Revolut Secured Singaporean Licensing — Slated to Launch in 2019

by Fintech News Singapore November 29, 2018Revolut, a London-based fintech unicorn was just granted a license for operations in Singapore and Japan.

The company has therefore confirmed that they are in the final stages of testing for launch in Asia Pacific in Q1 2019. Their Asia Pacific launch has been anticipated, with nearly 100,000 customers on the waiting list hailing from these regions.

Revolut has been granted a Remittance License by the Monetary Authority of Singapore, and will also be operating as a Stored Value Facility holder*, which will allow them to operate in the city-state. Revolut is also proactively working with the Singapore regulator to shape the upcoming Payment Services Bill thanks to its experience in Europe.

The company’s APAC HQ will most likely be based in Singapore, with a number of key personnel responsible for business development, public relations and compliance already hired in the region. They also have plans to hire an operations manager for further Singapore expansion in the coming months.

The APAC market is attractive to Revolut due to long-running customer frustrations with high fees levied by major retail banks and Asian consumers facing some of the highest fees in the world when spending and sending money abroad. Revolut has highlighted these as just one example of the opportunities available to unsettle the monopolies held by financial institutions in the APAC region.

According to a recent report from Oracle, 7 out of 10 of Singaporeans are open to digital banking alternatives—ahead of the global average of 67%. Japan has been slower to adopt to such alternatives, with only 50 per cent open to switching, an area that Revolut feels is changing rapidly. In addition, Japanese and Singaporean residents hold the world’s most powerful passports, as they are able to travel visa-free to the highest number of countries. Over 16 million Japanese residents travel abroad every year. Meanwhile, according to a study conducted by Visa, Singaporeans are an international leader in travel.

However, 4 out of 10 Singaporeans share that budget and that value for money for their trip is a major concern, as legacy banks are, as Revolut would say it, “still ripping off their customers” when they spend abroad.

Revolut states that they are able to solve those issues.

*Editors note: Revolut Technologies Singapore Pte. Ltd is regulated as a remittance business by The Monetary Authority of Singapore (MAS) license: 01530. Revolut Multicurrency Account stored value facility does not require the approval of the Monetary Authority of Singapore.

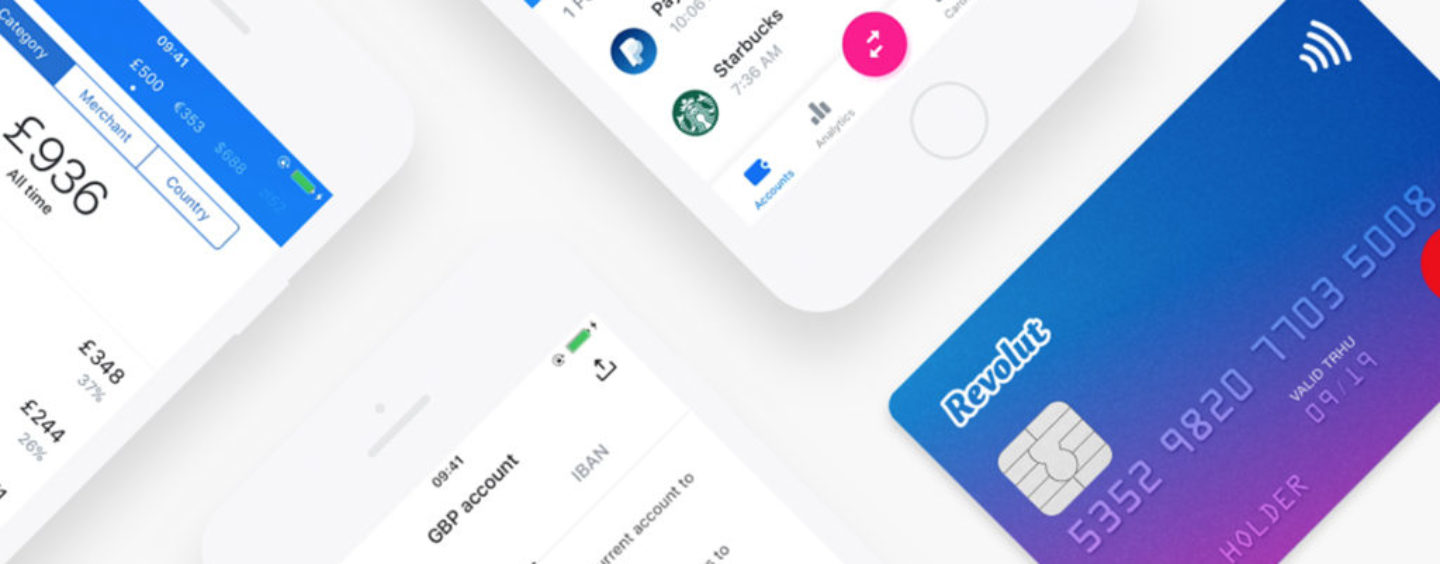

Featured image credit: Revolut