Mastercard: COVID-19 Accelerating Adoption of Contactless Payments in Asia Pacific

by Fintech News Singapore April 30, 2020During February and March, as many countries imposed or strengthened social distancing measures due to COVID-19, a significant majority of consumers turned to contactless card payments for necessary purchases. Citing safety and cleanliness, 79 percent of people worldwide and 91 percent in Asia Pacific say they are now using tap-and-go payments.

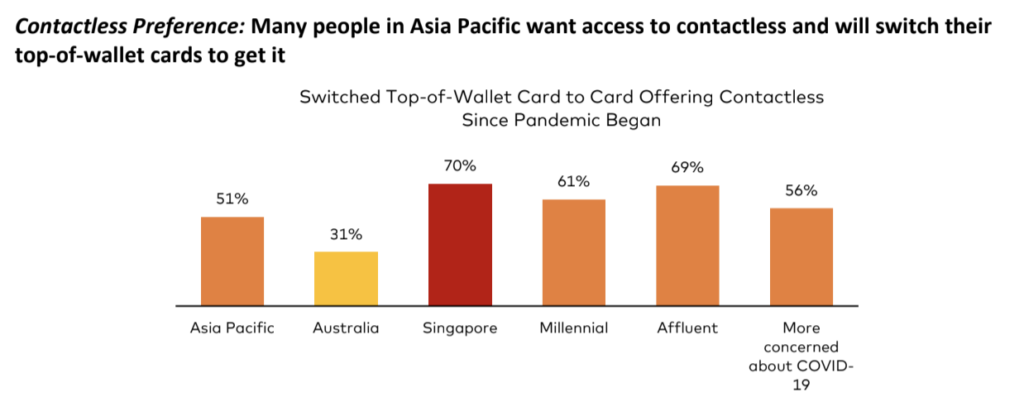

Consumer polling by Mastercard, studying changing consumer behaviors in 19 countries around the world, paints a picture of accelerated and sustained contactless adoption.

The act of going to the store for eggs, toilet paper, medicine and other necessities has changed dramatically this year. Shoppers have had to adjust to new challenges when buying everyday supplies – a shift in behavior that is particularly clear at checkout as people express a desire for contactless cards and voice concerns over cleanliness and safety at the point of sale.

The survey also shows that 75% of those from Asia Pacific said that they will continue to use contactless payments even after the pandemic is over, indicating that this a permanent shift in user behaviour.

Sandeep Malhotra

“Mastercard’s survey shows a clear shift to contactless – especially in Asia Pacific – as COVID-19 changes the payments landscape and the way people shop now and in the future,”

said Sandeep Malhotra, Executive Vice President, Products & Innovation, Asia Pacific, Mastercard.

“The fact that 3 in 4 people intend to keep using tap-and-go after the pandemic is a strong sign that consumers see the long-term benefits of having a safer, cleaner way to pay, checking out faster and being more socially responsible.”

Contactless Tipping Point

Now, as consumers increasingly seek ways to get in and out of stores quickly without touching payment terminals, Mastercard data reveals more than 40 percent growth in contactless transactions globally in the first quarter of 2020. More than 80 percent of contactless transactions are under US$25, a range typically dominated by cash.

While countries worldwide are at different stages of contactless card deployment and usage for daily shopping, Mastercard’s insights on trends at grocery stores and pharmacies – where many day-to-day essentials are being purchased – showed nearly all regions experienced significant spikes in February and March.

Reinforcing changing behaviors and consumer checkout preferences, Mastercard saw the number of tap-and-go card payments at grocery stores and pharmacies grow twice as fast as non-contactless transactions globally and 2.5 times faster in Asia Pacific.