Posts From Rebecca Oi

Redefining Scam Defense in Asia-Pacific with Feedzai

The Asia Pacific region is grappling with an alarming escalation in scams and financial fraud. These increasingly sophisticated and diverse deceptive practices undermine the financial stability of consumers and institutions and erode the trust and reputation upon which these entities

Read MoreBeyond KYC: Unmasking the Future of Fraud Prevention

Fraud prevention has become an increasingly crucial concern in Singapore’s ever-evolving financial technology and banking landscape. As the country continues establishing itself as a leading hub for financial innovation, the need for robust security measures has never been greater. In

Read MoreNavigating the AI Minefield in Financial Fraud Battles

In an era marked by rapid and unrelenting technological advancements, the financial services industry finds itself at the forefront of a complex battle against financial fraud. The increasing availability of sophisticated AI tools has significantly transformed the cybersecurity landscape, arming

Read MoreHow Temenos Champions ESG in Banking Transformation

The financial sector is experiencing a transformative era where Environmental, Social, and Governance (ESG) principles are emerging as fundamental components of business strategy. This shift reflects a broader societal movement towards sustainability and ethical governance, fundamentally altering the landscape of

Read MoreHow is Generative AI Transforming the Financial Industry?

The rise of Generative AI has been nothing short of remarkable. Many envisioned it as a powerful force for good from its inception, while others harboured concerns about its potential negative implications. Generative AI, with its ability to create content

Read MoreDigital Assets and Sustainable Finance Take Center Stage at Singapore Fintech Festival

At the Singapore Fintech Festival 2023, Ravi Menon, Managing Director of the Monetary Authority of Singapore, delivered an insightful address on fintech’s current and future direction. His speech thoughtfully reflected Singapore’s advancements in fintech since the previous year and a

Read MoreIs the Financial Industry Ready for the Radical Shift in Digital Assets?

The world of financial services is undergoing a profound transformation driven by the convergence of data and emerging technologies. During the “Digital Assets: Connecting the Dots” keynote session at the London Stock Exchange Group’s Open Day as part of the

Read MoreCan Singapore’s Insurers Adapt to the Ageing Well Challenge?

Singapore, often called the “Lion City,” is well-known for its thriving economy. Yet, beneath this successful exterior lies a significant demographic shift that brings challenges and opportunities. The country is witnessing a rapid rise in its ageing population, with a

Read MoreFintech Basics: What is Earned Wage Access?

Earned Wage Access (EWA) is a transformative service addressing a fundamental need in the fast-evolving landscape of financial solutions: timely access to earned wages. EWA, also referred to as on-demand pay or instant pay, presents an innovative way for employees

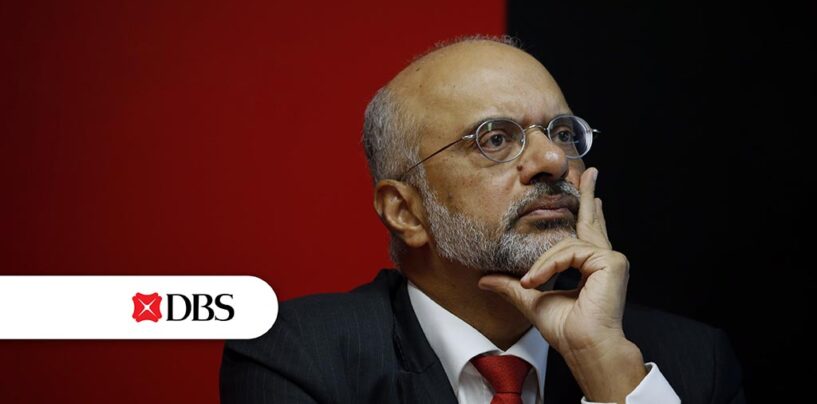

Read MoreHow Will DBS Bank Reclaim Trust After Service Interruptions?

DBS Bank, one of Singapore’s largest financial institutions, is facing an unexpected year of technical challenges in 2023. While digital banking has positioned itself as a convenient and efficient alternative to traditional banking methods, it’s not without its pitfalls. The

Read More