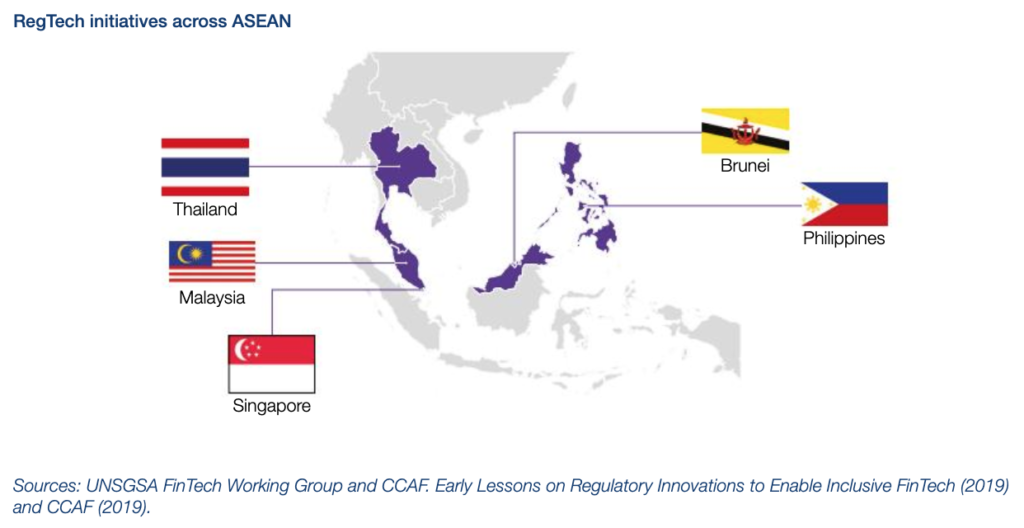

In Southeast Asia, 50% of Financial of Financial Authorities Have Developed Regtech Initiatives

by Fintech News Singapore December 18, 201950% of financial authorities in Southeast Asia have developed regtech initiatives, showcasing a wider trend among regulators across the region as these increasingly turn to technology to help them adapt to the changing financial services landscape, according to a new report by the University of Cambridge.

Around the world, regulatory innovation has become increasingly common. In Southeast Asia, financial regulators have begun turning to technology to address the challenge of rapidly changing financial services markets, according to a new report titled The ASEAN Fintech Ecosystem Benchmarking Study jointly produced by the Cambridge Centre for Alternative Finance at Cambridge Judge Business School, the Asian Development Bank Institute (ADBI) and FintechSpace.

Regulatory technology, also referred to as regtech, has emerged as a key tool for regulators and a long-lasting solution for its potential to help the public sector adapt to a changing marketplace.

In Brunei, the country’s Autoriti Monetari Brunei Darussalam (AMBD) has utilized regtech to help implement a centralized statistical system. AMBD partnered with regtech vendor Vizor Software in 2017 to use the startup’s solution to collect financial data from external entities via a single portal, generate reports and insights.

In April 2018, the Philippines’ Bangko Sentral ng Pilipinas (BSP) announced that it would roll out regtech and suptech solutions by the end of the year. BSP had partnered earlier with the Regtech for Regulators Accelerator (R2A), a global initiative that provides technical assistance for financial sector regulators to “develop and test the next generation of digital supervision tools and techniques.”

BSP Governor Nestor A. Espenilla, Jr. said in 2017 that the central bank had been testing two platforms that use artificial intelligence (AI) for the conduct of bank supervision.

In Singapore, the Monetary Authority of Singapore (MAS) has leveraged regtech in the fields of identity and know-your-customer (KYC), data governance and platforms for innovation. One of the regulator’s key initiatives is MyInfo, a digital service that enables citizens to authorize third party access to their data, which can then be used to open bank accounts, among other things.

MAS is currently in the process of merging money exchange and remittance systems law into one legislation, which would enable the comprehensive regulation of old and new payments services, notably through digital solutions.

In Thailand, the Bank of Thailand (BOT) has been looking to leverage distributed ledger technology (DLT) to transform government saving bonds, issuance, distribution and sales. Not only would the technology allow for stakeholders to more access information, blockchain would also allow for increased efficiency, transparency, as well as easy regulatory monitoring and reporting.

Finally, in Malaysia, the country’s central bank, Bank Negara Malaysia (BNM), launched an Open API initiative last year focusing on motor insurance, credit cards and small and medium-sized enterprise (SME) financing.

Image: Regtech initiatives across ASEAN, The ASEAN Fintech Ecosystem Benchmarking Study, September 2019

Besides regtech initiatives, regulators across Southeast Asia have also established innovation offices. Innovation offices are designed to provide regulatory clarification to financial services providers offering innovative products and services, and are often part of governments’ wider fintech strategy. Such offices exist in Thailand, Malaysia, Singapore, Indonesia and Brunei.

Another popular initiative by local governments is the regulatory sandbox, a special regime for financial services providers to test innovative solutions and business models. Regulatory sandboxes exist in Brunei, Indonesia, Malaysia, the Philippines, Singapore and Thailand. Vietnam is expected to launch its own regulatory sandbox soon, which will be operated by the State Bank of Vietnam (SBV).

But perhaps one of the most notable initiatives in this regard is the API Exchange (APIX), a cross-jurisdictional sandbox. APIX, a platform of the ASEAN Financial Innovation Network (AFIN), was established earlier this year by the International Finance Corporation (IFC), MAS and the ASEAN Bankers Association (ABA). The platform is designed to be a flexible online global fintech marketplace and sandbox platform for financial institutions from across the region.

Alongside Southeast Asian regulators launching their own regtech and suptech initiatives, the research also addresses the region’s emerging fintech landscape, highlighting the most notable trends.

Among the main trends, the research notes fintech firms’ shift from being customer focused to now progressively serving SMEs and large corporations, a trend particularly evident in the online lending and alternative financing space, as well as AI, machine learning (ML) and big data.

The report also found that predictive analytics and ML were the most commonly used technologies for all fintech firms in the region. Blockchain and DLT are gaining momentum in the digital payments space, and enterprise technology for financial institutions, as well as capital raising through crowdfunding have also gained in popularity.

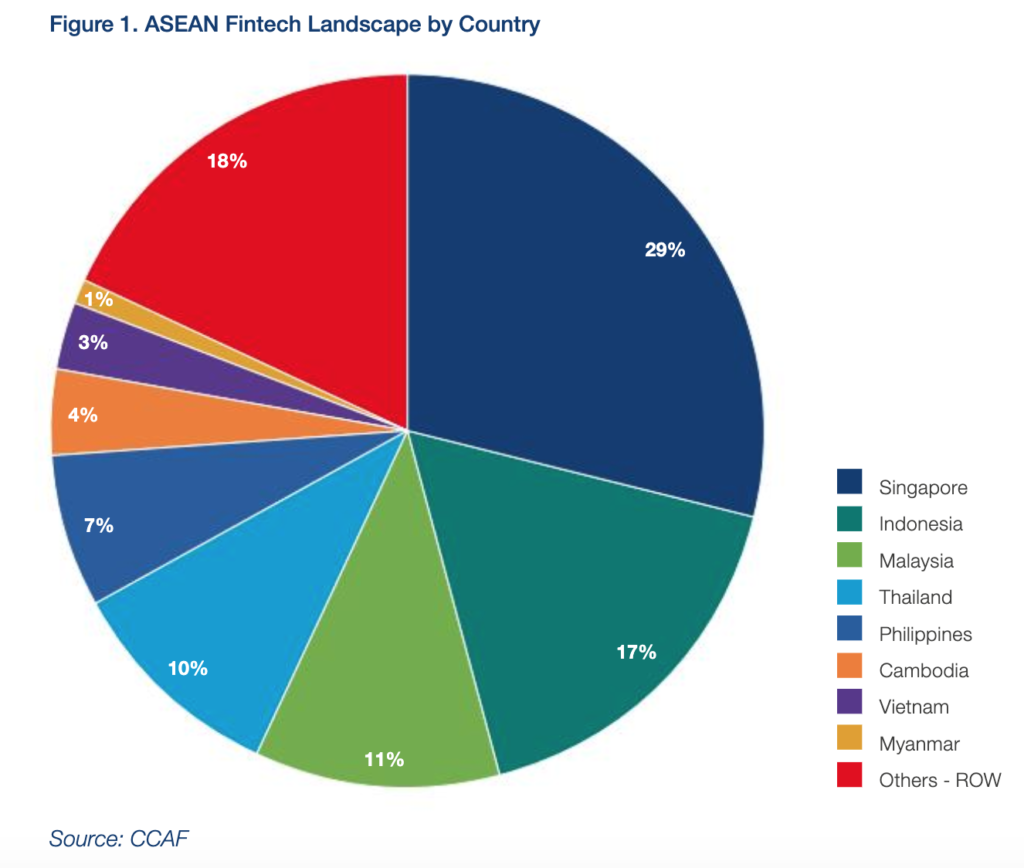

Singapore and Indonesia were found to be the top two countries in the ASEAN region by the number of fintech firms, representing 29% and 17% of the region’s overall fintech industry, respectively. They are followed by Malaysia, Thailand and the Philippines. Meanwhile, Vietnam, Cambodia and Myanmar were found to have nascent fintech markets, although strong growth has been witnessed in the past couple of years.

Image: ASEAN Fintech Landscape by Country, The ASEAN Fintech Ecosystem Benchmarking Study, September 2019

1 Comment so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.