Seedly Targets Singapore’s Millennials with New Personal Finance Mobile App

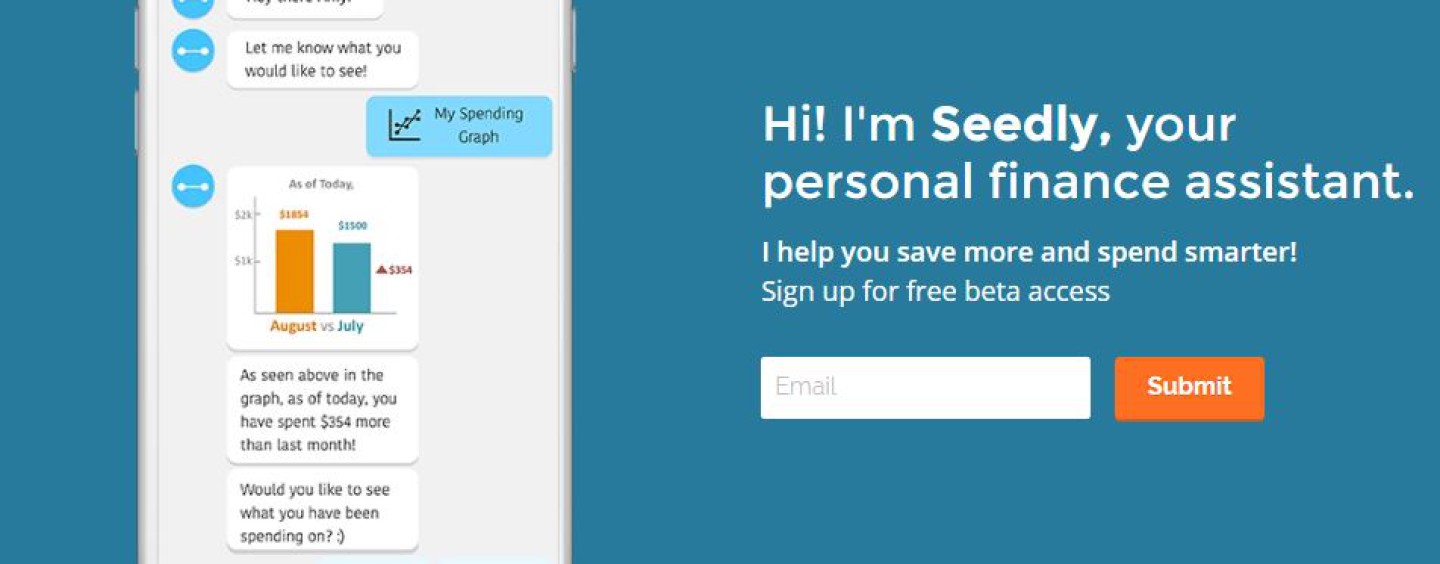

by Fintech News Singapore June 8, 2016Aimed at simplifying personal budgeting, Seedly is an app that lets you track your money in a simply and convenient manner.

Based in Singapore, Seedly provides a solution that works in three simple steps. First, you need link your bank or credit cards via a secure channel. The software then analyzes and aggregates your transactions historic. Finally, you can communicate with Seedly’s artificial intelligent chatbot to receive insights, patterns and recommendations.

Based in Singapore, Seedly provides a solution that works in three simple steps. First, you need link your bank or credit cards via a secure channel. The software then analyzes and aggregates your transactions historic. Finally, you can communicate with Seedly’s artificial intelligent chatbot to receive insights, patterns and recommendations.

The app utilizes behavioral machine learning to learn about your spending habits and let you know about discrepancies.

According to Kenneth Lou, co-founder and CEO of Seedly, the app is aimed at the Millennial generation. Speaking to TechInAsia, Lou said that the ideal user is 25, tech-savvy, fresh out of university, and on their first job. The idea is to centralize all bank accounts, credit cards and daily expenses in one place.

“The majority of personal finance solutions out there are very cumbersome [for Millennials], and there isn’t one place to pool multiple bank accounts together,” he said. “A lot of people also commented that they are too lazy to track their finances themselves.”

The startup has recently closed funding from East Ventures, which Lou said will be used for recruitment ahead of its launch later this year.

In May, Seedly was selected to enroll in the first phase of DBS Bank’s HotSpot program. Eight startups will be selected on August 01, to join the HotSpot Pre-Accelerator Programme.