Line Corp., the Japanese mobile applications and Internet firm operating Japan’s most popular messaging app Line, has invested US$182 million into its digital payments unit Line Pay Corp, according to a filing.

The move follows a challenging year 2018, which saw Line post a JPY 5.79 billion loss despite revenues growing 24% to JPY 207.18 billion, according to the company’s latest financial report.

Line has built an ecosystem around its messaging platform, which expanded to include gaming, e-commerce, manga and job services. The Line chap app has an estimated 50 million registered users.

The firm is now betting on payments to increase engagement across the ecosystem.

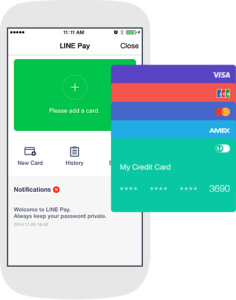

via Line Pay

Launched in 2014, Line Pay is a mobile payments service that allows users to top up their accounts at convenience stores, ATMs, or via bank transfers, and use these funds to send money or shop in physical and online stores.

Last month, the company announced an agreement with Visa to launch a co-branded card optimized for mobile payments, allowing users to make QR code and barcode payments by linking the card with their Line Pay account.

In November 2018, it unveiled a partnership with China’s WeChat Pay to enable foreign travelers to make payments at stores in Japan that accept Line Pay.

Line Pay sits inside the Line messaging app and is part of a growing number of tech companies across Asia that are looking to replicate the success of Chinese Internet giants Alibaba and Tencent in the fintech field.

Alibaba’s financial affiliate Ant Financial and Tencent’s WeChat have both established comprehensive multi-licensed integrated financial ecosystems, leveraging on their already massive captive customer bases. WeChat surpassed the one billion monthly active user milestone in March 2018 and Ant Financial has more than 600 million users across its financial services platforms.

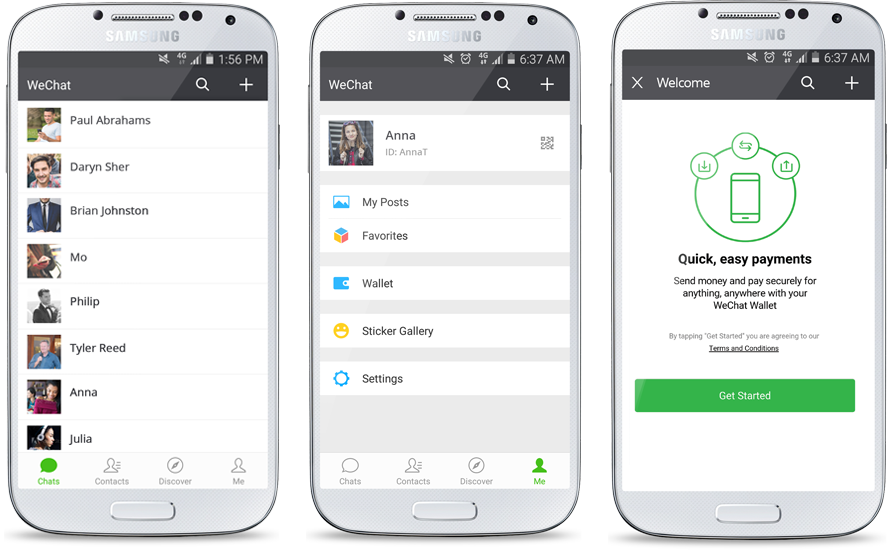

Ant Financial operates Alipay, the world’s largest mobile and online payments platform, Yu’e Bao, the world’s largest money-market fund, and Sesame Credit, a third-party credit rating system. WeChat Pay is a digital wallet service, which like Line Pay, is incorporated into the WeChat messaging app. WeChat Pay allows users to perform mobile payments and send money between contacts.

WeChat Wallet, via WeChat

Others that have gone the platform way and ramping fintech development include Indonesian ride-hailing startup and unicorn Go-Jek, which operates digital payments and e-wallet service Go-Pay, and its Singaporean rival Grab, which provides a similar service within its ecosystem called GrabPay.

Line Pay is also looking to international markets and is currently available in Thailand, Taiwan and Indonesia.

Line claims it has 165 million monthly active users and 40 million registered Line Pay users.

Besides payments, Line is also moving into banking and has been working with Mizuho Bank to launch a digital bank in Japan. The firm is also contemplating rolling out loans, insurance and other services backed by its own cryptocurrency.

Last year, Line opened its cryptocurrency exchange BitBox, which is operated by Line Tech Plus based in Singapore. The chess pieces for Line seems to be in place, all there is to do is to wait and see if it will all fall into place.

Featured Image via: LinePay Facebook and Takeshi Idezawa’s Twitter