The insurance industry is undergoing profound changes, driven by new customer expectations, emerging technologies, and sustained downward pressure on margin.

Since 2015, insurtech players have boomed globally and while initially perceived as potential threats, these are now quickly emerging as enablers that can help incumbents drive new customer experiences and deliver more value, according to a report by Startupbootcamp and PwC.

Breaking Boundaries, Startupbootcamp and PwC

The Breaking Boundaries report, released in July, analyzes data from over 1,000 startups and draws insights from interviews with entrepreneurs to understand and identify the latest trends in the insurtech industry.

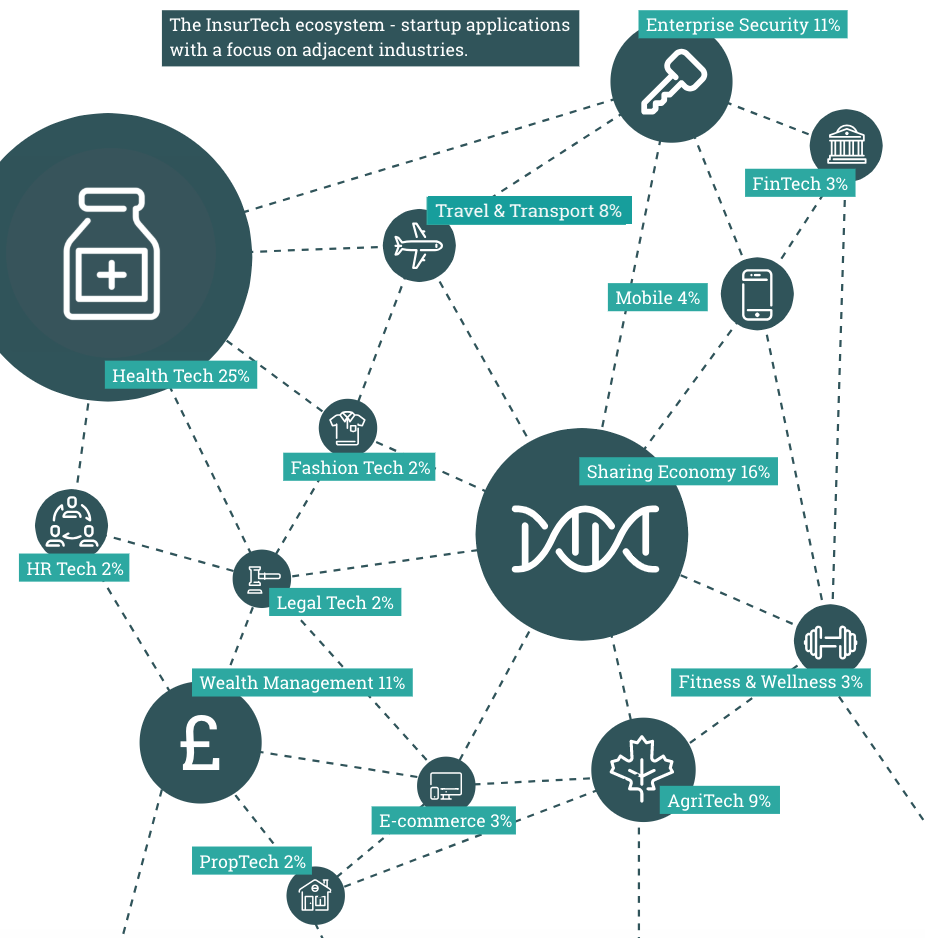

It stresses that “the idea of standalone insurtech will become as outdated as the concept of having a separate digital strategy for the company,” but instead “will become an innovation ecosystem in and around insurance, with insurers working with a range of partners from within the industry and beyond.”

In particular, collaboration with startups from adjacent industries, such as agriculture, aircraft manufacturing, health, cybersecurity, maritime and general transport, will be critical for incumbents and provide them with the opportunity to access new revenue streams.

The report cites the example of drones and satellite technology which are increasingly being used in agriculture to predict environmental factors, support farming activities, improve yield, and help farmers tackle localized issues. For insurers, these data offer a means to reduce crop claims with precision agriculture and to extend cover to the uninsured.

CyStellar, a Startupbootcamp 2018 startup, operates a platform that integrates, manages and secures data from ground sensors, aerial surveillance and satellite imagery. These data power applications such as precision agriculture, predictive maintenance, or logistics for interactive, predictive decision making.

Another example is the use of the Internet-of-Things (IoT) in property management to help commercial property managers and home owners predict and prevent events such as fire from faulty equipment, water leaks or theft. One startup that’s operating in the field is Flowenum. Flowenum helps commercial property managers minimize problems such as damp and mould, and plan their maintenance programs.

And of course, the use of the IoT and wearable devices in healthcare. These tools give individuals access to information about their wellbeing and provide opportunities such as the means to encourage change or manage medication. For insurers, opportunities include the possibility of new value-added services, better prevention and increased risk data.

Startups tapping into this opportunity include for instance vHealth Lab, which uses artificial intelligence (AI) technologies to help cardiac patients monitor their heart at home and make smart therapy decisions accordingly.

Insurtech ecosystem, Breaking Boundaries, Startupbootcamp and PwC

“Three years ago the hype was about startups disrupting traditional insurers. Now the talk, and increasingly the reality, is about startups and insurers working together to create meaningful partnerships,” Jim Bichard, UK insurance leader at PwC, commented on the changing nature of the insurance ecosystem. “All parties are working together and learning from other sectors to solve problems within insurance and react to the changing outside world.”

Given the importance of data in the insurance industry, the report points out the opportunity for startups and solutions that can provide access to new data sources or offer new ways to drive value from data with technologies such as AI, big data, and algorithms set to play a critical role.

Another key finding is that innovation has moved beyond just watch and learn, and insurers are now exploring how to scale proof of concepts into their broader businesses. These are increasingly collaborating with startups to build new products with 84% of surveyed Startupbootcamp partners stating they were interested in finding an innovative solution in cybersecurity, and 80% interested in business models linked to trends attached to the sharing economy.

Last for not least, the report highlights the growing threat coming from players outside of the tech or insurance industries:

“Although startups are increasingly looking to partner rather than disrupt, threats will come from tech giants, telecoms and other industries. Beyond these threats, startups have the potential to scale and collaborate to own the entire value chain – first moving reinsurers are already in pool position to provide the capacity.”

Featured image by Peshkova, via Shutterstock.com.