Posts From Fintech News Singapore

20 Upcoming Fintech Webinars and Virtual Events to Watch Live in Southeast Asian Time Zones

With COVID-19 still spreading, online events, virtual conferences and webinars continue to attract fintech professionals, investors and other stakeholders looking to build meaning connections while remaining safe. For those located in Southeast Asia, we’ve compiled a list of the top

Read MoreDBS Rolls Out Digitalised Audit Confirmation Solution for Corporate and SME Customers

DBS announced that it will be rolling out a digital audit confirmation solution for its corporate and SME customers. According to their media statement, the DBS Audit Confirmation cuts processing time for audit confirmation requests to under 24 hours, as

Read MoreSGX Ties up With Temasek to Develop Blockchain-Based Digital Asset Infrastructure

Singapore Exchange (SGX) and Temasek announced that they have entered into a joint venture (JV) to advance digital asset infrastructure through the use of blockchain. SGX said in a statement that the JV is set to be Asia Pacific’s first

Read MoreStashAway Hits US$ 1 Billion AUM Milestone

StashAway, Southeast Asian digital wealth manager for retail and accredited investors, announced that they’re managing more than US$ 1 billion (SG$ 1.35 billion) since their launch in 2017. The firm said in a statement that it was able to generate

Read MoreAccuity: Four Digital Payment Trends in 2021 for Banks and Payment Service Providers

We are experiencing more change in the payments space than we have over the past thirty years. This is an exciting time to be involved in payments. As we begin 2021, Accuity’s payments specialists look ahead to identify four digital

Read MoreTradeteq Secures Over US$ 9 Million in Series A Funding Round

Tradeteq, a technology provider for bank asset distribution, has announced the successful completion of its Series A funding round, securing US$ 9.4 million from a consortium of US technology investors. This brings the total raised since the company launched to

Read MoreGBG Sets up Intelligence Center to Help Financial Institutions to Combat Fraud

Identity data intelligence specialist GBG has announced the launch of its GBG Intelligence Center. The center is intended organisations better validate, verify and assess profiles, behaviours and intent of individuals and entities across branch, web, mobile and app, and transform

Read MoreDigital Securities Platform iSTOX Bags US$50 Million From Japanese State-Backed Investors

Digital securities platform iSTOX announced that it had closed its Series A funding round with a total of US$50 million joined by two state-backed investors in Japan. The new investors include the venture capital arm of Japan Investment Corporation (JIC)

Read MorePayments Specialist PPRO Achieves Unicorn Status With US$180 Million New Funding

PPRO, a London-based payments infrastructure provider, announced over US$ 180 million in new investment which pushed its valuation to over US$ 1 billion. Investors include Eurazeo Growth, Sprints Capital, and Wellington Management. This news comes just six months after the

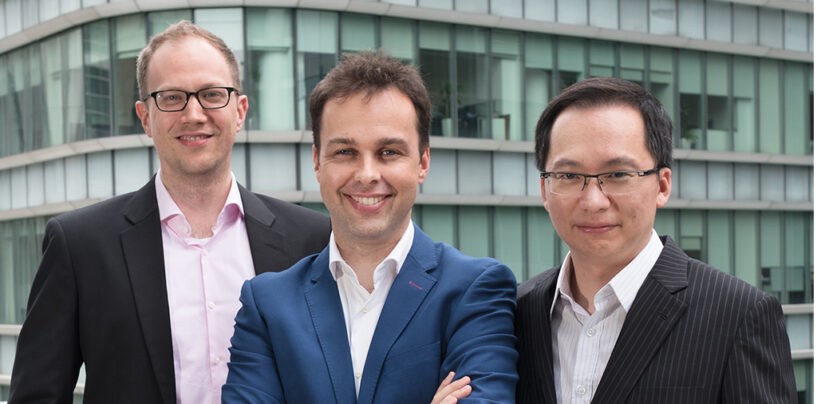

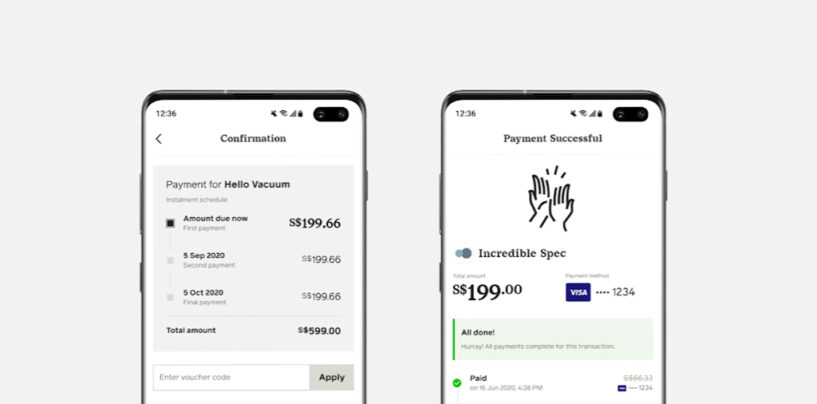

Read MoreFormer WeWork Regional MD Launches Buy Now, Pay Later Solution With 7-Figure Funding

Entrepreneur Turochas “T” Fuad who had previously founded Spacemob and Travelmob, has launched his latest venture Pace Enterprise, a Buy Now Pay Later (BNPL) solution that facilitates extended buying limits to underserved segments. Pace raised a seven-figure seed round co-led

Read More