Robo-Advisor Endowus Aims to Improve CPF Investment while Lowering Cost

by Fintech News Singapore May 6, 2020The COVID-19 health crisis and the related protection measures put in place have critically impacted economic activity, with the International Monetary Funding (IMF) projecting a contraction of the global economy by 3% in 2020 as a result of the pandemic – much worse than during the 2008-2009 crisis.

The current climate has particularly stopped the music for the venture capital (VC) ecosystem, startups and small and medium-sized enterprises (SMEs), which have been at the front line of the battle and felt the repercussions of the pandemic the most.

In these dire and uncertain times, businesses of all sizes and from all around the world have shown solidarity and support by donating resources, offering their services for free, or developing new products and services for those impacted by the COVID-19.

To do our part in this global effort and support the fintech startup community, the Fintech News Network will be looking at a promising south east asian fintech startup each week to give them a well-deserved spotlight.

For this week, we will be digging into Endowus, a robo-advisory startup from Singapore.

Endowus: improving CPF investment while lowering costs

Founded in 2017, Endowus is a licensed digital financial advisor that touts itself to be the city state’s first and only digital advisor for Central Provident Fund (CPF). The company’s mission is to offer consumers access to exclusive, competitive funds at the lowest possible costs.

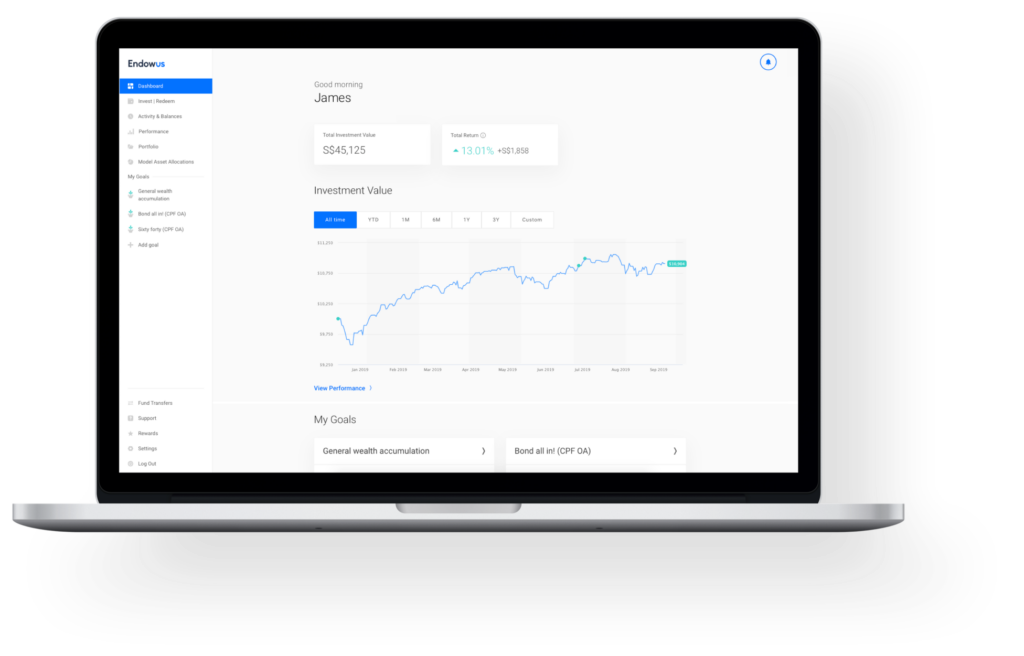

Endowus dashboard, via endowus.com

Endowus’ robo-advisory platform allows Singapore-based investors to invest and manage their CPF, Supplementary Retirement Scheme (SRS), and cash savings seamlessly online, providing a centralized investment and advisory platform spanning both public and private savings.

This integrated, “three-in-one” wealth solution allows customers to receive advice and invest holistically on a single platform across all three sources of funds, increasing investment efficiency and maximizing the probability of success in reaching their investment and retirement goals.

The company says it has partnered with some of the world’s largest fund management companies including Eastspring, First State, Legg Mason, Lion Global, Natixis, Schroders, UOB Asset Management, and Vanguard to create globally diversified portfolios suitable for all types of CPF members.

A quick, convenient and digital onboarding process

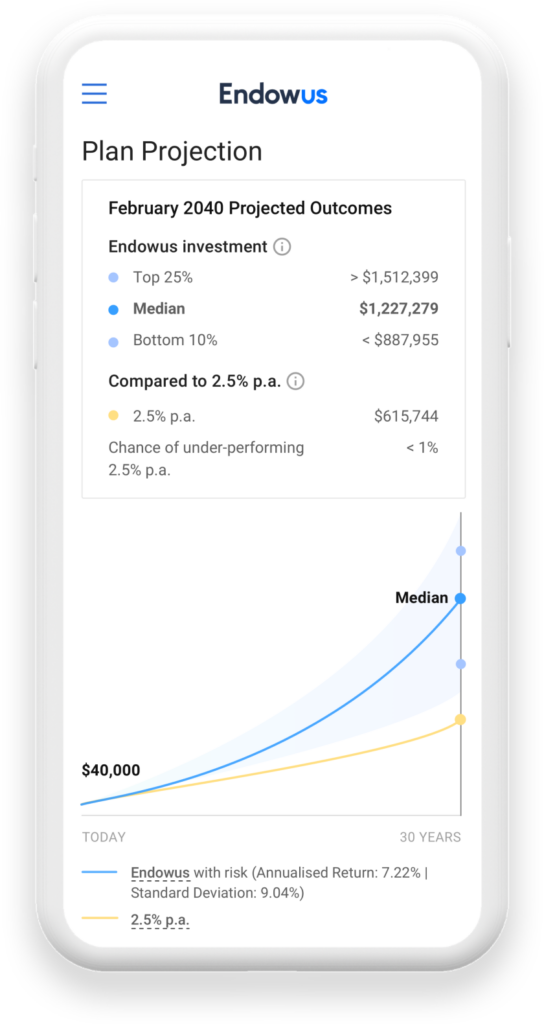

Signing up to Endowus is a simple, quick and straight-forward process. In just a few clicks, users get a detailed, personalized investment plan based on their risk tolerance, goals and investment timeline. The plans are based on global model portfolios, built and continuously monitored by Endowus’ team of experts. Signing up takes just a few minutes and is done entirely online.

Endowus mobile app, via endowus.com

Endowus’ partner broker is UOB Kay Hian, one of Asia’s largest brokerage firms, and so when users create an Endowus account, they actually create a trust account in their name at UOB Kay Hian. UOB Kay Hian processes all the transactions made by users through the Endowus platform.

Endowus is a fee-only company, meaning that it charges only its investor clients and is not beholden to any product providers. It charges a flat 0.6% fee but requires a minimum investment of S$10,000.

Most recently, Endowus introduced the Infinity Global Stock Index Fund, a new fund managed by Vanguard, one of the world’s largest passive fund managers. With this addition, Endowus’ CPF members are being given a low-cost option to invest their CPF savings in a passive index fund for developed markets – a first in the industry, the company claims.

Endowus is part of the ever more competitive robo-advisory sector in Singapore, which currently includes companies such as Stashaway, Syfe, and MoneyOwl.

Smartly, a startup established in 2016 and a well-known name is the space, ceased operations in Singapore in April citing “intense” competition in the digital advisory sector.