Automated advisory platforms, also known as robo-advisors, have already caused a stir in the US and the UK, and are now winning market share in Asia.

These digital platforms offer online, customized investment advice and portfolio constitution, most of the time through ETFs or mutual funds, and are starting to appear in Asia as the region is expected to drive most the private wealth’s growth for the next decade and beyond.

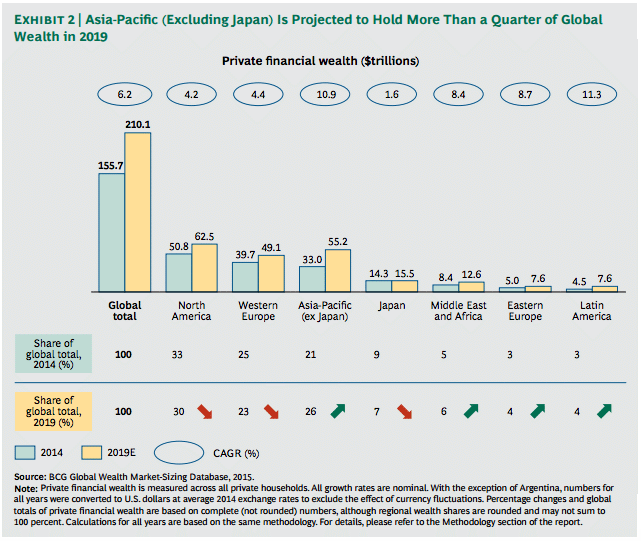

The Boston Consulting Group predicts that Asia-Pacific (excluding Japan) will surpass Western Europe (a projected US$49 trillion) – which currently stands as the second-wealthiest region after North America – with a projected US$55 trillion in private wealth in 2019. Asia-Pacific is expected to hold 26% of the global financial wealth in 2019, compared to the 21% share it held in 2014.

It is clear that Asia-Pacific will drive growth in the sector, and given Asia’s high Internet penetration rates and the habits of new millennials, robo-advisors have the potential to be a hit in the region.

What robo-advisers bring to the wealth management industry is pretty obvious: democratization. Not only do they offer lower entry points for potential investors, they also allow for a much easier sign up process – “in under 10 minutes” in the case of Wealthfront, for instance.

Certainly, Asia is still lacking the more established robo-adviser platforms that are operating in markets such as the US and Europe – think of Wealthfront, Betterment and WiseBanyan.

However, the region has got a number of automated advisory platforms that are growing fast and which you may want to keep an eye on.

THEO

THEO, a product of Money Design Co., Ltd., is Japan’s first robo-advisor operating essentially via a mobile application. THEO launched in February and has already seen great traction, on-boarding over 2,000 clients in its first month.

THEO allows users to invest starting from 100,000 JPY (~US$940). Users answer 9 simple questions before the algorithm determines the best investment combination from 6,000 ETFs.

8 Securities

8 Securities is the Asian equivalent of Robinhood. 8 Securities provides users with a mobile app (8Now!) that lets them trade over 15,000 US and HK stocks and index funds for no commission.

Based in Hong Kong, 8 Securities aims at hyper-connected millennials and has already expanded in Japan and China following a US$9 million Series B funding round raised in August 2014.

Bambu

Bambu is a B2B hybrid mobile app providing businesses with digital wealth services including savings and investing solutions.

Bambu, a company based in Singapore, launched earlier this year, and yet, has already managed to sign up key players including Thomson Reuters, Tigerspike, a leading digital agency, Finantix, a digital finance company providing solutions in wealth management, banking and insurance, and Eigencat, a Singaporean digital investment management company.

Quantifeed

Based in Hong Kong, Quantifeed is a B2B fintech company targeted at financial institutions in Asia that uses investment models and cloud-hosted technology to deliver affordable online wealth management services that require no minimum wealth amounts.

Quantifeed aims at providing Asia’s mass affluent investors with solutions that suit their needs.

Smartly

Aimed at simplifying investing as well as educating users, Smartly announced in February a robo-advisor service targeted at Southeast Asian millennials.

The platform, expected to launch in beta in July, will focus on allowing the average individual to build wealth starting with as little as US$50. Along side the investment platform, Smartly plans to build an educational portal to educate users on the basics of investing.

Infinity Partners

Infinity Partners, a Singaporean financial advisory company, is looking to launch a robo-advisor for wealthy clients. The firm plans to start offering the service to American expatriates working in Singapore.

The technology will use automated algorithm-based portfolio management software and will allow users to build ETFs in the US, according to the Straits Times.

Featured image by everything possible, via Shutterstock.com.

1 Comment so far

Jump into a conversation