Mobile Payments Move into Hawker Centres: Is Cash Officially Dead?

by Fintech News Singapore October 17, 2016Hawkers in Singapore’s Tiong Bahru and Bukit Timah centres are riding at the forefront of the revolution that will kill off cash as they begin to use a simple mobile payment system.

Modern life in Southeast Asia is already technology-driven, with mobile payments available for everything from taxis to cappuccinos via restaurants and cinema tickets, but certain areas have so far remained untouched. The hawker centres which serve as the beating heart of Singapore’s culture have long been a bastion of hard cash. That has just changed.

The new solution from Singapore start-up, Liquid Pay, is helping merchants do away with physical cards and terminals. Instead, a customer scans a simple printed code and enters the amount of their bill. At the touch of a button the trader knows they have paid, and lunch is served. No hard currency required.

“We are trying to make it easy. I think this is the last frontier, if you look at Singapore for e-payments they are quite pervasive, but if we don’t get this sector going we can’t get the e-payment penetration that we want. So it will take a real effort and I think we have a lot of support from the various stakeholders, from the government – we’re taking a plough at it,” says Jeremy Tan from Liquid Pay.

A digital revolution

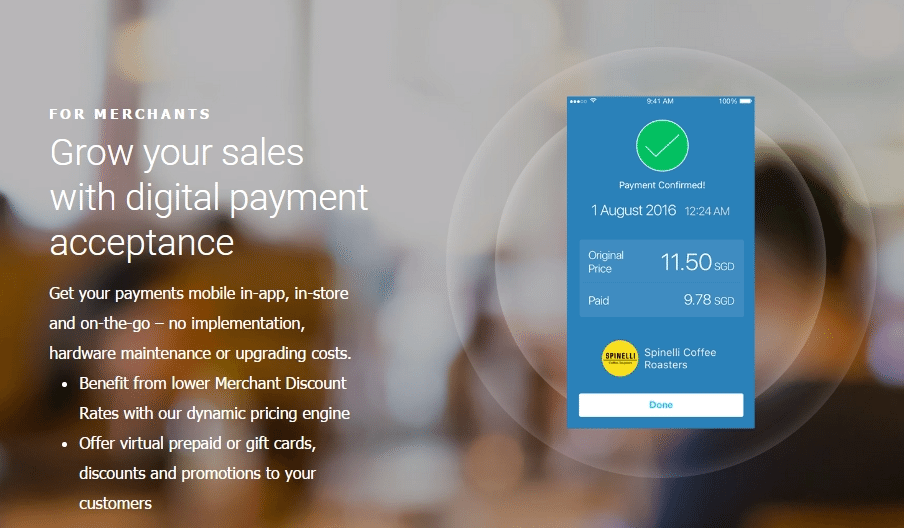

This system is revolutionary as without physical cards and substantial infrastructure set up, the barriers to adoption are low for small to medium enterprises (SMEs). Merchants will no longer have to invest or rent terminals and pay maintenance fees. Consumers can add all kinds of scheme cards. Visa, MasterCard, Amex and more. Why ever carry cash at all?

From the hawker’s point of view, the QR codes that the system uses can be changed to meet the business needs of the day, with new codes regularly printed at slight expense. And with no new technology required to accept payments, this presents a huge saving for business. Liquid Pay is also looking at ways to use internet technologies to convert existing equipment.

So as mobile payments dig deeper into our daily lives, what might the future look like? China has one of the world’s most vibrant markets and the Alipay app, for instance, is a combination of PayPal, Groupon, and Yelp. It offers payments, but also discounts and deals at merchants, plus reviews and recommendations from other customers. Alipay says it is not a payments tool, but a “lifestyle super app.”

So as mobile payments dig deeper into our daily lives, what might the future look like? China has one of the world’s most vibrant markets and the Alipay app, for instance, is a combination of PayPal, Groupon, and Yelp. It offers payments, but also discounts and deals at merchants, plus reviews and recommendations from other customers. Alipay says it is not a payments tool, but a “lifestyle super app.”

And it is the introduction of mobile payment systems to small businesses, like hawker stalls, that will see ASEAN countries triumph in the push for a flexible and modern digital economy. If a stall-holder of 50 years can be convinced to move away from cash, then space can be created to develop and bloom the country’s financial sector in ways that will bring new opportunities to millions of people.

According to business strategist, McKinsey, “the frequency of transactions makes the new payments procedure familiar and habitual. This stickiness allows successful operators to launch new payments tools and reach a tipping point of usage and adoption with a speed that was unheard of a decade ago.”

Reasons to go mobile

Looking back to Singapore, the full roll-out of mobile payments into the food and beverage sector is about more than just convenience. One of the key issues for the industry is the lack of manpower. In 2013, there was a 5.6% wage growth in the industry; however, job vacancies rose to 7,740 from 5,010 between 2014 and 2015. Most of these vacancies had been open for at least six months.

Solutions like Liquid Pay could free companies from the need to employ dedicated cashiers, and allow people to process payments directly from their tables – without the need for a member of staff at all. It is also worth noting that the transaction fees for small business owners are considerably lower. In the example of a large restaurant, apart from the manpower savings and productivity gains, costs could be reduced by $15,000 to $20,000 Singapore dollars per month.

And support for this kind of progress is coming from the highest levels. Singapore’s Minister for Trade and Industry (Industry) ) S Iswaran recently explained, “E-payments confer on our SMEs — whether digital or traditional in their business model — significant productivity gains through the digitisation of business processes and greater efficiency of e-payments.” He believes that it is the development of financial technology (or fintech) is a, “critical differentiator” for Singapore’s economy.

But perhaps news of the death of cash is, so far, greatly exaggerated. There will always be a place for hard currency. And there will always be a portion of the community that prefers to use it.

But as technology develops, and mobile money becomes the norm, that space is becoming smaller and smaller. For the technophobic, even a hawker centre is no longer a place to hide from the march of modernity.

This Article first appeared on Aseantoday, All images and pictures are from liquidpay.com