In the fast-evolving world of payments, where preferences shift and technologies advance, the concept of a Central Bank Digital Currency (CBDC) has emerged as a focal point.

This reflects the changing payment dynamics among households and businesses and the concurrent progress in underlying technologies. In this context, extensive research has been conducted in recent years, both in Australia and across other jurisdictions, to probe the potential role that a CBDC could play in shaping the future of the payment system.

While a significant corpus of research exists on the prospective design and technical feasibility of CBDC, a facet has yet to be substantially addressed, particularly in countries such as Australia, which already possess modern, well-functioning electronic payment systems. This dimension pertains to the broader public policy rationale for a CBDC.

To unravel the potential benefits a CBDC might bring to the Australian financial system and, consequently, to the larger populace, the Reserve Bank of Australia (RBA) and the Digital Finance Cooperative Research Centre (DFCRC) embarked on a collaborative year-long research project.

This project explored various use cases and business models that a CBDC could support if introduced in Australia.

Project design and scope

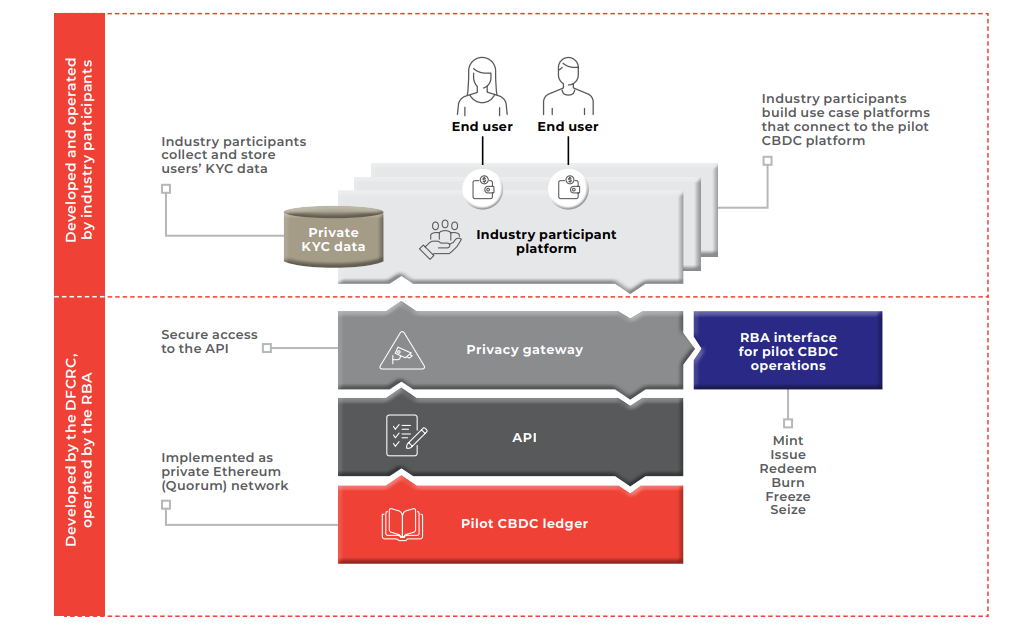

Central to the project’s objectives was the engagement of industry players to delve into plausible use cases for a CBDC. The operational framework entailed the RBA releasing a “pilot” CBDC within a controlled, delimited environment to selected industry participants.

These participants were tasked with illustrating how a CBDC could underpin inventive and value-additive payment and settlement services for households and enterprises.

Distinct from earlier initiatives where the CBDC was primarily a proof-of-concept, the pilot Australian CBDC, in this case, was treated as a genuine legal claim on the RBA.

Responding to a white paper unveiled in September 2022, industry stakeholders were invited to submit their CBDC use case proposals. The RBA and DFCRC subsequently handpicked a subset of these proposals for development and operation within a live transactional framework, leveraging the pilot CBDC.

This approach extended beyond a mere proof-of-concept, as the actual legal claim nature of the pilot CBDC infused real-world gravitas to the project. The exercise necessitated grappling with many issues associated with CBDC issuance, encompassing legal, regulatory, technical, and operational considerations.

The project received strong industry interest, with about 110 use cases submitted for the transactional pilot. After a careful evaluation process based on multiple criteria, 16 use cases were selected for the pilot, which took place from March to July 2023.

Additionally, approximately 60 submissions were received from entities keen on sharing their perspectives on CBDC use cases without actively participating in the transactional pilot phase. These submissions spanned the spectrum from smaller fintech players to more prominent financial institutions, often pooling resources as consortiums to advance specific use cases.

The transactional pilot was an extensive industry consultation process involving over 50 companies and government departments, soliciting their viewpoints on CBDC and its potential use cases.

Emerging use case themes

The submitted use cases reflected various CBDC applications that may provide distinct advantages to Australian households and businesses.

An apparent inclination towards tokenising financial and tangible assets on Distributed Ledger Technology platforms was evident, showcasing the industry’s eagerness to utilise CBDCs for atomic settlements in transactions, including traditionally slower markets like debt securities.

Such tokenisation efforts even touched less liquid assets, such as Australian carbon credits and supplier invoices, highlighting the potential to increase market efficiency, transparency, and the overall liquidity of asset markets.

Another interesting facet was the potential of CBDCs to fortify the resilience of the payment system, particularly by acting as an alternative payment method when conventional systems fail, which can be crucial in post-natural disaster scenarios.

Furthermore, CBDCs can cater to specific groups facing banking constraints, like travellers or victims of domestic violence.

The industry also emphasised the significant role CBDCs could play in enhancing interoperability among newer forms of private digital money, from tokenised bank deposits to asset-backed stablecoins.

This suggests a promising avenue for CBDC-backed stablecoins, sparking competition and innovation in the digital currency domain.

Finally, the programmability of CBDCs stood out as a game-changing attribute, allowing for complex programmable payment setups via smart contracts.

These capabilities enable the automation and conditional execution of multi-party transactions, reducing risks and greatly enhancing operational efficiency.

Key CBDC features

The submissions and pilot implementations revealed several essential features of a CBDC that stood out in the context of the investigated use cases.

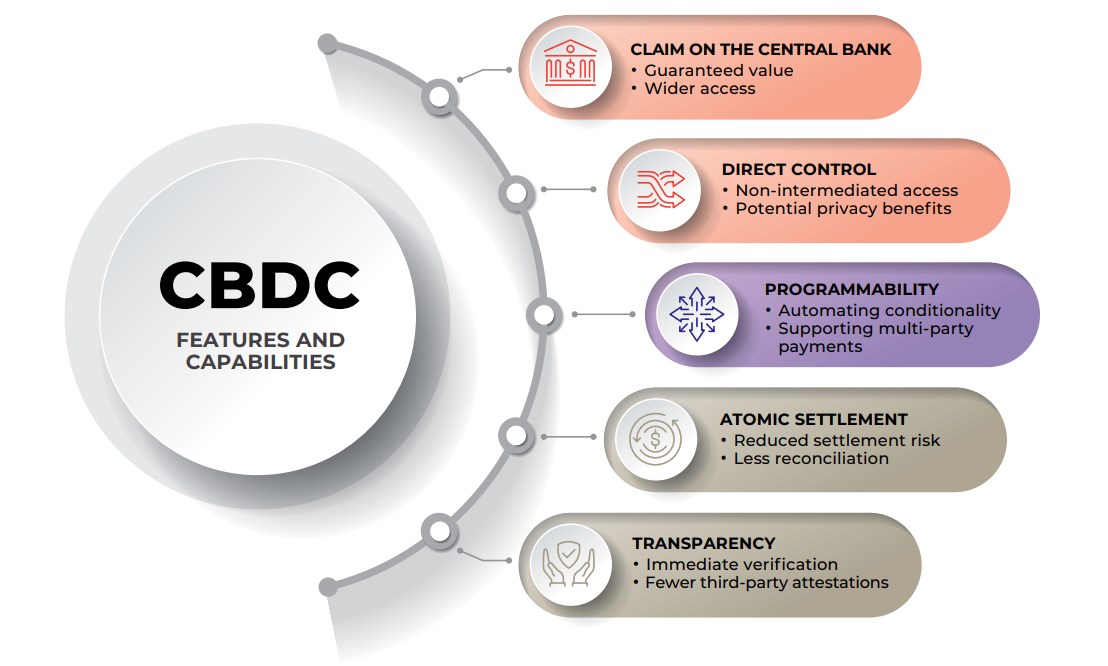

First and foremost, CBDCs are direct claims on the central bank, which inherently eliminates counterparty risks in transactions. This factor gains significance in high-value settlements, as traditionally, relying on bank money can lead to increased risk.

The CBDC model gave holders direct control over their assets, removing the need for intermediaries and offering enhanced flexibility, which is especially crucial in significant financial transactions.

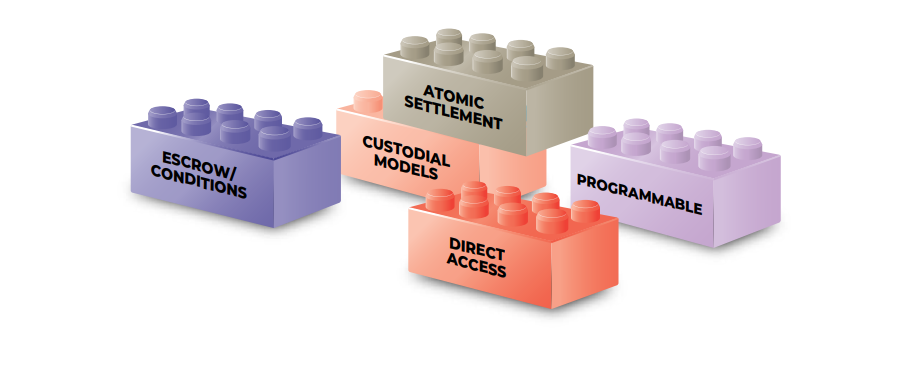

Another feature to highlight is the ability to integrate smart contracts with CBDCs, introducing the capability for conditional, automated payments. This innovation increases efficiency and reduces risks associated with complex financial exchanges.

The tokenised characteristic of CBDCs ensures atomic settlement in transactions, which optimises the process, diminishes risks and boosts overall productivity. Lastly, the project highlighted the delicate interplay between transparency and privacy in CBDC transactions.

While transparency was lauded for augmenting trust and responsibility in specific scenarios, privacy was emphasised as crucial for various financial activities, demanding a well-thought-out strategy to harmonise these potentially opposing needs.

Legal and regulatory dimensions

The introduction of an Australian CBDC bears significant legal and regulatory implications. The pilot project illuminated these complexities as the real-value nature of the pilot CBDC mandated adherence to extant legal and regulatory norms.

The exercises embarked upon through the pilot brought forth a series of regulatory grey areas, especially in asset tokenisation. This underscored the need for novel regulatory paradigms attuned to the innovative potential of CBDCs.

Technical considerations

The project illuminated several technical aspects even though its primary focus was not on the technical domain. One of the main revelations was the decision to emphasise simplicity in smart contract deployment to sidestep potential regulatory and operational pitfalls.

This resulted in avoiding direct deployment on the CBDC platform. Furthermore, the project highlighted the diverse models utilised to achieve atomic settlement of tokenised assets with the pilot CBDC, emphasising the significance of understanding the ramifications of various deployment strategies.

Due to specific technical design choices, the delicate balance between transaction privacy and data sharing was an emerging challenge.

Lastly, adopting Ethereum as the foundational platform suggested its aptness for spearheading innovations, but it was not endorsed as the standard model for a full-scale CBDC system.

Key themes from use case submissions

The submissions for the CBDC pilot project revealed a broad spectrum of potential use cases, underscoring the myriad capabilities that a CBDC could bring to the fore.

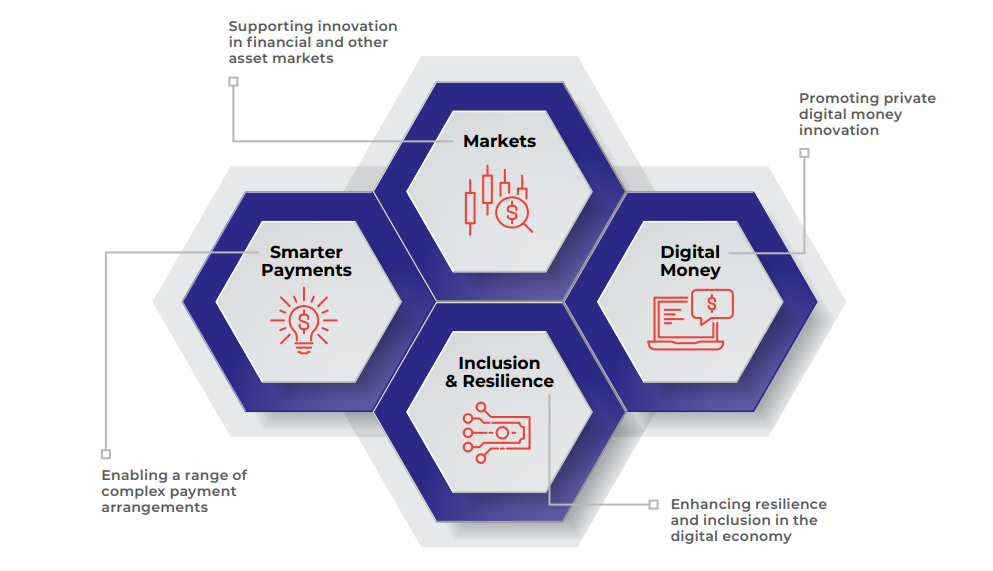

Among these, the idea of “smarter” payments resonated deeply. Participants envisioned a programmable CBDC that would handle intricate payment schemes that contemporary systems find challenging.

This programmability means transactions could be initiated through smart contracts when certain conditions are met, leading to automation, risk reduction, and negating manual reconciliations.

Additionally, CBDC’s flexibility could revolutionise governmental programs and introduce innovative business models, as demonstrated by the proposals for its use in various benefit schemes, tax collections, and supply chain finance.

The submissions noted a pronounced interest in the tokenisation of assets, from financial products to environmental credits. A CBDC would significantly streamline the issuance, management, and trade of such tokenised assets on distributed ledger technology platforms.

In markets where traditional infrastructures are not firmly established, assets like carbon credits have the potential for significant transformation. The simultaneous exchange of the asset token and its tokenised value – or atomic settlement – using CBDCs also stood out, promising increased efficiency, risk mitigation, and market liquidity.

The role of CBDC in boosting innovation in private digital money, such as tokenised bank deposits and regulated stablecoins, was another dominant theme.

A proposed model highlighted how central banks, commercial banks, and financial institutions could exchange tokenised liabilities, enhancing interoperability and using CBDC as a primary settlement asset.

There was also mention of CBDC’s potential as a foundational asset for privately issued stablecoins, providing a safety net linked to central bank money, which would likely be alluring to end-users.

Lastly, CBDC’s potential to enhance resilience and inclusion in the digital world was recognised. It could serve as a valuable alternative for electronic payments, especially in scenarios where traditional banking might be inaccessible.

Its capability to support offline transactions, independent of utilities like electricity or telecom services, and enable privacy-oriented payments makes it an ideal solution for a diverse demographic, from travellers to victims of domestic abuse, emphasising its potential for financial inclusivity.

Lessons from the Australian CBDC pilot project

The Australian CBDC pilot project marks a significant step in understanding the potential role of CBDCs in reshaping the financial landscape.

The diverse use case submissions shed light on the multifaceted capabilities that a CBDC could offer, from enabling sophisticated payment arrangements to promoting innovation in asset markets, supporting private digital money, and enhancing financial resilience and inclusion.

As the digital finance realm continues to evolve, the insights gleaned from this project will be crucial in shaping future discussions and decisions related to CBDC issuance guiding regulators, policymakers, and industry stakeholders towards a more digitally innovative financial ecosystem.