Despite Much Support, Cashless Indonesia Faces Many Obstacles

by Fintech News Indonesia August 6, 2018Indonesia’s cashless experiments in Jakarta has yielded interesting results. By 2017, many of the industry’s observers were already discussing the possibility of Indonesia transforming into a cashless nation, and this impression has held on until this year.

And transportation is seemingly leading the fold towards cashless.

In certain areas, using public transport can all be done with e-money. Not to mention, there is a sharp increase in cashless transactions for homegrown Go-Jek and Grab, who are either paving the way for cashless in Indonesia, or simply reaping its benefits. Since both companies offer food delivery as well, the movement towards cashless is a promising one.

In fact, Indonesia is in the midst of developing Jakarta’s MRT and LRT systems which will be fully cashless, as well as the One Card One Trip (OK OTrip) programme which would allow you to switch between busses, minivans and trains with just one card, and one flat rate.

The cashless bug has bit beyond just Jakarta. Some examples, like the Mandiri’s e-money and e-cash, uses it’s card and wallet respectively to reach out to the unbanked populations of Indonesia with the goal of serving as a replacement to normal bank accounts.

While there is a lot of support, both from the higher powers, telcos, banks and fintech startups, a question remains: is the Indonesian public taken with the concept of cashless?

Based on a little bit of digging, while things are promising, we have some concerns.

Promising Still Remains a Promise

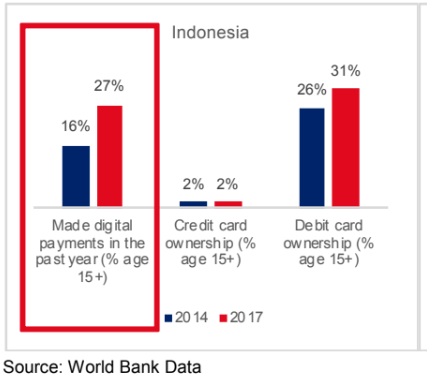

Go-Jek and Grab reported a sharp increase in cashless adoption on their rides, but World Bank reports that only 27% of 2017’s transactions comprised of digital payments. Meanwhile, debit card ownership has only reached 31% of the population in 2017.

Go-Jek and Grab reported a sharp increase in cashless adoption on their rides, but World Bank reports that only 27% of 2017’s transactions comprised of digital payments. Meanwhile, debit card ownership has only reached 31% of the population in 2017.

Credit cards do not fare any better either.

Curiously though, 61% of Indonesia’s consumers prefer cashless compared to cash, as recorded by Statistica.

Perhaps the discrepancy can be boiled down to Indonesia’s merchants who are not yet on board with the cashless trend. While cashless can be more convenient for the consumers, admittedly this does require a bit of setup from Indonesia’s vendors. Merchants, especially smaller merchants, can find it difficult to apply for EDC (electronic draft capture) which for the longest time, is the only cashless option available for Indonesia to adopt.

So while the many transportation-based initiatives have converted the public, it will remain to be seen if merchants this year are coming aboard as well. But efforts are underway. For one thing, Indonesia’s Cashlez developed a mobile POS (point of sales) system which can be installed quite quickly, and accepts most bank cards, including debit, Visa, and Mastercard.

The card reader uses an app on the merchant’s phone which can be installed. It accepts most cards from different banks, including debit, Visa, and Mastercard.

Like China, Indonesia’s Cashless Saviour May Be Online Shopping

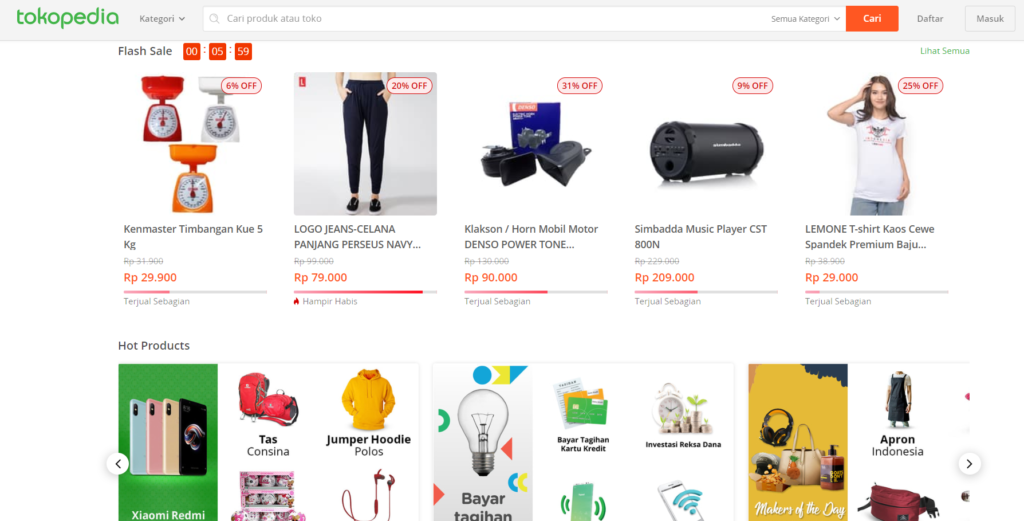

With Indonesia’s e-commerce sales expected to increase by 91% from 2018 to 2022, Indonesia’s new breath in cashless may actually boil down to online shopping.

The availability of relatively niche items, as well as the cheaper price point of e-commerce products could serve as another great educator for cashless in Malaysia. When it comes to popular websites such as Tokopedia, the merchants would automatically be on board the cashless train without them needing to port into a card reader.

After all, it was the e-commerce boom in China, the cashless dream of many nations, that partly led to the natural e-wallet growth. It’s no coincidence that Alipay is one of the top guns in the nation, and affiliated with China’s e-commerce goliath Alibaba.

Seeing the success of e-commerce in neighbouring nations like Malaysia and Singapore, it can be surmised that Indonesia would take to online shopping as well.

For Indonesia to compete on a global scale, it is crucial for the nation to adopt the ever popular cashless trend that the world’s fintech has moved towards. This was perhaps why Indonesia leads in financial inclusion, and saw a big increase in adults with bank accounts from 36% in 2014, to around half in 2018.

Between 2014 and 2017, Indonesia also saw the biggest account ownership increase of any emerging economy in the East Asia and Pacific region.

The problem though, is that many Indonesians consider proximity to banks a big hurdle.

Meanwhile, 69% of this segment owns a mobile phone—a huge opportunity for a non-bank digital money storage solution to swoop in.

This is perhaps why the Indonesian e-wallet scene has been described as saturated . The problem though, as we’ve outlined for the Malaysian markets, is that too many options may actually impede the public’s adoption, especially if it’s a new technology the ecosystem isn’t familiar with yet.

At the very least, we know that there is a majority of Indonesians who are supportive of the government’s vision towards a cashless society. Once the nation does find a system that works, that will be the expected cashless boom that has been the prediction of many observers, and finally put Indonesia on a global fintech scale.

Featured Image Credit: Yosomono on flickr