Strong growth in e-commerce has been a catalyst to the boom of buy now, pay later (BNPL) and other alternative payment methods. By 2024, it’s estimated that BNPL arrangements will account for 4.2% of global e-commerce payment methods, according a new report by fintech-focused investment banking firm Financial Technology Partners (FT Partners).

BNPL arrangements will jump two places, becoming the 5th most used e-commerce payment method by 2024, behind digital and mobile wallets, credit cards, debit cards and bank transfers. The move will come on the back of declining usage of cash on delivery and charge and deferred debit card for e-commerce purchases, the firm said in a new report.

Global e-commerce payment methods, Graphic by FT Partners, July 2021

BNPL arrangements had witnessed a surge in popularity in the past years but COVID-19 has further propelled usage to new levels.

With the global pandemic moving everyday lives further online, the growth of e-commerce has accelerated, putting a renewed focus on the BNPL providers who managed to successfully integrate themselves into the online checkout experience.

These BNPL players are helping merchants increase conversion and average order value (AOV), all the while increasing consumers’ purchasing power and financial flexibility through installment payment plans typically offered without any interest.

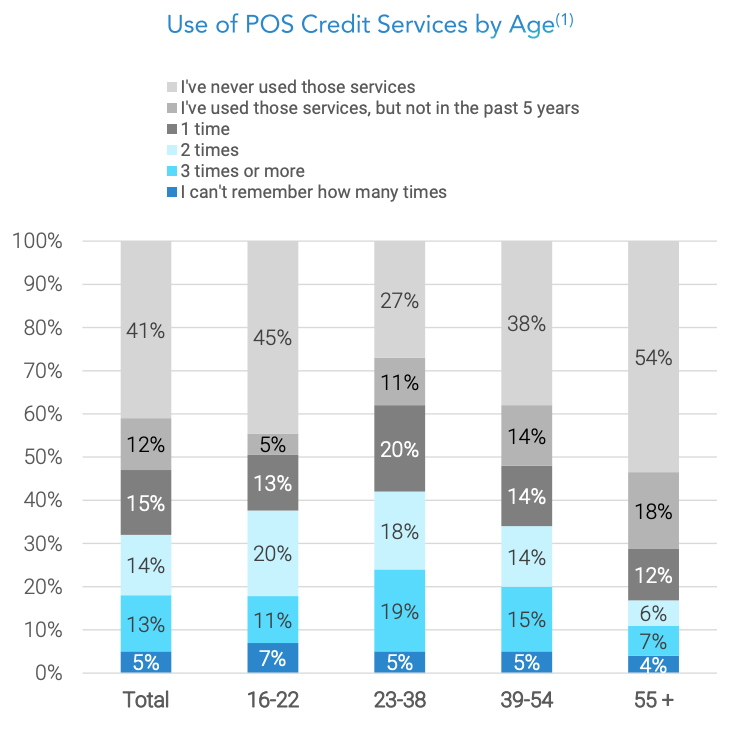

BNPL options have been particularly popular amongst younger, more technologically and financially-savvy generations. A 2019 Kearney survey found that over 60% of UK millennials (aged 23 to 38) have used point-of-sale (POS) credit services/installment payment options, and 42% of them have used them more than once.

Use of POS credit services by age, Graphic by FT Partners, July 2021

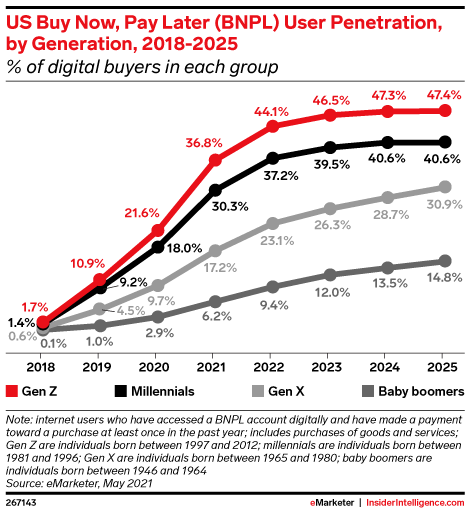

Though today, younger consumers are still more willing to try alternative payment options than older generations, the proportion of millennials and Gen Zers 14 and over has declined over the past three years, dropping from 80% of BNPL users in 2018 to 73.2% in 2021. This implies that other segments of the population are warming up to these payment methods, findings from a eMarketer research show.

US BNPL user penetration by generation, 2018-2025, Source: eMarketer, May 2021

Increasing competition

Australian BNPL fintech firm Zip Co estimates that the addressable global market for BNPL providers stands at US$22 trillion. This red-hot market is attracting a growing number of players looking to capture a piece of a pie.

The FT Partners analysis shows that BNPL efforts picked up considerably in 2020 and continued this year onwards. The market now comprises a wide range of providers ranging from incumbent banks, payment firms and pure players.

Some like Mastercard, Worldpay, Stripe, Shopify and Citi have formed partnerships to either get exposure to the BNPL market or launch BNPL arrangements. Most recently, Bloomberg reported that Apple has been working on a new service that would enable consumers to pay for any Apple Pay purchase in installments. The upcoming service, known internally as Apple Pay Later, will use Goldman Sachs as the lender for the loans needed for the installment offerings, sources told the media outlet.

Others including incumbents ICICI Bank and the National Australia Bank (NAB), Chinese tech giant Tencent, and leading payment network Visa, have launched BNPL offerings over the past year to capitalize on the trend, the analysis shows.

As the global BNPL market grows and matures, signs of consolidations are showing as larger players continue to build in new geographies. Australia’s Zip Co has been on an acquisition spree since at least 2019, scooping up startups including PartPay, Spotcap, Quadpay, Spotii and Twisto. Similarly, Afterpay has acquired the likes of Clearpay, Pagantis and Empatkali.

Global Buy Now Pay Later Landscape, Source: FT Partners, July 2021

Featured image: Photo by Cup of Couple from Pexels