Banking in Vietnam had stood in place for decades before it’s moved to a new stage of Internet banking. For the first time ever, Vietnam has its first Digital Bank.

First Mobile-Only Bank in Vietnam — Timo

Timo stands for TIME & MONEY, which serves for the right purpose of the product: saving time on many transactions and payments, instead of being tired queuing at the banks or logging with several different internet banking systems.

On August 4th, 2015, the National Bank of Vietnam had confirmed that Vietnam Prosperity (VP Bank) bank had registered to issue a new debit card named TIMO — a new generation of Banking in Vietnam, aims to support locals and expatriates in managing their money in their way wherever and whenever.

The first Digital Banking for Vietnam— TIMO has launched recently which gives users a better solution to manage their money, bills and even top up mobile cards. However, alike many other Internet Banking services on PC and Smartphone, what makes TIMO a phenomenon? To study about TIMO in detail, let’s start step by step.

Testing out the Timo website and app

First of all, take a glimpse at their website here:

Click: “Join TIMO now”. Hence follow the guidance till you receive an email from TIMO team with an invite link to join them. After the completion of the online registration, TCR (TIMO Care Representative) will give you a call. Then you need to visit their TIMO Hangout to open an account and active your debit card.

“Timo confirmed versus Fintechnews to have already 56,000 users on the waiting list.”

Secondly, once you arrive at TIMO hangout, it’s likely a place to hang out more than a bank office, where can even be an ideal place to meet friends or to work.

A free drink will be served when you first come to open account and later you get 50% discount on the menu as Timo member. Whilst enjoying your drink, TCR will explain, demonstrate and answer all your questions.

The third step, download and try out the Timo app. In general it seems much easier to use than other Internet banking or wallet apps.

Timo supplies three main accounts with their own missions, and can be use by one easy finger-swiping on your device.

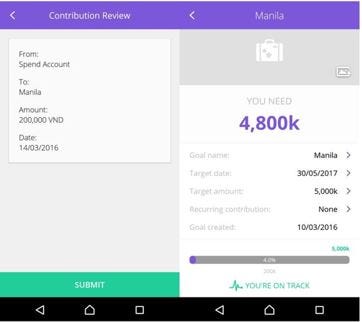

Goal save account: to manage your goals

Goal save account offers its users the interest rate of 1%/year and will be paid monthly.

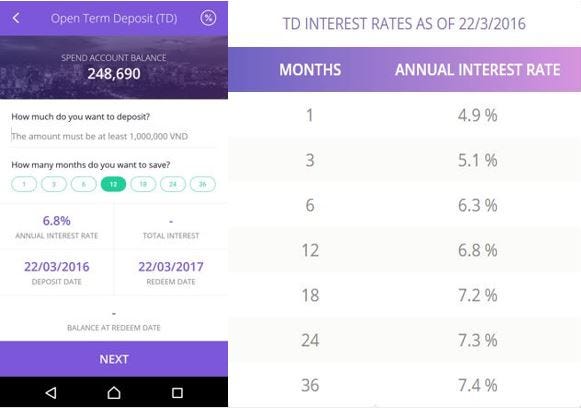

Term deposit account offers a competitive interest rate in VND

Term deposit account is the best option for people who aren’t good at saving their money. Timo offers a competitive interest rate up to 6,8% for a 12-month deposit. Once you choose to open a term deposit account, Timo app automatically asks the holder to divide the amount up to 4 parts. This makes sure that in case you need money you still can benefit on the other parts from the high interest rate.

Other benefits that Timo offers

- More than 17,000 ATMs to serve Timo debit cards free of charge.

- Free transferring out from Timo account to any other Vietnam bank accounts.

- Free cash in and withdraw from any VP banks in Ho Chi Minh.

- Free of charge withdrawing up to 20 million VND at Timo Hangout.

And a lot more to be discovered with Timo.

Who can open a Timo account?

Everyone who has an ID/passport, an email address, a Vietnamese phone number and a smartphone that can connect to internet. This is also a great opportunity for expatriates who doesn’t want to have any obstacle while opening a bank account in Vietnam.

Nevertheless, Timo still needs to improve some parts.

- It isn’t 100% Digital Banking, as people need to visit the Timo Hangout to open an account. This is due to KYC Banking regulation in Vietnam.

- For any adjustment or changing based on your account, you need to show up at their office as well.

- Clients with an active VP account need to discuss further with TCR due to their terms and conditions.

- Timo let you pay only a selection of invoice. For example in Cable (TV), they are only connected with VTV, not yet SCTV.

Conclusion

For people who faced quite enough issues with banking, it’s worth a try to open a Timo account. Prior to its advantages and the great support from its staff Timo app is easy to use and easy to manage. So it’s time to save your time and money to enjoy a better UX and better experience. 56,000 potential customers are already on the Timo waiting list, let’s see if Timo is able to onboard them all.

You can open an account here.