Lending

Funding Societies Raises US$18 Million in Debt Financing

Funding Societies, Southeast Asian SME digital financing platform, announced that it has raised US$18 million in debt financing led by a trio syndicate of financial institutions including Helicap Investments, the newly launched Social Impact Debt Fund, and an unnamed Japanese

Read MoreMAS Says BNPL Does Not Pose Significant Risk at This Stage

Buy Now, Pay Later (BNPL) schemes do not pose a “significant risk” to household indebtedness as they are not yet widely used relative to other payment methods, according to a Parliamentary reply yesterday. The popularity of the BNPL scheme has

Read MoreFinAccel Raises Additional US$125 Million PIPE Investment Ahead of IPO Plans

FinAccel, the parent company of Buy Now, Pay Later (BNPL) platform Kredivo, announced that three of its existing investors has joined its PIPE deal which is in excess of US$125 million. The investors in the PIPE deal are MDI Ventures,

Read MoreSiam Commercial Bank’s Spin-off SCB Abacus Closes US$12 Million Series A

SCB Abacus, an alternative digital lending platform in Thailand, has raised US$12 million in an oversubscribed Series A funding round. The firm, a fintech spin-off from the Siam Commercial Bank, has a flagship digital lending application “MoneyThunder” offering micro loans

Read MoreHSBC, Temasek Launches US$150 Million Debt Financing Platform for Sustainable Projects

HSBC and Temasek announced a partnership to establish a US$150 million debt financing platform dedicated to sustainable infrastructure projects with an initial focus on Southeast Asia, as part of efforts to reduce climate change. In a joint statement, both entities

Read MoreIndonesian BNPL Kredivo Begins SE Asian Expansion Plans with Vietnamese Launch

Kredivo, an Indonesian Buy Now, Pay Later (BNPL) platform, announced its expansion into Vietnam through a joint venture with Phoenix Holding, a family investment company based in the country. This move comes on the heels of the announcement by FinAccel,

Read MoreIndonesian P2P Lender Ringan Deploys OneConnect’s Digital Lending Solutions

Peer-to-peer lending app Ringan, deploys a suite of digital lending solutions built by OneConnect Financial Technology, an associate of Ping An Group, to provide Indonesians a seamless and secure loan application experience. The digital solutions automate and simplify Ringan’s loan

Read MoreDriving Financial Inclusion With BNPL and Smarter Decisioning

While news headlines broadcasting Buy Now, Pay Later’s (BNPL) incredible adoption trajectory are a daily occurrence, innovative lenders know that BNPL offers more than a growth story. It’s an opportunity to make headlines about how their business is empowering consumers

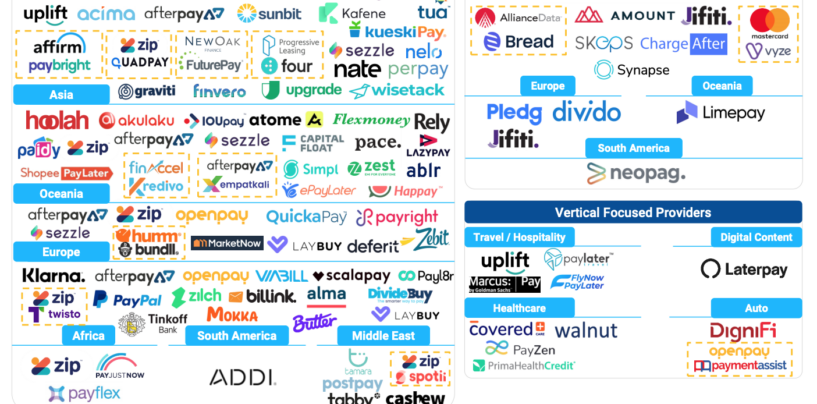

Read MoreUnpacking the Rise Behind Buy Now Pay Later (BNPL) Schemes

Strong growth in e-commerce has been a catalyst to the boom of buy now, pay later (BNPL) and other alternative payment methods. By 2024, it’s estimated that BNPL arrangements will account for 4.2% of global e-commerce payment methods, according a

Read MoreIndonesian BNPL Platform Kredivo Poised for an IPO Through US$2.5 Billion SPAC Deal

FinAccel, the parent company of Buy Now, Pay Later (BNPL) platform Kredivo, plans to go public through a special purpose acquisition company VPC Impact Acquisition Holdings II (VPCB) sponsored by Victory Park Capital (VPC), valuing it at US$2.5 billion. VPC,

Read More