Lending

Study Shows BNPL in the Spotlight Amidst Other Consumer Payment Trends

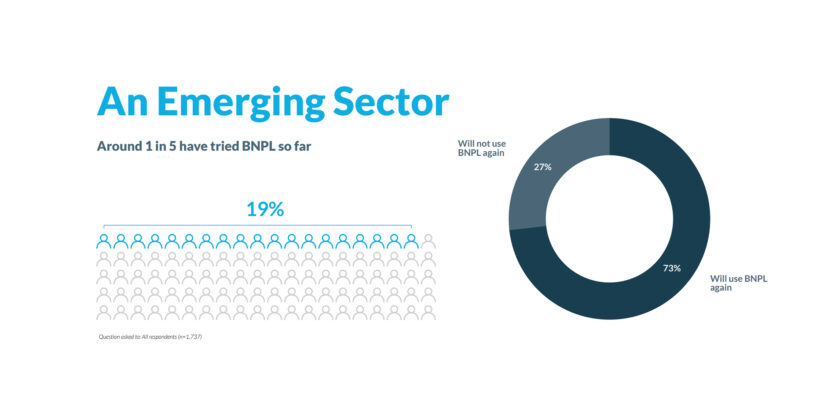

Singapore-based consumer insights firm Milieu Insight’s new report “The Big Picture – Payments” exploring consumer payment trends puts a spotlight on the Buy Now, Pay Later (BNPL) sector in Singapore. The study explored BNPL usage in-depth and found that approximately

Read MoreAre Buy Now Pay Later Schemes Evil?

Buy-now-pay-later (BNPL) arrangements have surged in popularity over the past couple of years, but the global pandemic has further pushed that growth to new levels. Although BNPL providers are offering consumers with potentially better choices and deals, as well as

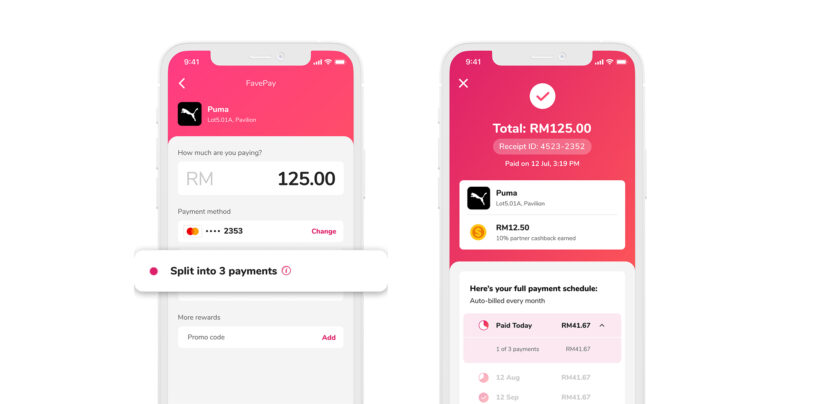

Read MoreFave Pilots BNPL Services for Over 6 Million Users in Singapore and Malaysia

Payments platform Fave has launched its Buy Now, Pay Later (BNPL) service in Singapore and Malaysia to provide over 6 million users with instant access to interest-free credit to be used at over 40,000 stores as a pilot. The service

Read MoreNew Study from NUS Calls for Risk-Approriate Regulation for BNPL Schemes

Buy now pay later (BNPL) schemes have witnessed strong growth in Singapore but for the sector to develop in a way that’s beneficial to consumers, rules and regulatory oversight are needed, a new paper says. Authored by Allen Sng, a

Read MoreA Look at the Global BNPL Industry

Though “buy now, pay later” (BNPL) still accounts for just a small portion of the industry, the pandemic-fueled e-commerce boom could see this alternative model grow 10-15x its current volume and reach as much as US$1 trillion in gross merchandise

Read MoreValidus Secures S$50 Million From UK’s Asset Manager Fasanara to Boost SME Lending

Validus, a peer-to-peer (P2P) lending platform for SMEs, has received over S$50 million from UK’s alternative asset manager Fasanara Capital to boost SME lending for underserved and unbanked SMEs in Singapore. In addition to investing over S$20 million on Validus’

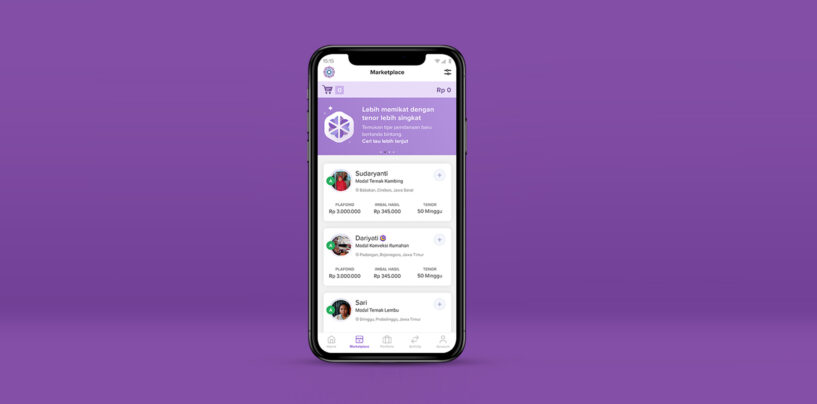

Read MoreIndonesian P2P Lender Amartha Secures US$ 28 Million From Women’s World Banking

Amartha, a P2P lending platform in Indonesia, received new funding worth US$ 28 million (IDR 405 billion) led by Women’s World Banking Capital Partners II (WWB) and MDI Ventures. WWB Capital Partners II is the second gender lens investment fund

Read MoreAtome Ties up with FOMO Pay to Expand BNPL Acceptance Across Asia

FOMO Pay, a QR payments provider, announced a partnership with Atome that will expand seamless Buy Now, Pay Later (BNPL) acceptance across thousands of online and offline retail businesses in Singapore and across Asia. Atome’s platform has over 3,000 online

Read MoreHoolah Selects Perx for Personalised, Gamification-Based BNPL Platform

Perx Technologies, a SaaS lifestyle marketing platform provider, announced its partnership with Buy Now, Pay Later (BNPL) platform hoolah to offer engaging in-app customer experiences. Launched in February 2018, Singapore-headquartered hoolah offers merchants a BNPL platform with a seamless, gamification-based

Read MoreAtome Financial Acquires Indonesian Financing Firm

Atome Financial, the parent company of Buy Now, Pay Later (BNPL) firm Atome, has completed its acquisition of local financing company PT Mega Finadana Finance in Indonesia. Details of the acquisition was not disclosed. The acquisition will allow Atome Financial

Read More