DBS’ Report: Asia at the Forefront of the Digital Currency, Payments Revolution

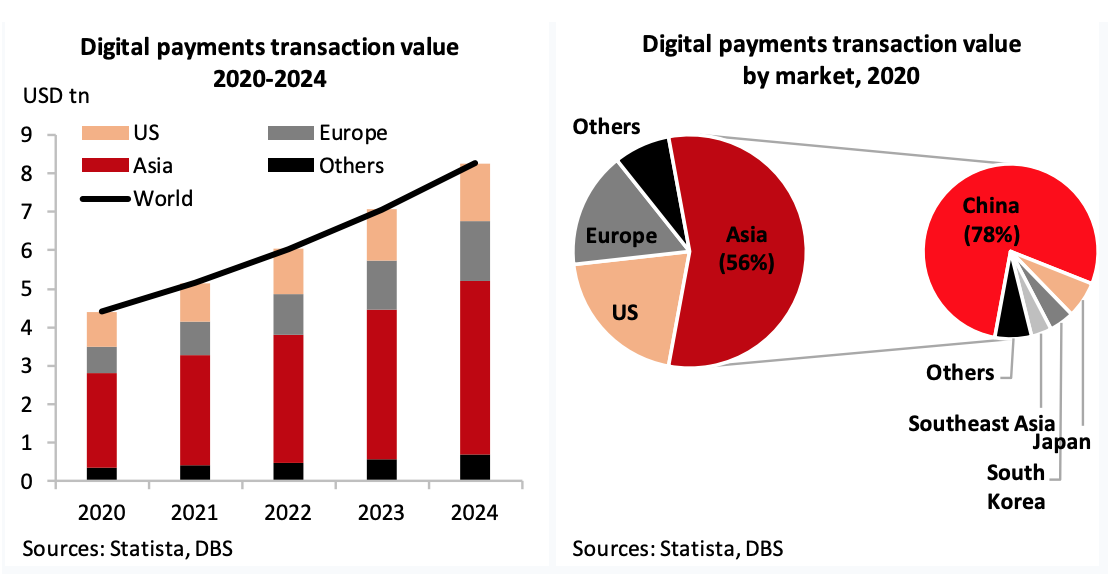

by Fintech News Singapore August 21, 2020Asia is the largest market for digital payments and will maintain its leading position with an estimated 16% compounded annual growth (CAGR) rate through the first half of this decade, according to a new report by Singapore’s DBS Bank.

In a report titled Digital Currencies: Public and Private, Present and Future, the bank looks at the latest developments in the world of digital currencies and payments, arguing that Asia has been at the forefront of the digital payments revolution.

In Asia, China makes up 78% of all digital payments transaction value, which, on a global scale, translates to nearly half of all transaction value, the report says.

Digital payments transaction value, Digital Currencies: Public and Private, Present and Future, DBS Bank, August 2020, Sources: Statista, DBS

A booming digital payments industry

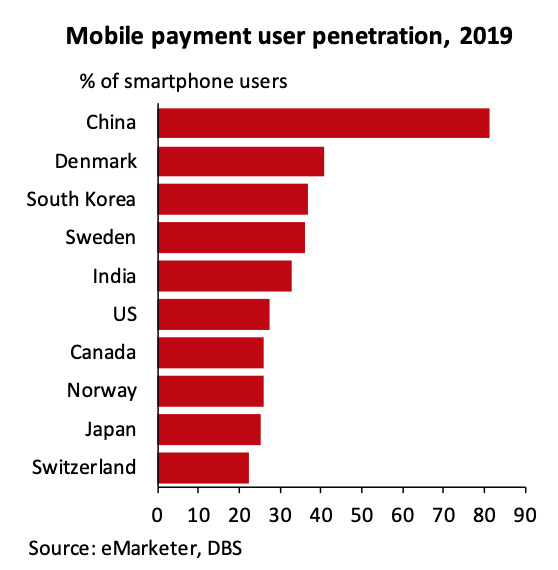

Globally, China is the leader in mobile payments with a penetration of 81.4% in 2019. China is followed by Denmark and South Korea, with mobile payment user penetration rates of about 40%.

Mobile payment user penetration, 2019, Digital Currencies: Public and Private, Present and Future, DBS Bank, August 2020, Sources: eMarketer, DBS

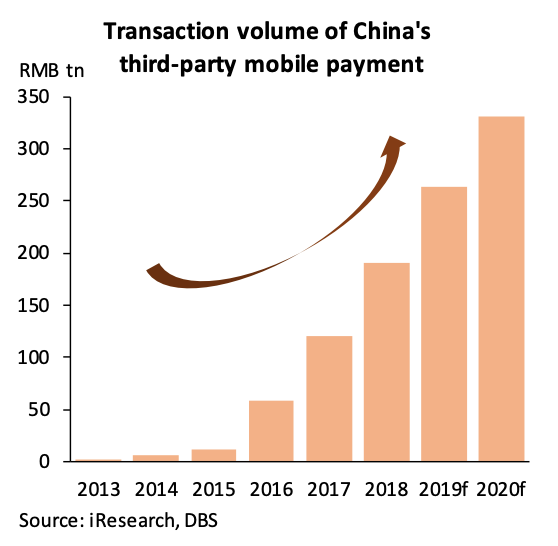

In China, mobile payments have skyrocketed over the past five years with total transactions reaching RMB 190.5 trillion (US$27 billion) in 2018, representing about 80% of all payments made in China that year.

Transaction volume of China’s third-party mobile payment, Digital Currencies: Public and Private, Present and Future, DBS Bank, August 2020, Sources: iResearch, DBS

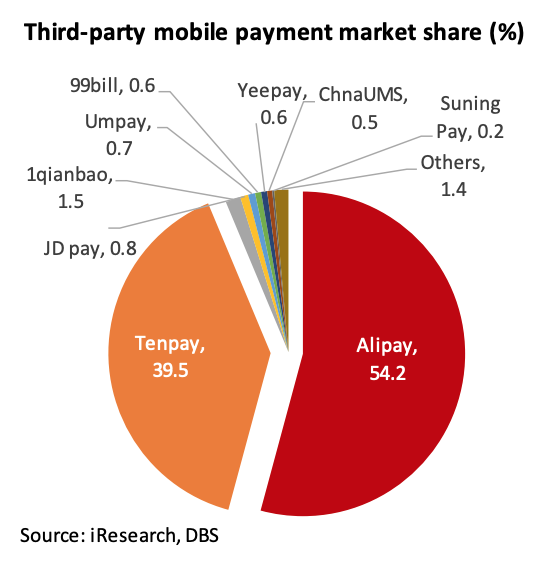

Ant Financial’s Alipay currently leads the domestic mobile payments market with a 54.2% market share, followed by Tencent’s Tenpay, including WeChat Pay, at 39.5%.

Third-party mobile payment market share (%), Digital Currencies: Public and Private, Present and Future, DBS Bank, August 2020, Sources: iResearch, DBS

But in Asia, it’s not just China that’s seen a booming digital payments market. In Singapore, digital payments transaction value will rise from US$15 billion in 2020 to US$21 billion, growing at a 9% CAGR, the report says. By 2024, the city state is projected to have 1.3 million mobile payments users, and 3.9 million digital commerce users.

Hong Kong is expected to witness stronger growth, with digital payments transaction value projected to rise from US$16 billion in 2020 to US$25 billion in 2024 at a CAGR of 11%. By 2024, Hong Kong will be home to 2 million mobile payments users, and 6.3 million digital commerce users, the report says.

A leading crypto hub

In addition to being a world leader in digital payments adoption, Asia is also a key market for cryptocurrency trading and issuance: China is the leader in Bitcoin mining, accounting for about 70% of the global Bitcoin mining industry; Singapore is a global hub for initial coin offerings (ICOs); and Hong Kong is home to some of the world’s largest crypto exchanges and trading platforms.

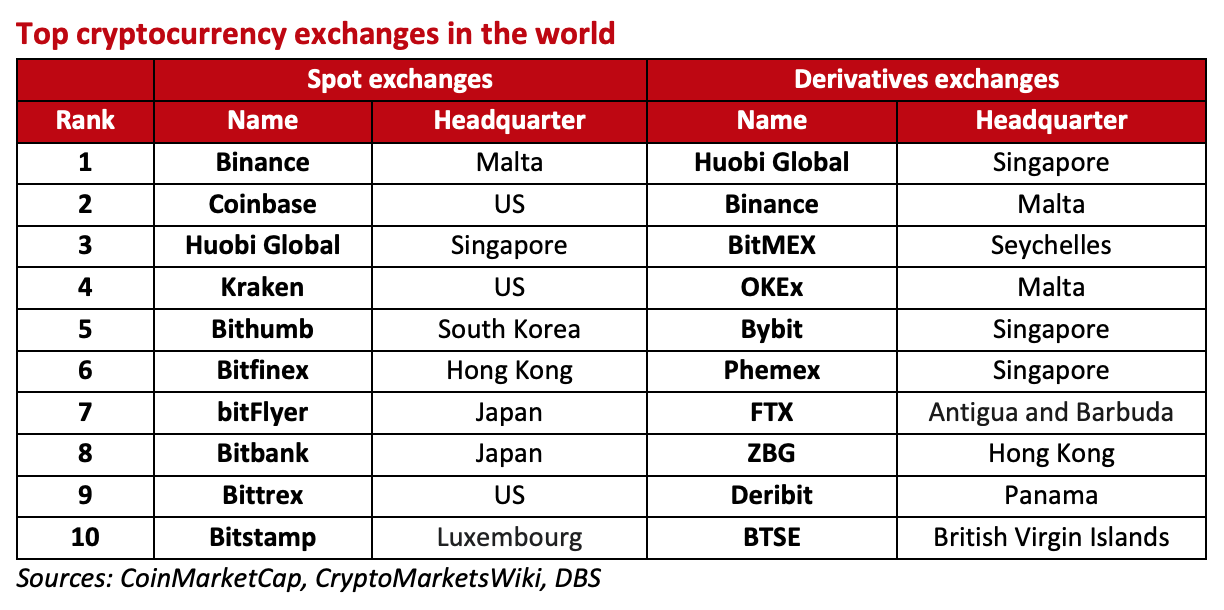

According to the study, half of the world’s top ten crypto spot exchanges are headquartered in Asia, including Huobi, which is based in Singapore but originally from China, Bitfinex, which is headquartered in Hong Kong, and Bithumb from South Korea.

Additionally, out of the world’s top ten crypto derivatives exchanges, three are headquartered in Singapore: Huobi, Bybit and Phemex.

Top cryptocurrency exchanges in the world, Digital Currencies: Public and Private, Present and Future, DBS Bank, August 2020, Sources: CoinMarketCap, CryptoMarketsWiki, DBS

Asia’s CBDC race

Regulators and central banks in Asia themselves have been actively investigating digital currencies.

This year, the People’s Bank of China (PBOC) became the world’s first central bank to launch a central bank digital currency (CBDC), kicking off a trial in April in four cities: Shenzhen, Suzhou, Chengdu and Xiong’an.

Since then, the POBC has enrolled more than 20 companies as partners, including tech giants Didi Chuxing, a ride-hailing app, and Meituan Dianping, a food delivery service. Didi Chuxing boasts a client base of about 550 million, while Meituan Dianping, which provides services ranging from meal delivery to online travel, has nearly 450 million customers and about 6 million companies selling their products on the platform.

In Singapore, the Monetary Authority of Singapore (MAS) has been exploring the use of blockchain and distributed ledger technology (DLT) for clearing and settlement of payments and securities since 2016.

In Thailand, the central bank has been developing a payment system for businesses that uses a CBDC. In Japan, the Bank of Japan has been experimenting with a CBDC. And most recently, Bangko Sentral ng Pilipinas (BSP), the Philippines’ central bank, has created a committee to look at the feasibility and policy implications of issuing its own digital currency.

Featured image credit:Money photo created by master1305 – www.freepik.com