to use e-hong baos, monetary gifts given in envelopes, during the coming Lunar New Year. This is in line with the safety measures currently in place due to COVID-19. E-hong baos

Read MoreSingapore Fintech Report 2021: Blockchain Dominates Singapore’s Fintech Scene

Singapore’s fintech industry continued its momentum in 2020 on the back of new regulations, fintech initiatives from regulators themselves and the introduction of the city state’s very first digital banks, according to the Singapore Fintech Report 2021 produced by Fintech

Read MoreGrab’s Fintech Arm Secures Over US$300 Million in Series A Funding Round

Grab Financial Group (GFG), the fintech arm of Grab, announced that it has raised over US$300 million in its Series A funding round, led by Hanwha Asset Management Co. Ltd., South Korean asset management company. Other investors in the round

Read More