NTUC Income Launches Snack, a Bite-Size “Stackable” Insurance Product

by Fintech News Singapore June 12, 2020NTUC Income (Income) launched SNACK, which they described as an “innovative, industry-first insurance proposition that revolutionises the way consumers engage with, purchase and obtain insurance protection in Singapore.”

Typically, an insured is required to pay insurance premiums at a fixed quantum either monthly or annually, and sometimes over a fixed duration of time, in order to be covered for a specified sum assured.

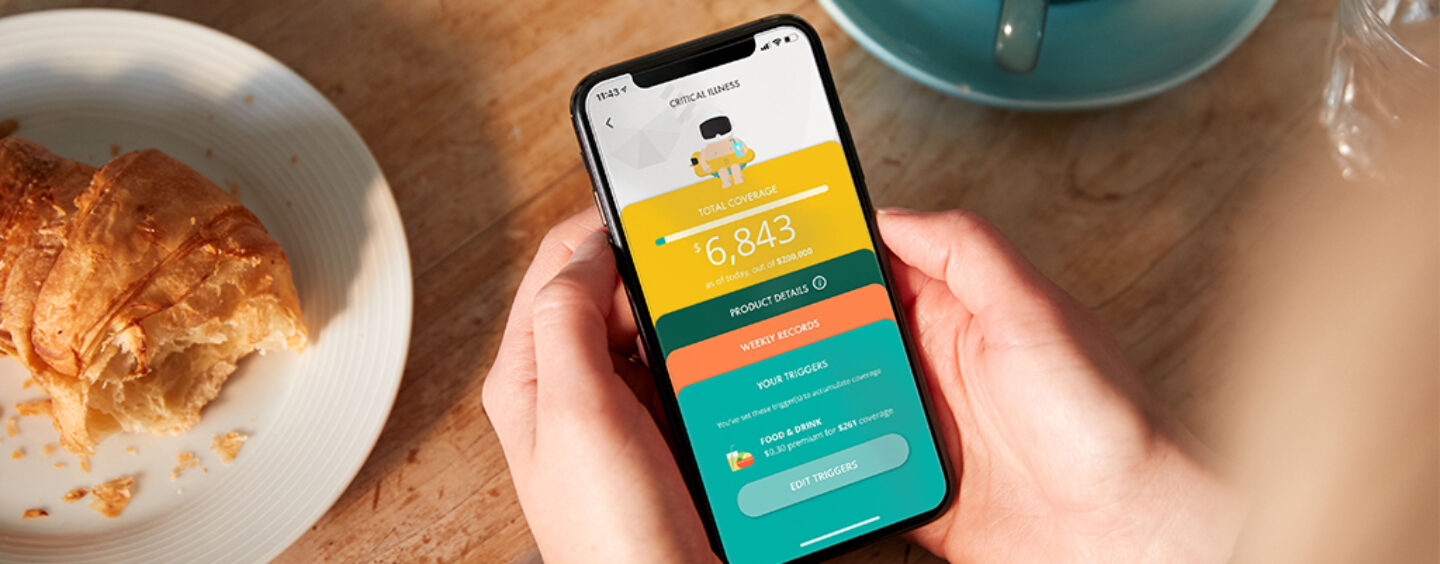

With SNACK, the insured gradually builds or stacks his insurance coverage by paying micro-premiums at either $0.30, $0.50 or $0.70 and accumulate micro-policiesthat offer a specified sum assured – based on the insured’s profile- that corresponds with the premiums paid. The SNACK insured can also decide when and how frequent premiums are paid by linking them to his preferred lifestyle triggers, such as ordering a meal, exercising or simply by taking public transport.

More significantly, each micro-policy, which is issued when a micro-premium is paid, covers the SNACK insured for 360 days. This means that the insured stays protected by insurance coverage that has been accumulated over time even when he stops using his lifestyle triggers or if the weekly cap is reached.

Peter Tay

Mr Peter Tay, Income’s Chief Digital Officer said,

“Today’s consumers are empowered individuals who are well informed, and seek choice, convenience and personalisation in the products and services they engage with, and insurance is no exception. By reimagining insurance, SNACK is offering consumers new freedom and flexibility in protecting themselves, just by going about their daily activities. This makes insurance more accessible and relevant to everyone, keeping it easily adaptable to lifestyle needs and personal financial situations.”

Currently, SNACK partners EZ-link, Fitbit and Burpple to enable insureds to accumulate Term Life (TL), Critical Illness (CI) and Personal Accident (PA) insurance coverage on the SNACK mobile app each time they pay for. their public transport using their EZ-link card, clock 5,000 steps a day on their Fitbit or redeem a dining/takeaway deal on Burpple Beyond.

The corresponding insurance coverage (i.e sum assured) earned at the same premium quantum for an insurance product

is determined by the insured’s profile such as, age, gender, a smoker or non-smoker.

To make insurance more accessible via SNACK, new partners such as Visa, will come on board this first-of-its-kind insurance model to enable retail, entertainment, transport and groceries category triggers for all local Visa cardholders whenever they make a purchase online or offline.

This means that a SNACK insured will be able to stack his insurance coverage in TL, CI and PA insurance more accessibly, and potentially reached maximum sum assured quicker, with more lifestyle trigger options.

For example, 25 year-old Zac, who is a non-smoker, sets up a transport trigger on his SNACK mobile app to pay $0.30 premium for CI coverage each time he commutes on a public bus or train. With each bus or train trip, Zac accumulates a micro-policy that offers him $321 sum assured.

Subsequently when the retail trigger is available on SNACK, he can further stack his CI coverage every time he shops online with his Visa card. He can stack these micro-policies to accumulate a maximum coverage of $200,000 for CI and TL insurance and $100,000 for PA insurance.

Additionally, SNACK offers insureds the flexibility to build insurance coverage at their own pace by setting a weekly cap of up to a maximum of $50 on payment triggers, if they wish to ease cash flow. SNACK is also looking to enhance its insurance offerings by offering options that help insureds save and invest for their future.