Digital Assets Wealth Management: A US$54B Opportunity for Asia’s Wealth Managers

by Fintech News Singapore June 24, 2022In Asia, adoption of digital assets as an investment is growing at a staggering pace, emerging this year as the fifth largest asset class in the region. But despite soaring demand from investors, the majority of wealth management firms are still holding back from offering the asset class, turning their back on a US$54 billion market opportunity.

This is according to an Accenture study, which polled more than 3,200 affluent investors across eight Asian markets, 550 relationship managers, and 21 senior executives of wealth firms operating across the region, to understand the state of wealth management in Asia and the trends emerging out of the region.

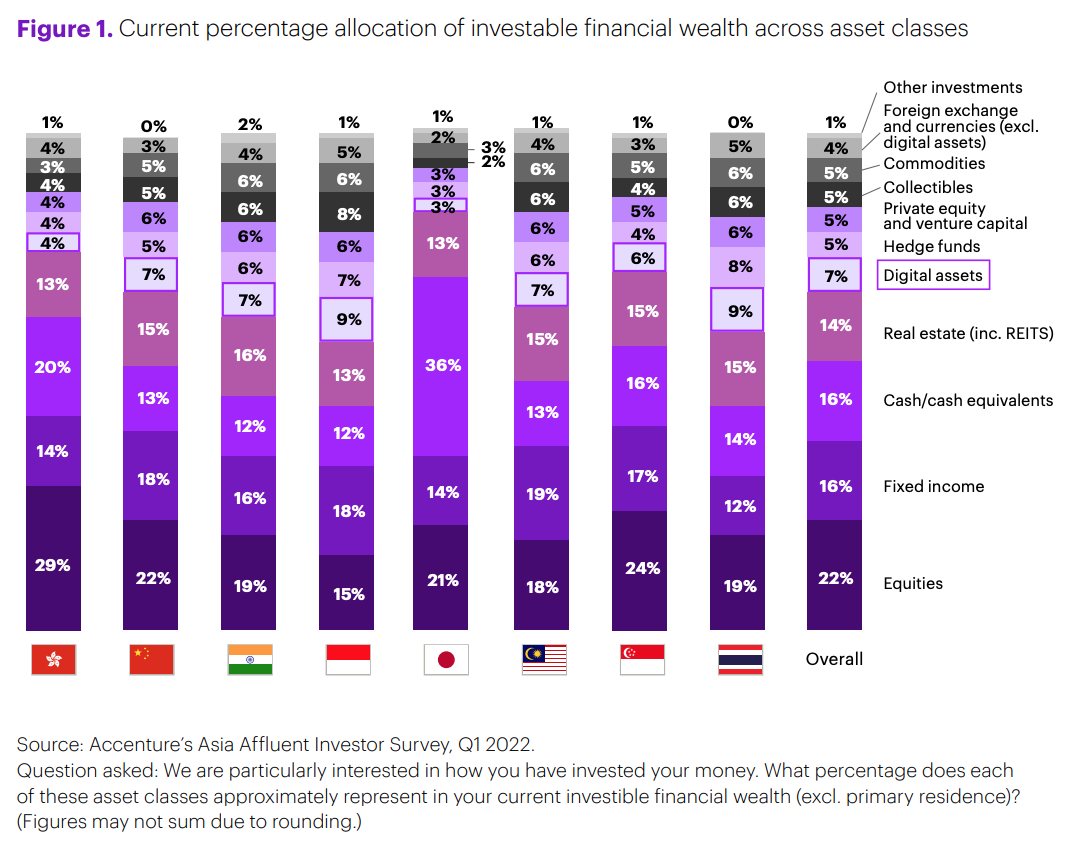

Results from the research show rising interest and adoption of digital assets, which now represent 7% of surveyed investors’ portfolio – more than foreign exchange (FX) and currencies, commodities or collectibles. This makes digital assets the top-five asset class for affluent investors in Asia.

Current percentage allocation of investable financial wealth across asset classes in Asia, Source: Accenture’s Asia Affluent Investor Survey Q1 2022

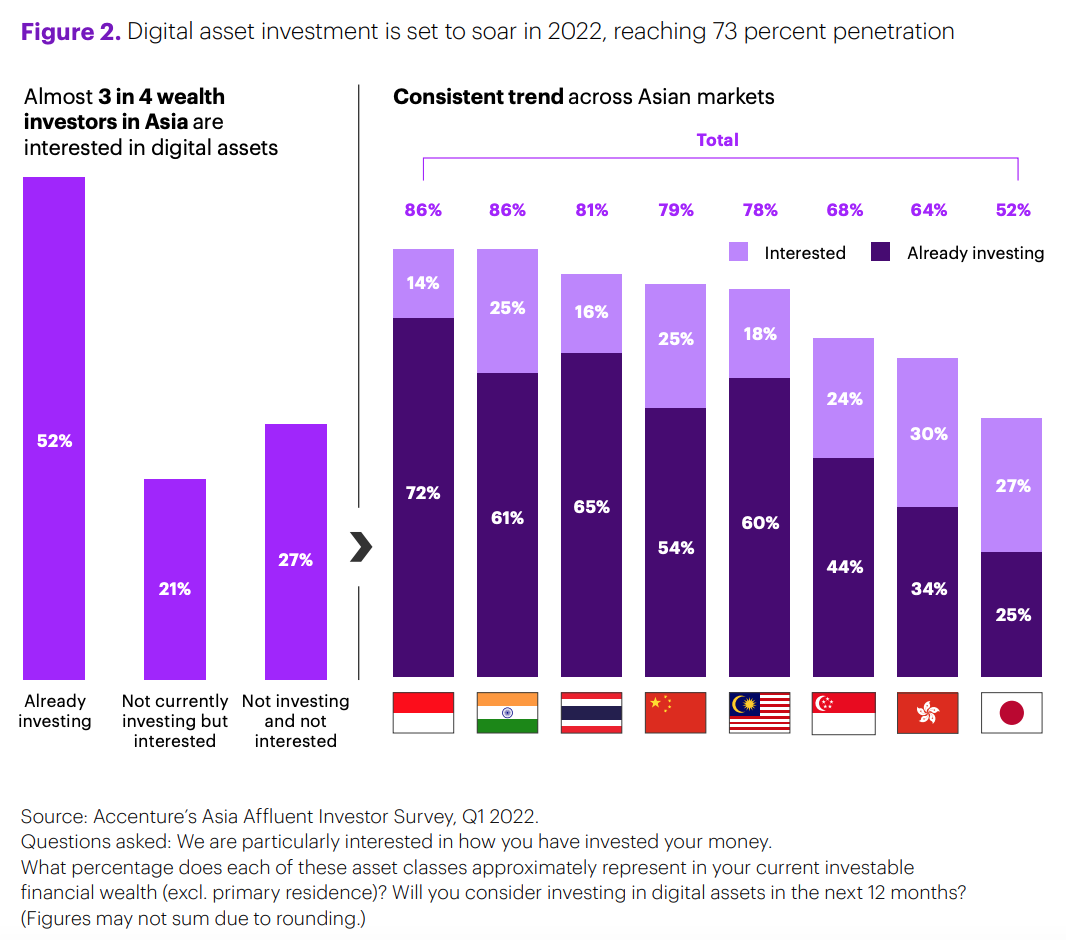

Currently, 52% of investors in Asia hold digital assets of some sort, whether that’s cryptocurrencies, crypto tokens or crypto funds, the survey found. By the end of 2022, that figure could very well rise to 73%.

Digital asset investment penetration in Asia, Source: Accenture’s Asia Affluent Investor Survey Q1 2022

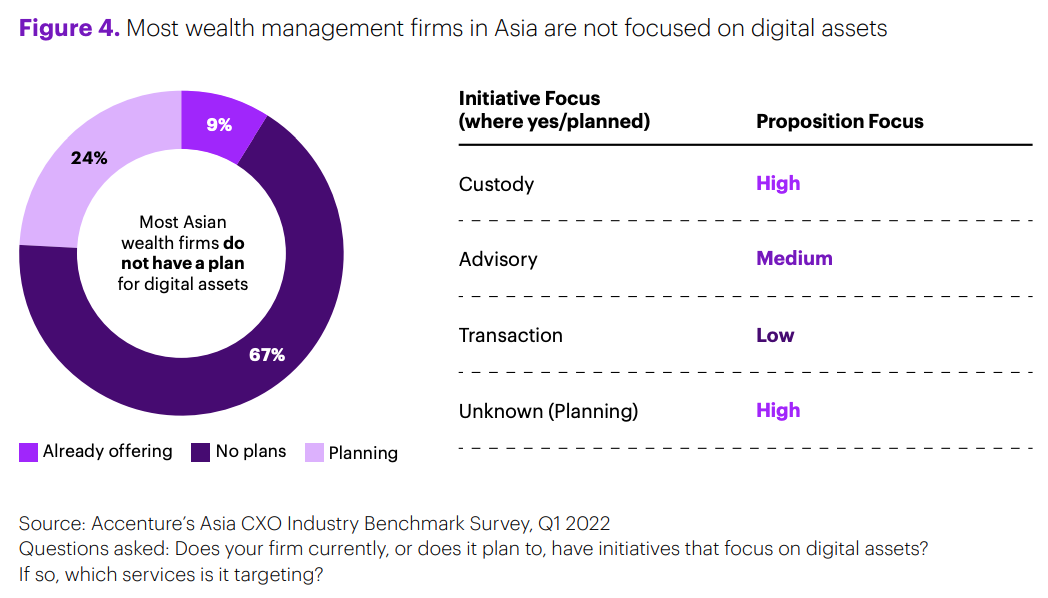

Even though investor interest is rising, most wealth management firms in Asia currently have no plans to target the asset class. Of the C-suite executives surveyed by Accenture, two-thirds said they are not planning any initiative related to digital assets.

24% indicated having plans to start offering the asset class, and only 9% already offered digital assets propositions.

Most wealth management firms in Asia are not focused on digital assets, Source: Accenture’s Asia CXO Industry Benchmark Survey, Q1 2022

Interviews with senior executives of wealth firms operating across Asia found that the reasons for not offering digital assets are multiple. Some indicated having adopted a “wait and see” approach. Others said they were skeptical about whether digital assets would be a profitable business. Regulatory concerns and operational constraints were also cited as main challenges for wealth managers.

Asia’s digital assets wealth management market

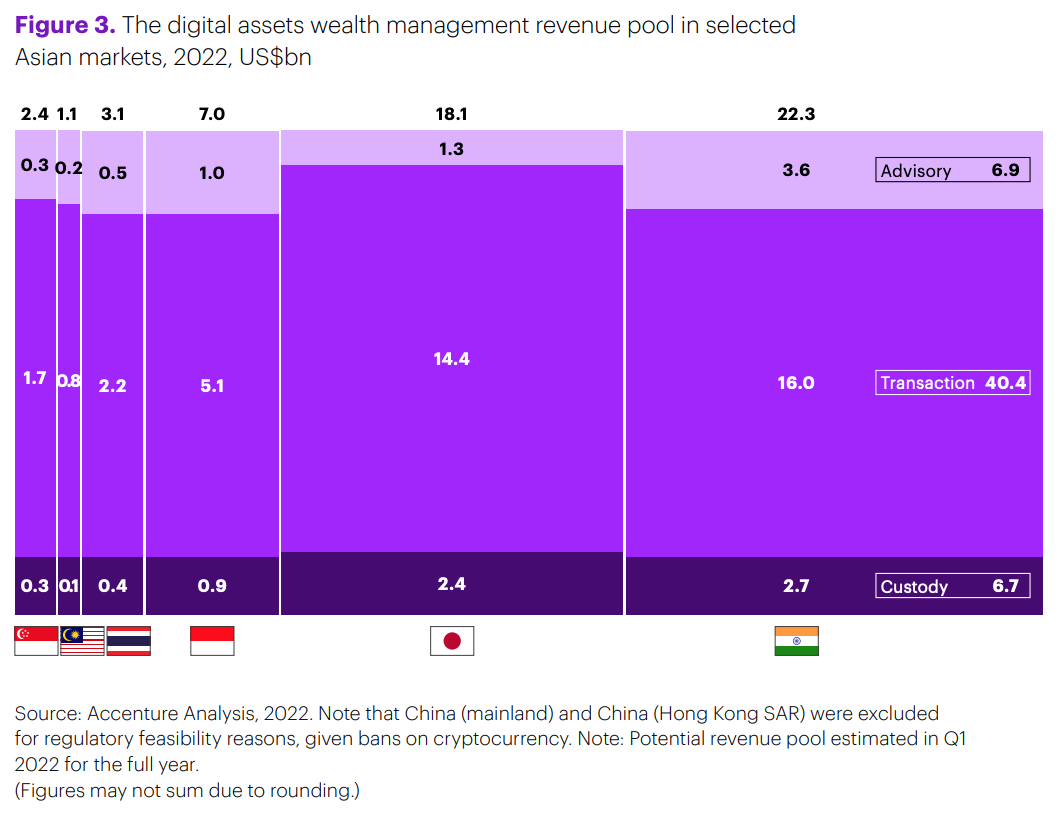

Accenture estimates that digital assets are a US$54 billion market opportunity for wealth management firms in Asia, with transaction fees representing a potential US$40 billion revenue pool, and advisory fees and custody fees, US$7 billion, each.

The bulk of the potential revenues are located in India and Japan, representing US$40.4 billion, but Southeast Asian nations, including Indonesia, Malaysia, Singapore and Thailand, also have a sizeable combined potential revenue pool, amounting to US$13.6 billion.

The digital assets wealth management revenue pool in selected Asian markets, 2022, US$bn, Source: Accenture Analysis, 2022

Interest in digital assets is not only growing among retail investors, but also institutional investors. A 2021 study by Fidelity Digital Assets found a positive perception of digital assets among investors surveyed, and rising intent to invest in the asset class.

70% of institutional investors surveyed globally expect to buy or invest in digital assets in the future, and more than 90% of those interested in digital assets expect to have an allocation in their institutions’ or clients’ portfolios within the next five years.

Interest was the highest in Asia, where 80% of respondents shared plans to purchase digital assets.

Year-over-year future purchase intent of digital assets, Source: The Institutional Investor Digital Assets Study, Fidelity Digital Assets, 2021

Featured image credit: Freepik