Payments Council Sets Up Taskforce to Develop Common QR Code for Singapore

by Company Announcement August 30, 2017Establishing interoperable electronic payments and developing a common QR code for Singapore were two key topics that the Payments Council discussed at its inaugural meeting on 11 August 2017.

Establishing interoperable electronic payments

The Council noted electronic payments as a strategic enabler to enhance business operations and provide greater convenience for citizens, as part of Singapore’s Smart Nation agenda.

Council members noted that usage of e-payments was growing in Singapore and there was a variety of e-payment solutions available in Singapore that provided consumers choice. However, interoperability among these solutions were lacking. Interoperable solutions should allow for Singaporeans to make payments to one another, regardless of the payment solution chosen. The Council agreed that Singapore had the right infrastructure in place to achieve this vision but needed better coordination within the ecosystem of banks and other industry players.

The Council welcomed the development of PayNow, the recently launched peer-to-peer (P2P) funds transfer service. PayNow is a good example of an infrastructure rail that makes e-payments interoperable. By linking mobile numbers/NRIC to bank accounts, it allows consumers to transfer money to anyone who has registered for the service. PayNow is currently offered by seven banks, and has seen more than 500,000 registrations and more than $10 million in transfers since its launch.

The Council welcomed the development of PayNow, the recently launched peer-to-peer (P2P) funds transfer service. PayNow is a good example of an infrastructure rail that makes e-payments interoperable. By linking mobile numbers/NRIC to bank accounts, it allows consumers to transfer money to anyone who has registered for the service. PayNow is currently offered by seven banks, and has seen more than 500,000 registrations and more than $10 million in transfers since its launch.

However, the Council noted that while the take-up numbers for PayNow were encouraging, there was scope to enhance the user interface and experience of the bank solutions riding on PayNow. A specific example of such an enhancement was to provide SMS notifications to both senders and recipients of funds.

Developing a common QR code for Singapore

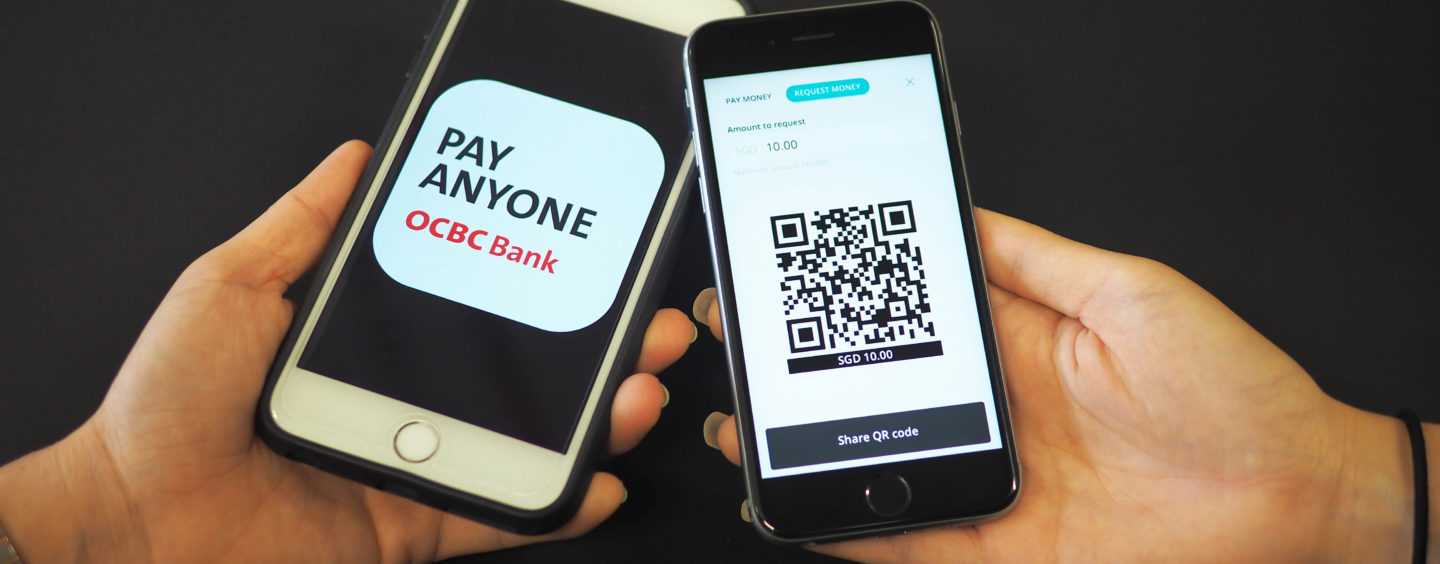

Council members advocated the use of QR code-based payments as a practical and convenient way to introduce e-payments to cash-based merchants. While debit and credit card schemes worked well for large merchants and retailers, these solutions were often not feasible for smaller merchants who preferred an infrastructure-light and cheaper solution.

The Council noted, however, that the proliferation of more proprietary QR codes at such merchants risked fragmentation of payment solutions and inefficiency among merchants and consumers. Council members agreed that a common QR code could facilitate payments among different payment schemes, e-wallets and banks. It would help make payment transactions simple, swift, seamless and safe for everyone.

The Council agreed to establish an industry taskforce to develop a common QR code for Singapore (“SGQR”). The SGQR Taskforce will be co-led by the Monetary Authority of Singapore (MAS) and the Info-communications Media Development Authority (IMDA) and involve a broad range of stakeholders such as banks, payment schemes, QR payment service providers, and relevant government agencies. (The list of stakeholders who have agreed to join the SGQR Taskforce is at Annex 1.)

The SGQR Taskforce aims to have in place by the end of 2017, standardised SGQR specifications to accept both domestic and international payment schemes. The SGQR Taskforce will also consider the governance structure and implementation strategy for QR payments.

Mr. Yeo Hiang Meng

Mr. Yeo Hiang Meng, a member of the Payments Council and President of the Federation of Merchants’ Association, Singapore (FMAS), said,

“Singaporeans are interested in the mobile payment experience. FMAS will work with the MAS, Association of Banks in Singapore and financial institutions to expedite the adoption of the common QR code for mobile payments. We hope to see intensified marketing efforts to encourage businesses and consumers to adopt mobile payments at heartland shops and hawker centres.”

Ravi Menon

Mr. Ravi Menon, Chairman of the Payments Council and Managing Director of the MAS said,

“The Council is off to a good start. This is the kind of idea exchange and collaboration that we need within the ecosystem to realise our shared vision of an e-payments society. Our goal is to make the payments experience efficient for businesses and delightful for everyone, including the young and elderly.”