Insurtech Firm FWD Expands into Travel Insurance with FWD Flyer

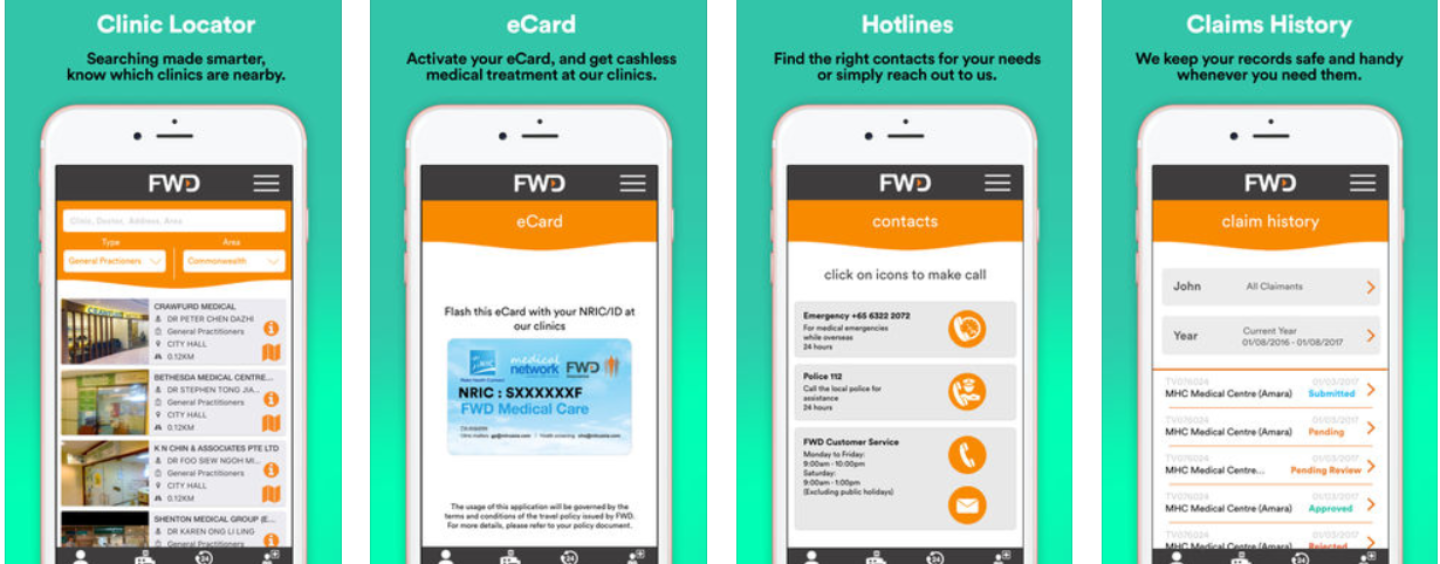

by Fintech News Singapore September 4, 2018Insurtech firm FWD announced the launch of the FWD Flyer mobile app, which it claims to be an end-to-end digital insurance solution. The app provides FWD customers cashless medical claim functionalities and provides them quick access to their policies and emergency contacts.

Available on both Android and iOS devices, the FWD Flyer app’s goal is for FWD customers to get their medical expenses in Singapore paid without needing to file a claim.

Available on both Android and iOS devices, the FWD Flyer app’s goal is for FWD customers to get their medical expenses in Singapore paid without needing to file a claim.

With its eCard, travellers who have fallen ill during or after a trip can receive the necessary treatment at any of FWD Singapore’s panel clinics without needing to pay beforehand.

The app also allows travellers to locate the nearest panel clinics and doctors, making the whole claim experience seamless.

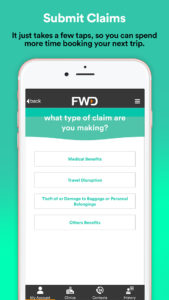

Whilst many conventional insurers in the industry still require their customers to manually download, print and mail their claim forms, FWD claims to have digitalised the entire process.

With the FWD Flyer App, consumers can also:

- Choose from more than 500 clinics in Singapore or simply select a clinic nearby

- Enjoy cashless medical treatments simply by activating and showing the eCard in the app to the clinic

- Access a list of useful contact numbers such as emergency assistance, local police or connect with FWD

- Submit other travel-related claims such as baggage delay or flight delay, all within a few clicks

- Buy travel insurance for the next trip

Abhishek Bhatia, FWD Singapore’s CEO, and Group Chief Officer of New Business Models, explained that the FWD Flyer app is just one of the many digital initiatives the insurer is taking to streamline its customers’ experience.

Abhishek Bhatia

The launch of the FWD Flyer app follows the insurer’s implementation of electronic claims payments via PayNow. The platform allows customers to receive their claims pay-outs directly in their bank accounts; unlike most traditional insurers who make their payouts via cheques. With PayNow, unnecessary delays such as lost cheques are reduced and the payout time for claims has reduced from 5 days to an industry leading next-day upon successful claim approval.

Featured image via https://www.fwd.com.sg/