Lending

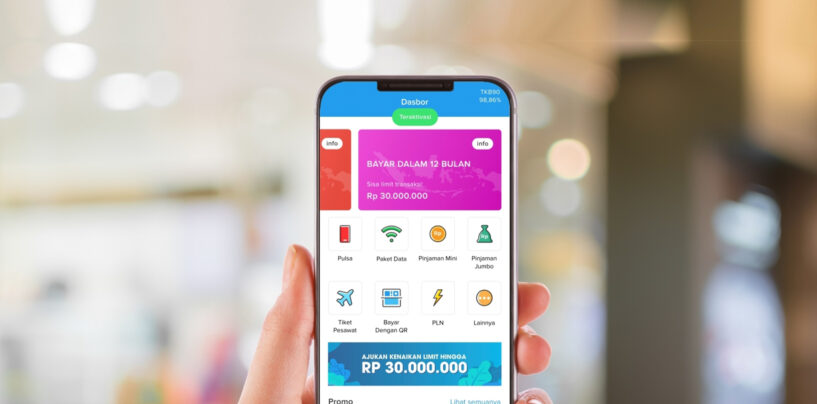

Indonesian P2P Lender Ringan Deploys OneConnect’s Digital Lending Solutions

Peer-to-peer lending app Ringan, deploys a suite of digital lending solutions built by OneConnect Financial Technology, an associate of Ping An Group, to provide Indonesians a seamless and secure loan application experience. The digital solutions automate and simplify Ringan’s loan

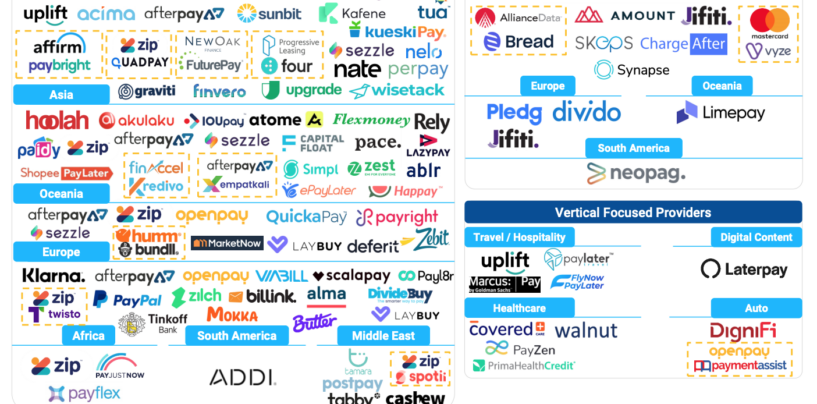

Read MoreDriving Financial Inclusion With BNPL and Smarter Decisioning

While news headlines broadcasting Buy Now, Pay Later’s (BNPL) incredible adoption trajectory are a daily occurrence, innovative lenders know that BNPL offers more than a growth story. It’s an opportunity to make headlines about how their business is empowering consumers

Read MoreUnpacking the Rise Behind Buy Now Pay Later (BNPL) Schemes

Strong growth in e-commerce has been a catalyst to the boom of buy now, pay later (BNPL) and other alternative payment methods. By 2024, it’s estimated that BNPL arrangements will account for 4.2% of global e-commerce payment methods, according a

Read MoreIndonesian BNPL Platform Kredivo Poised for an IPO Through US$2.5 Billion SPAC Deal

FinAccel, the parent company of Buy Now, Pay Later (BNPL) platform Kredivo, plans to go public through a special purpose acquisition company VPC Impact Acquisition Holdings II (VPCB) sponsored by Victory Park Capital (VPC), valuing it at US$2.5 billion. VPC,

Read MoreDBS and Temasek Launches US$500 Million Debt Financing Platform for Tech Startups

DBS and Temasek announced that they have entered into an agreement to jointly launch a US$500 million growth stage debt financing platform called EvolutionX Debt Capital. Headquartered in Singapore, EvolutionX will provide non-dilutive financing to growth stage technology-enabled companies across

Read MoreMambu Rolls Out Fully Digital Solution for SME Lenders to Fast Track Loan Approvals

Mambu, a SaaS cloud banking platform, has unveiled a fully digital solution for small and medium-sized enterprise (SME) lenders that cuts costs and speeds time to market. The platform provides banks and fintechs with robust, scalable loan management technology as

Read MoreValidus Exceeds S$1 Billion in SME Lending, Plans to Double That in 2022

Validus, a peer-to-peer (P2P) lending platform for small and medium-sized enterprises (SMEs), announced that it had exceeded S$1 billion in disbursals across the region. The firm said that this development comes as it enters its sixth year of operations. In

Read MoreGrab Deepens Partnership With Payments Firm Adyen to Expand Its BNPL Offering

Grab has deepened its partnership with payments platform Adyen by enabling more merchants, starting in Singapore and Malaysia, to offer its PayLater service to consumers. Available through the GrabPay wallet, merchants will now be able to offer PayLater payment methods

Read MoreHow Will PayPal and Citi Fare in Australia’s Crowded BNPL Space?

Competition is heating up in Australia’s buy now, pay later (BNPL) market as US digital payments giant PayPal and incumbent bank Citi are entering the \vercrowded space. Just last week, PayPal launched its BNPL service to retailers in Australia, a

Read MoreTop 10 Buy Now Pay Later (BNPL) Players in India

The global pandemic brought about a fundamental shift in the way consumers interact with businesses. As lockdowns and movement restrictions were implemented, digital adoption soared at an accelerated speed. People started shopping online for almost everything from food and groceries

Read More