Design thinking is a methodology used during the process of designing and a problem-solving protocol which consists in, first, defining the problem, and then, implementing the solutions, always with the needs of the user demographic at the core of concept development.

User centric: design to solve an issue

Design thinking is essentially about understanding the challenges that face customers and working with, observing and iterating with them to find a solution. It is also about taking a ‘human experience first’ approach to problem solving, and a customer-centered approach to end-to-end process fulfillment.

In a new report released last week, Lightbulb Capital unveiled results of a survey it conducted on 24 experts in design thinking in financial services to learn about their experiences with design thinking in the financial sector. Respondents included chef innovation officers, senior UX consultants and other seniors in the innovation and design in banking sector.

In a new report released last week, Lightbulb Capital unveiled results of a survey it conducted on 24 experts in design thinking in financial services to learn about their experiences with design thinking in the financial sector. Respondents included chef innovation officers, senior UX consultants and other seniors in the innovation and design in banking sector.

The study found that continuous involvement from decision makers can be a key success factor when executing design thinking projects. It also suggests that design thinking teams are ideally composed of individuals from different backgrounds and parts of a financial services firm.

Other essential factors for success include planning, tight time management and expectation management.

Respondents shared success stories in design thinking in financial services, among which the successful creation of a value proposition for younger customer segments, the redesign of websites for digital banking products, but also in areas such as increasing sells of retirement insurances.

“Our newly developed website triumphed over the old one by applying intense customer centric design methods, such as persona and customer journey mapping. So far, it can be considered the best banking website in Vietnam,” one respondent shared.

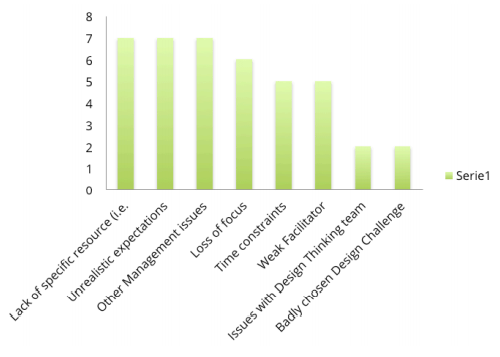

In the case of unsuccessful design thinking initiatives, respondents cited the lack of specific resource, unrealistic expectations and management issues, as the main causes of failure.

Many banks are working hard to bring a user-centric approach to redesigning their services.

For instance, Spanish banking group BBVA triggered in 2010 a new project aimed at redefining the automated teller machine to enhance the self-service banking experience.

BBVA, in partnership with IDEO, is working on a custom-designed ATM that would offer all of the most common banking transactions in a simple, flexible, and intuitive manner.

Another banking group that has been working towards rethinking its products is ASB Bank in New Zealand, which was among the first banks in the world to pioneer interactive, two-way video banking applications for mobile devices.

French banking group BNP Paribas on the other hand, has fully embraced innovation making it one of its core values. BNP Paribas has teamed up with a number of startups to explore emerging technologies and new business models. For instance, the partnership with SmartAngels, announced earlier this year, is aimed at leveraging blockchain technology to enable private companies to issue securities.

Going beyond innovation on a process or a product, design thinking can be applied to bring culture change in an organization, as noted by Christopher Whitlock, Vice President, Executive Creative Director at Fidelity Investments.

“You can use a design thinking exercise to figure out how to make meetings be more productive, to come up with a better seating plan, or how to improve the atmosphere of the office,” Whitlock said. “All these have an effect on the culture of the organization.”

Featured image: Group of Multiethnic Designers Brainstorming by Rawpixel.com, via Shutterstock.com.