Coinbase regularly engages with students and universities across the country as part of recruiting efforts. They partnered with Qriously to ask students directly about their thoughts on crypto and blockchain — and in this report, they outline findings on the growing roster of crypto and blockchain courses amid a steady rise in student interest.

When David Yermack, the finance department chair at New York University Stern School of Business, first offered his course on blockchain and financial services in 2014, 35 students signed up, eight fewer than the school’s typical elective.

By spring 2018, the number of enrolled students climbed to 230, forcing Stern to move the class to its largest auditorium. This academic year, Yermack will teach the blockchain course both semesters to meet interest from students.

Yermack says he first developed the class because he was interested in bitcoin and how quickly interest in the cryptocurrency was growing. But other reasons soon emerged, notably demand from companies for people who understood cryptocurrency-related issues. Now, he sees his class as a way to give students the skills they’ll need for jobs in the future.

“A process is well underway that will lead to the migration of most financial data to blockchain-based organizations,” he says. “Students will benefit greatly by studying this area.”

Similar scenes are playing out at top universities around the world. Students are flocking to classes on cryptocurrency and blockchain — the “distributed ledger” technology that makes decentralized financial systems work — motivated in part by a hot job market for graduates with training in those fields.

Universities, in turn, are forming research centers and adding more crypto-related courses, in part to meet rising demand and also because they now see cryptocurrency as an area worthy of serious academic study.

42 % of the top 50 universities offer at least one class on blockchain or cryptocurrency

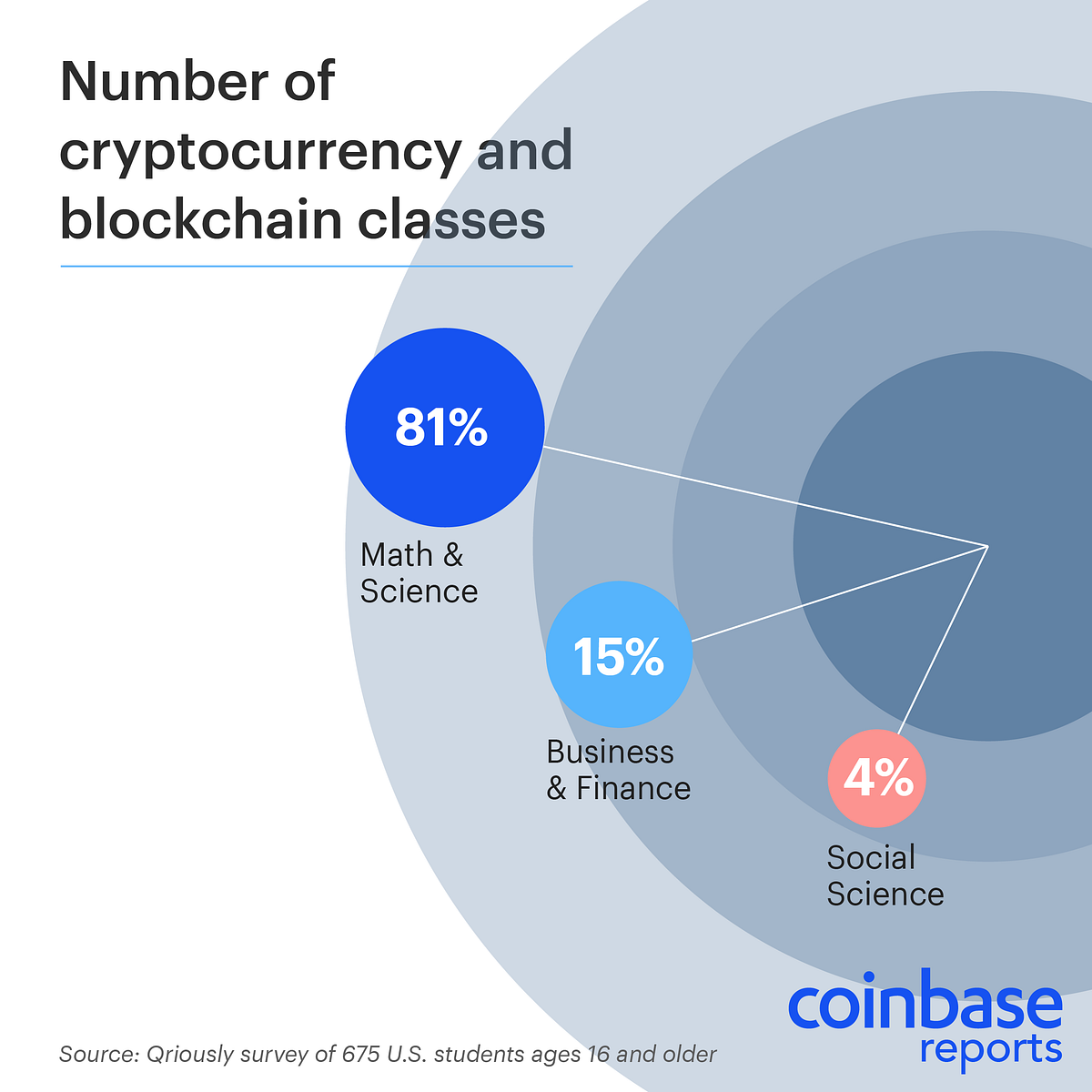

Coinbase reviewed course catalogs at the top 50 universities and found cryptocurrency classes across a variety of departments, including anthropology and finance — not only computer science.

In fact, the rise in offerings across disciplines maps to student interest: Students with a diverse set of majors say they’d like to take cryptocurrency classes, according to a Coinbase survey conducted in partnership with Qriously. Nearly half of all social science majors expressed interest in taking a crypto class.

One possible reason for such diverse interest in blockchain is its potential to impact society across many domains.

Dawn Song, a computer science professor at University of California, Berkeley says,

“Blockchain combines theory and practice and can lead to fundamental breakthroughs in many research areas. It can have really profound and broad-scale impacts on society in many different industries.”

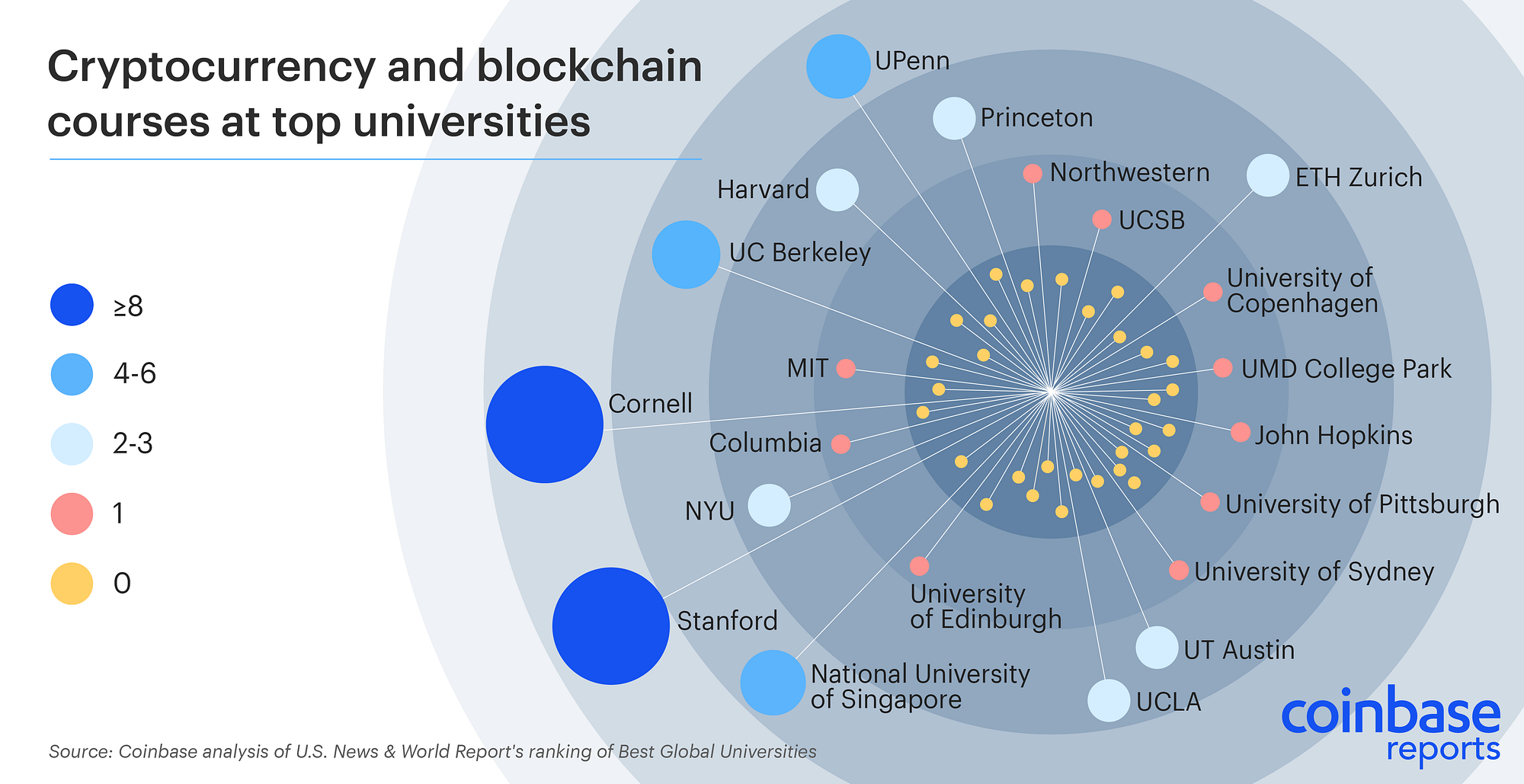

To assess the current landscape of cryptocurrency in higher education, Coinbase analyzed the courses at the world’s top 50 universities as ranked by U.S. News and World Report. Our study focused on classes available to undergraduate-level students in the fall 2018 semester or the most recent semester for which information was available online.

The analysis found that 42 percent of the top 50 universities offer at least one class on blockchain or cryptocurrency, and 22 percent offer more than one. Expanding the results to include longstanding foundational classes on cryptography, 70 percent of universities offer at least one crypto-related class.

Blockchain and cryptocurrency courses are most prominent in the U.S. Only five of the 18 international universities on the list, or 27 percent, offer at least one class on blockchain or cryptocurrency. And only two — Swiss Federal Institute of Technology Zurich and National University of Singapore — offer more than one.

Meeting Rising Demand

Johns Hopkins University offers a business course on blockchain, where students learn about its security features and “the potential benefits and weaknesses of its fundamental structure as applied to businesses and organizations,” according to the school’s course catalog.

At Princeton, students can take an information-security class focused on secure computing systems, cryptocurrencies, blockchain, and related economics, ethics, and legal issues.

Cornell offers the highest number of classes when including cryptography, cryptocurrency, or blockchain. The 28 courses include “Anthropology of Money” and “Introduction to Blockchains, Cryptocurrencies, and Smart Contracts,” which covers the cryptocurrency bitcoin and “the technological landscape it has inspired and catalyzed,” according to the course description.

More than half of the universities analyzed offer at least one class on cryptography, the study of creating and solving coded messages and a key technical foundation for blockchain and cryptocurrencies.

“The techniques used in blockchain aren’t necessarily new,” says Song, as it draws on areas such as cryptography, game theory, and distributed systems. These are areas “where research and even education has been around for a really long time.”

Stanford launched its Center for Blockchain Research this summer to bring together students and faculty from across the school’s departments to work on various aspects of cryptocurrencies and blockchain.

Dan Boneh, a professor of computer science and electrical engineering at Stanford University and co-director of the center, said that every time he talks with a new team in the group he finds himself walking away with three new research ideas.

“There are new technical questions being raised by blockchain projects that we would not work on otherwise,”

he says.

Other leading universities that are known for strong engineering programs are adding courses and programs centered around blockchain, too. The University of Waterloo, Georgetown University, and the University of Illinois at Urbana-Champaign are among those expanding their research and course offerings.

Branching Out

At Berkeley, Song co-taught a course in the spring semester of 2018 on “Blockchain, Cryptoeconomics, and the Future of Technology, Business and Law.” It was a collaboration between the school’s computer science, business, and law schools and admitted an equal number of students from each school.

Song says the course was “hugely popular,” noting that the instructors had to turn away more than 200 students because their classroom only had a 70-student capacity.

That interdepartmental approach may emerge as a hallmark of cryptocurrency and blockchain education, given the number of departments that are currently offering classes on the subject. Coinbase’s analysis found that of the 172 classes listed by the top 50 universities, 15 percent were offered by business, economics, finance, and law departments, and four percent were in social science departments such as anthropology, history, and political science.

Harvey says students recognize how in-demand this kind of knowledge is now.

“If you’re graduating from law school it’s a tough market these days,” Harvey says. “However, the law students that are trained in blockchain, they don’t need to apply anywhere. People are just asking them to join their firms.”

Student View

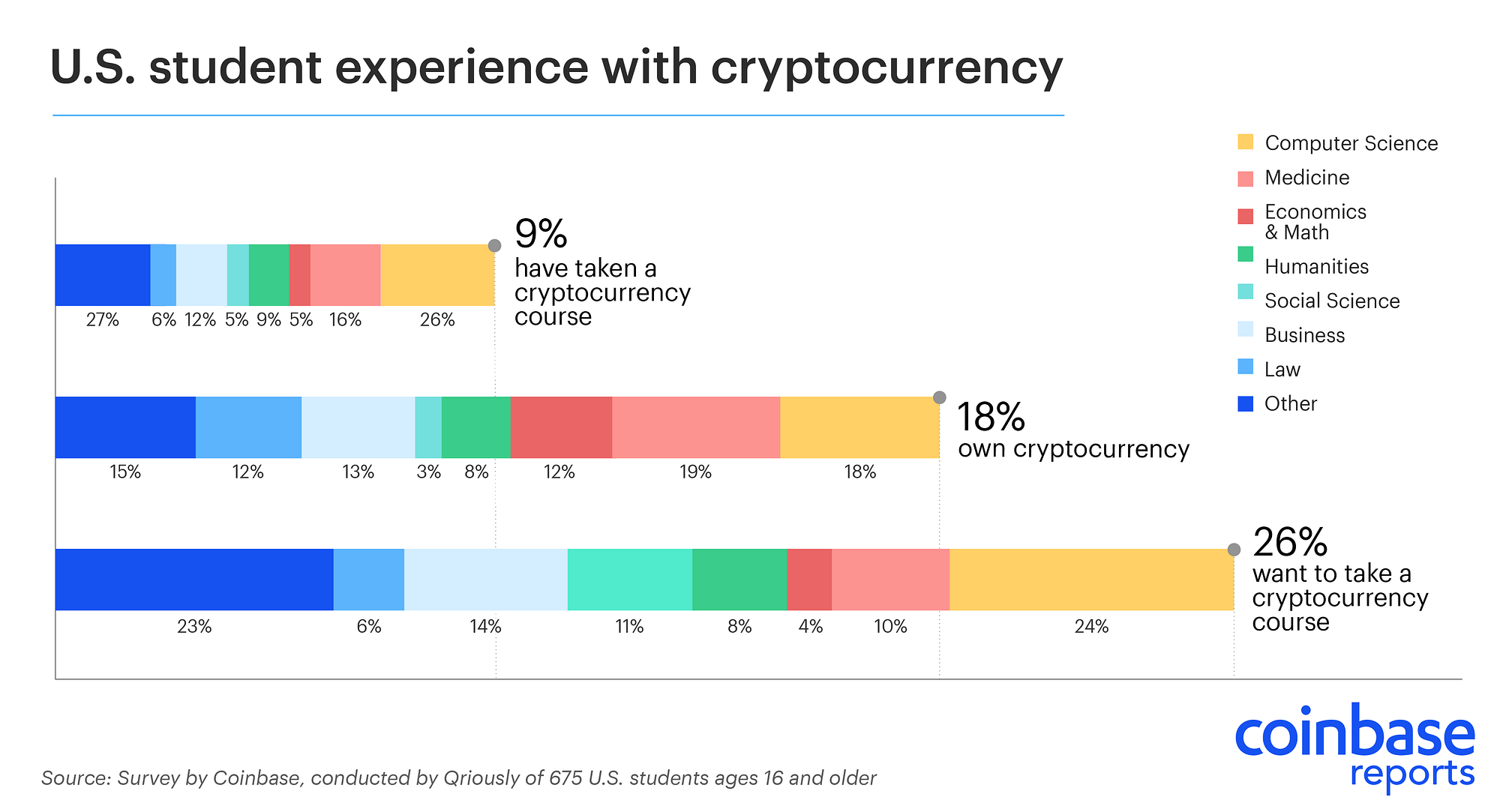

Among students, interest in cryptocurrency and blockchain cuts across fields. In fact, more social science majors — 47 percent — said they were interested in learning about cryptocurrency than computer science and engineering majors — 34 percent — according to a survey of 675 U.S. students commissioned by Coinbase and conducted by Qriously.

The survey found that 17 percent of computer science and engineering majors have already taken a course that focuses on cryptocurrency and blockchain, as have 15 percent of economics and math majors and 11 percent of business majors. Just five percent of social science majors have taken such a course, the survey found.

Among all students surveyed, 17 percent said they consider their knowledge of cryptocurrency and blockchain very good, compared to just nine percent of the general population surveyed at the same time. Similarly, 18 percent of students said they own (or have owned) cryptocurrency, twice the rate of the general population.

A quarter of all students said they would definitely or probably take a course focused on cryptocurrency or blockchain.

“There’s tremendous excitement”among students right now, says Benedikt Bünz, a doctoral student at Stanford focusing on cryptocurrencies.

Bünz was pursuing a master’s degree in artificial intelligence when he took a cryptography class. That sparked his interest in cryptocurrencies, setting the direction for his doctoral degree.

People often approach Bünz asking if he’d be able to recommend someone with knowledge of cryptocurrencies for a job, he says, but the high demand means all the candidates he knows already have positions secured.

These days, he says,

“if you’re an expert in cryptocurrencies and cryptography you’ll have a difficult time not finding a job.”

Looking Ahead

There are also plenty of options for people not currently enrolled at a university to learn more about crypto. Online learning sites like Udemy, Coursera, edX, and Udacity offer hundreds of courses, including general lessons in foundational cryptography and more specialized classes on blockchain and cryptocurrency.

These classes draw on a range of experts, including professors from some of the top 50 global universities and practitioners in the field. For instance, Coinbase Chief Technology Officer Balaji S. Srinivasan is one of several industry experts featured as part of the Udacity nanondegree program called “Become a Blockchain Developer.” The program has two three-month terms and is focused on “mastering job-ready skills with a hands-on approach.”

Academia isn’t known for moving quickly. But professors say that the maturation of blockchain and cryptocurrency and their adoption by businesses and other groups over the last few years has made it clear that it’s a field with the potential for wide-ranging impact. And that’s causing universities to take it seriously.

“You need to prepare your students for the future,” Duke’s Harvey says, and “blockchain is not going away.”

This Article First Appeared on blog.coinbase.com. Featured Image via ShutterStock