Fintech Indonesia Report 2018 – The State of Play for Fintech Indonesia

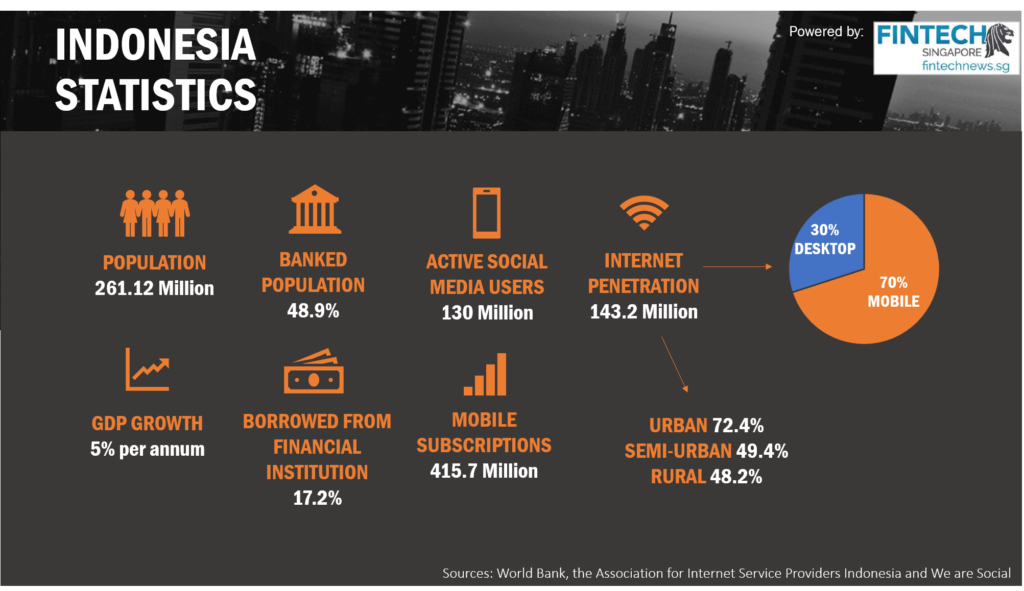

by Fintech News Singapore June 26, 2018Indonesia, the largest economy in South East Asia, with an estimated population of over 260 million people, the majority of which are under the age of 35 and growing mobile phone and Internet penetration rates, Indonesia is a treasure trove of untapped fintech opportunities.

Fintech companies looking to expand in South East Asia would be remiss if they were to overlook the Fintech Indonesia scene as a potential market. With that in mind we hope to help you navigate the Indonesian landscape with our latest edition of the Fintech Indonesia report 2018

Fintech Indonesia Report -Overview of the Indonesian Economy

With interventions by the regulators and increased boom of fintech startups addressing financial inclusion issues, the World Bank has lauded Indonesia as the country in East Asia with the most improvement in bringing its citizens into the formal financial system in the past three years, particularly women.

Fintech Indonesia Report – Steady Growth For Fintech in Indonesia

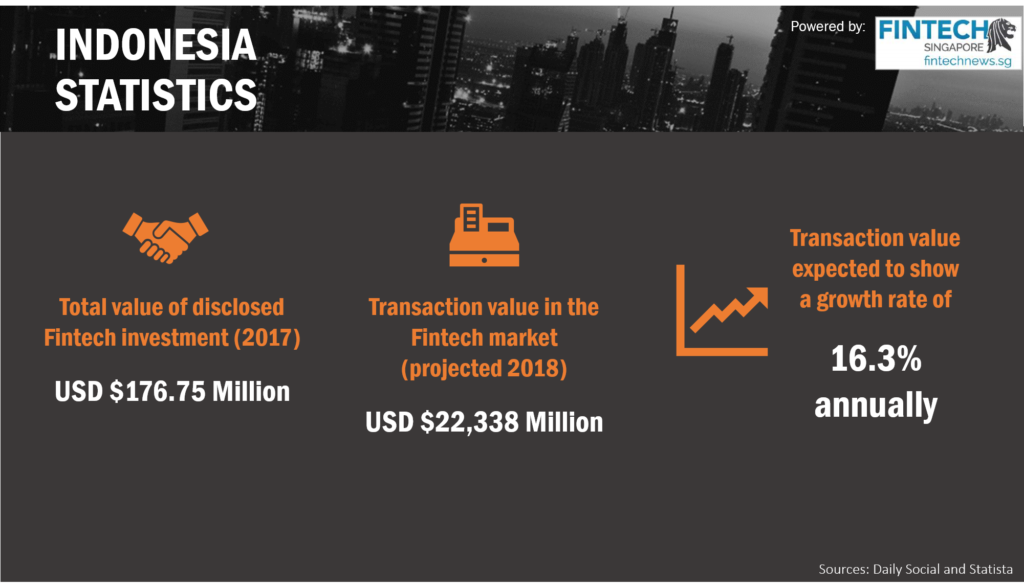

The market has also shown a considerable amount growth with the annual growth rate of 16.3% with the total investment into fintech companies standing at USD 176.75 Million in 2017 alone.

Fintech Indonesia Report -Regulatory Environment for Fintech in Indonesia

The fintech indonesia scene is primarily regulated by two main entities; namely Bank Indonesia and Otoritas Jasa Keuangan. While Bank Indonesia is an entity that is primary function is geared towards monetary policies it has taken matters relating to payments under its regulatory scope, arguing that it has a big direct impact on the monetary stability.

Whereas OJK functions as a supervisory arm of the government to regulate the financial services sector, in particular within the fintech ecosystem OJK oversees P2P Lending, Crowdfunding, Digital Banking, Insurtech, Fintech in Capital Markets, Online Financing, data security and of course consumer protection.

Initiatives to prop up the fintech sector in Indonesia by the regulators include the setting up of the Fintech Office, the launch of the National Payment Gateway, establishment of the Fintech Regulatory Sandbox, regulation for P2p lending services. To date there are already 40 P2p lending service registered with OJK.

Fintech Indonesia Report – Map of Fintech Companies in Indonesia

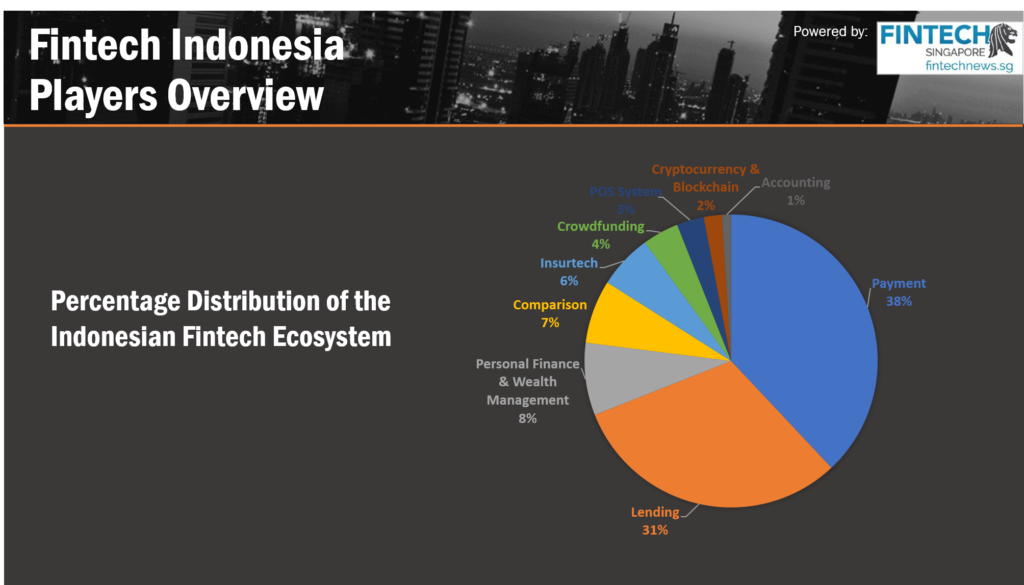

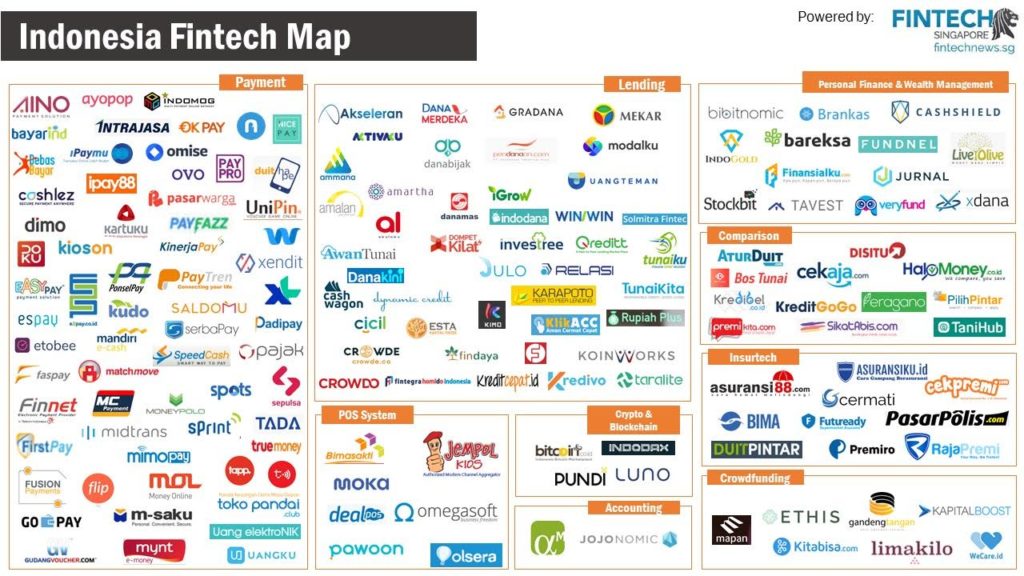

Similar to it’s other Southeast Asian counterparts like Singapore and Malaysia, payments and lending dominates a large portion of the fintech ecosystem.

The growth within the Indonesian fintech space is remarkable, in our last report that was produced in 2016, we’ve identified a total of 50 fintech companies operating in Indonesia, contrasting that with our current findings we identified a total of 167 fintech companies operating in Indonesia.

Other resources you might be interested in

Curious about other Asian Fintech Startup Maps and Report? Here’s a handy guide looking at the fintech startup maps in Asia by country.

and the fintech startups report in Asia by country.